Delegate Payments with UPI Circle: Standard Capabilities and Strategic Opportunities

Contents

- Delegating Payments in UPI Circle: Key Players, Roles & Responsibilities

- Delegate Payments in Action: UPI Circle Demo

- Mandated and Standard Features for UPI Circle Implementation

- The Strategic Opportunity for Banks in Delegate Payments

After two decades of digital payment innovation, we’ve solved for speed, security, and scale, but delegating payments, a fundamental financial behavior, remains unaddressed.

Even today, cash remains the only payment instrument that truly enables delegation. Hand someone a ₹500 note, and you’ve effectively delegated payment authority without complex setup or technical barriers. This simple fact explains why customer segments like the following remain excluded from the convenience and security of digital payments:

- Family members of the daily wage earner who depend on him for household expenses

- The business owner and their staff managing expenses across multiple locations

- The parent trying to provide controlled spending access to teenagers

- Senior citizens dependent on family members or caregivers for purchases

These scenarios represent not just edge cases but massive transaction volumes, and potentially millions of new digital payments users. UPI Circle, introduced by NPCI last year, tackles this delegation gap head-on with an innovative framework built on UPI’s proven infrastructure.

This blog looks at how delegating payments works in UPI Circle and how banks and payments service providers (PSPs) can build a compliant delegation experience. We also look at the strategic opportunities that exist for full-stack banks with both, issuer and PSP capabilities.

Delegating Payments in UPI Circle: Key Players, Roles & Responsibilities

Over the last 2 years, NPCI has been adding new types of payment instruments on UPI rails such as RuPay cards, prepaid accounts and credit lines to drive engagement and participation. This has resulted in more payment options for existing users and also enabled some new users to enter the UPI ecosystem. NPCI has also been innovating with new types of payment methods, like UPI Lite (an on-device wallet for faster low value payments), UPI Tap and Pay (An Apple Pay like experience on UPI), UPI ATM (cash withdrawal on ATMs using UPI), and more.

With UPI Circle, NPCI seeks to fundamentally transform how payment relationships work by introducing:

- Primary and secondary user relationships: Allowing account holders to designate others who can initiate payments from their accounts

- Delegated payment flows: Enabling transactions by secondary users while maintaining appropriate controls

- Standardized implementation protocols: Ensuring interoperability across the UPI ecosystem

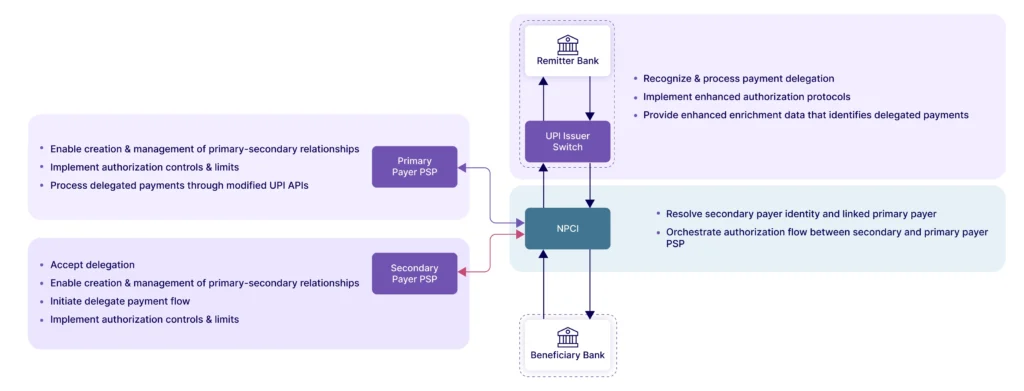

What makes UPI Circle particularly powerful is how it leverages the existing UPI infrastructure—simple, secure, and ubiquitous—and extends it for entirely new user segments and use cases. Image 1 shows the additional roles and responsibilities of the key entities in a UPI transaction in the context of delegated payments.

Image 1: Roles and Responsibilities in a UPI Circle Delegate Payment

Delegate Payments in Action: UPI Circle Demo

The following videos illustrate two flows: the addition of a secondary/delegate payer, and the transaction flow of a payment initiated by a secondary user.

Adding a Secondary User to UPI Circle

The primary user can add a secondary user by adding two identifiers – their UPI ID and their mobile number. The primary user also needs to select whether they want to assign the secondary user as a partial delegate (which means they need to approve every transaction initiated by the secondary user) or as a full delegate who can transact independently within a prescribed monthly limit. Once these details have been added, the secondary user receives an invitation on their device. Once the secondary user accepts the invite the UPI Circle set up is complete.

Transaction Flow of a Delegate Payment in UPI Circle

The secondary user initiates a payment in their PSP app. Upon selecting the primary user’s account as their payment account, they receive a notification saying that a payment request has been sent to the primary user. The primary user receives a notification on their device requesting them to approve the payment initiated by the secondary user. The primary user selects which account to make the payment from and enters their UPI PIN to complete the payment.

Mandated and Standard Features for UPI Circle Implementation

For banks/issuers and payment service providers (PSPs) looking to implement UPI Circle effectively, the following features are essential.

- Robust User Hierarchy Management

- Support the notion of primary and secondary users

- The PSP needs to enable creation of secondary users and recognize when a secondary user initiates a payment to apply transaction controls and trigger the modified payment flow

- The issuer needs to maintain a record of delegation and honor authorized secondary payer transactions

- Offer intuitive interfaces and DIY controls for the creation and management of secondary users

- Enable onboarding flows and creation of UPI ID for secondary users, where:

- Secondary user has an existing UPI linked account

- Secondary user does not have an existing UPI linked account

- Control Mechanisms

- Implement transaction controls that allow primary users to set transaction value limits for secondary users

- For example, NPCI has mandated that secondary users can transact up to a value of Rs. 15,000 per month

- PSPs should allow primary users to set lower limits than this if they prefer

- Implement controls on the number of secondary users that can be added by one primary user

- NPCI mandate is maximum 5 secondary users per primary user

- Implement controls on the number of delegations that a particular secondary user can have

- NPCI mandates that a secondary user can be added as delegate payer by only one primary user at a time

- Enhanced API Implementation

PSPs need to support the expanded UPI Circle APIs that:

- Enable creation of UPI IDs for secondary users

- Handle the modified payment flow for delegated transactions

- Manage authorization routing between primary and secondary users

- Process transaction-specific approvals

- Real-time Notification Systems

PSPs and issuers will need real-time notification capabilities to:

- Alert primary users when secondary users initiate transactions

- Provide approval requests for transactions requiring authorization

- Summarize activity across all secondary users

- Send spending limit warnings

- Enhanced Transaction Data

Offer enriched transaction details including:

- Clear identification of which secondary user performed each transaction

- Categorization of delegated spending

- Consolidated views of all account activity

- Security and Compliance Features

Implement appropriate security measures like:

- Cooling period after a secondary user has been added

- Restricting collect and mandate requests for delegate payment transactions

- Easy mechanisms to revoke access when needed

The Strategic Opportunity for Banks in Delegate Payments

For banks and payment service providers, UPI Circle represents a significant opportunity driven through inclusion of under-served and unserved people. The potential benefits include:

Transaction Volume Growth: By capturing transactions that would otherwise remain cash-based, UPI Circle can drive substantial increases in payment volumes.

Customer Acquisition: UPI Circle creates paths to bring new users into the digital payments ecosystem, particularly those previously excluded due to constraints like age, banking access, or technological comfort.

However, a more strategic opportunity exists for ‘full-stack’ banks that own both, the issuer switch and the PSP app. While all PSPs will implement baseline UPI Circle capabilities, banks with proprietary payment apps can build deeply integrated experiences that generate direct revenue through premium features, while simultaneously driving customer acquisition and retention.

For example, by controlling both ends of the transaction flow, these institutions can:

Develop Premium Service Tiers: Beyond basic delegation capabilities, banks can offer enhanced controls, granular permissions, and advanced monitoring as premium services for both consumer and business segments.

Create Specialized Experiences: The recent launch of BHIM 3.0’s “Family Mode,” built on top of delegate payments, demonstrates how providers can develop targeted solutions for specific use cases. Banks can develop their own specialized experiences for business expense management, household budgeting, or elder care financial management.

Deliver Advanced Analytics: By combining transaction data across primary and secondary users, banks can offer valuable insights that help primary users optimize spending, budget more effectively, and identify potential fraud patterns.

We’re doing some exciting work with the UPI stack to develop integrated capabilities that can help banks compete successfully in payments. If you’re working on a digital payments strategy for your bank and are looking for differentiating features, we’d love to show you what we have.