Benefits for fintech distributors

Multi-account support

Issue multiple types of accounts digitally including prepaid, checking, savings, credit and virtual accounts to power different use cases ranging from lending to gift cards to loyalty to refunds and expense management

Multiple form factors

Issue multiple types of payment instruments including prepaid/debit/credit card, virtual cards, tokenized cards, EMV cards, magstripe, contactless cards and QR codes

Multi-network support

Supports Visa, Mastercard and American Express

Integrated digital rewards

Real-time reward earn and burn engine with statements. Support for plugging in redemption catalogs or convert to cash

Lower Total Cost of Ownership (TCO)

Simple, pay-as-you-go commercials so that you only pay for services you need, for as long as you use them, and without requiring long-term contracts or complex licensing for an overall lower TCO

Branding control

Customisable white-labeled cards, SDKs and apps to match the look and feel of your brand

APIs and SDKs

Easy integration through ready APIs, SDKs, webhooks and interceptors

Built-in compliance

Fusion’s financial products come baked-in with regulatory compliance — so that you don’t have to worry about writing any additional code

Secure

PCI DSS, SOC 27001, AICPA SOC3, ACS 2.0 certified. Fusion’s APIs and SDKs are PCI DSS compliant so that you focus on only writing the business logic

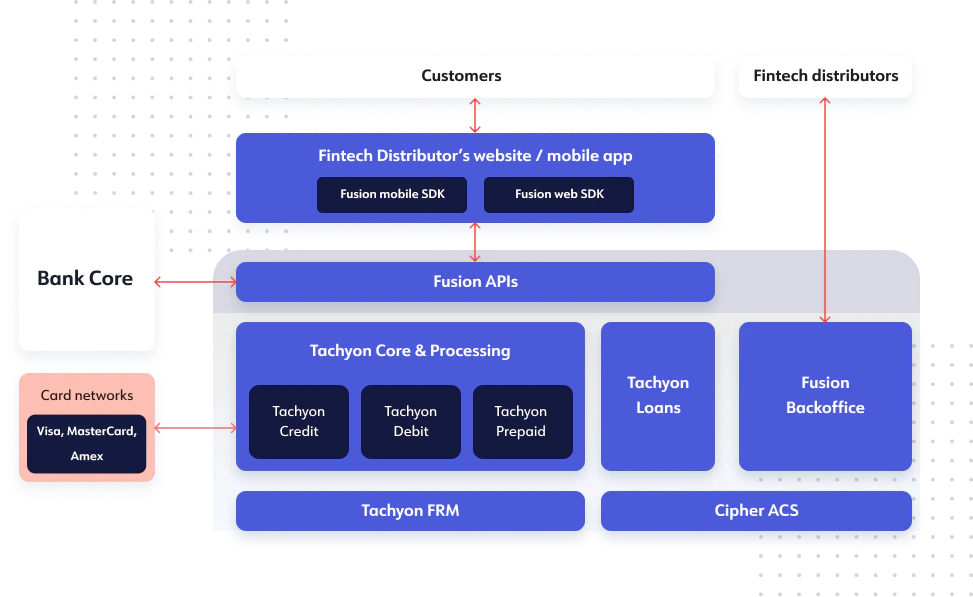

How Fusion works

Fusion provides APIs and SDKs that enable you to embed financial products and services of one or more banks into your apps and experiences