Will Shared Finance

Redefine How Banks Serve

Households, Teams, and Networks?

Banking Needs a Shared Finance Revolution

Money management has outgrown single‑owner accounts. Households now pool resources across generations, roommates split every utility, and teams distribute spending power well beyond a single corporate card. Yet most core banking systems still assume one customer, one balance, one set of rights.

Shared Finance reimagines money as a network, not a node. By enabling multiple parties to co‑own and co‑govern a single account – each with precisely scoped permissions – issuers can capture more spend and cut service costs. This paper shows why the pivot matters and how banks can execute it.

Finance Today is a Shared Experience

Contemporary life is increasingly multiplayer, but banking hasn’t caught up. A closer look at household composition, income patterns, and payment behaviors reveals how far consumers have moved beyond the one-customer-one-account paradigm.

Households are becoming more interdependent

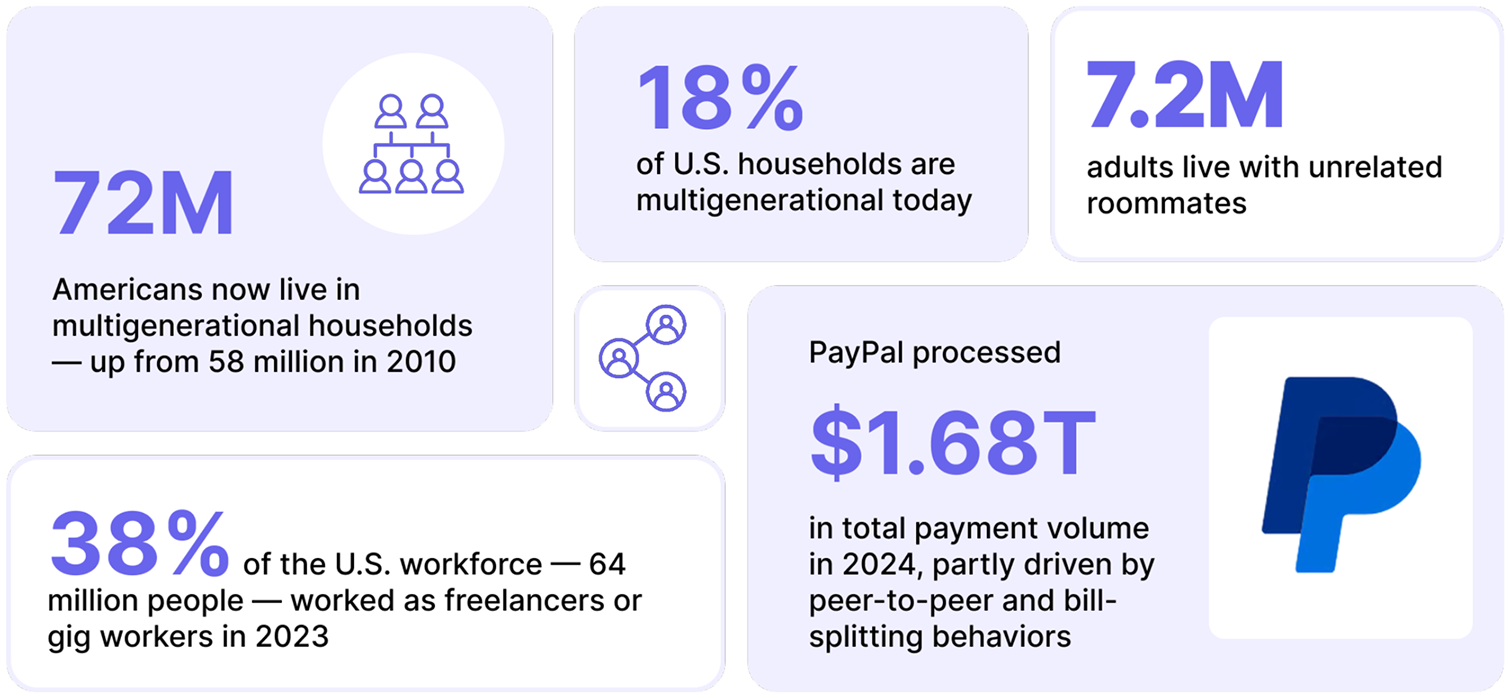

Multigenerational living is now mainstream. According to Pew Research Center, the number of Americans living in multigenerational households grew from 58 million in 2010 to 72 million in 2022, now accounting for 18% of US homes1. Financial responsibilities in these households are often shared, but traditional banking products don’t reflect that.

Roommate living and shared expenses are commonplace

As many as 7.2 million adults live with unrelated roommates2. These arrangements require flexible tools for shared expenses, yet most banks still center around single-account ownership.

Income sources are fragmented, especially for younger consumers

The gig economy isn’t a side hustle anymore. An Upwork report found that nearly 64 million Americans, representing 38% of the US workforce, worked as freelancers or gig workers in 20233. These users often manage complex inflows and split earnings with partners, roommates, or family, demanding more flexible financial structures.

Expense-splitting is a normalized behavior

In 2024 alone, PayPal recorded a total payment volume of $1.68 trillion4. These numbers confirm that shared financial activity is widespread, even if traditional bank products still treat it as edge-case behavior.

These patterns expose the limitations of banking products designed for solo users in an interconnected world. Consumers respond by stitching together P2P apps, shared spreadsheets, and “who‑paid‑what” text threads – workarounds that erode loyalty and generate service tickets.

Hidden Costs of Single‑Owner Accounts

As finance becomes increasingly collaborative, single-owner constructs are eroding value across the P&L. From churn risk to revenue leakage and rising service costs, outdated assumptions now carry real financial consequences.

74% of P2P users feel more positively about their bank because of P2P payments provider Zelle5, and 1 in 3 users would switch banks if their financial institution stopped offering Zelle.

US merchants paid $172 billion in processing fees in 20236; specialist family‑finance and SMB‑card fintechs (e.g., Greenlight, Brex) now capture a growing share.

57% of US banking contact centre leads expect call volumes to rise to 20% by 2026 as interactions grow more complex7.

Collaborative living is mainstream, and the service, revenue, and churn data already reflect that reality. Banks that cling to single‑owner constructs are swimming against a demographic riptide.

Legacy Constraints That Limit Multi-User Innovation

Technical, commercial, and risk constraints explain why banks have not adapted as quickly as fintech newcomers.

Legacy cores tie ledger rows to a single CIF; daily batch posting blocks real‑time role updates

Most retail P&Ls count “accounts opened,” not “users per relationship,” muting incentives to deepen wallets

Joint‑and‑several liability norms deter fine‑grained sharing

System constraints limit granular account sharing capabilities

These barriers can also reinforce each other:

- Compliance templates assume solo-user data models tied to single-CIF architectures

- P&L metrics reward account growth over multi-user engagement

- Risk frameworks default to joint-and-several liability, blocking granular sharing

Modern event-stream cores decouple these dependencies, making it possible to solve all constraints in parallel.

Why Banks Should Care

Collaborative money behaviors are already reshaping financial relationships, and banks that fail to respond are at risk of losing both relevance and revenue. When banks don’t support shared use cases, spend, deposits, and trust quietly shift to more adaptable providers, while servicing costs keep rising.

Spending is leaking to challengers

Fintechs like Greenlight and Apple Card Family are capturing significant share by offering multi-user experiences with role-based controls and flexible permissions. Greenlight alone now serves over 6 million families with dynamic spend caps and parent-child roles8. Apple, meanwhile, has brought over a million users into Shared Finance ecosystems through its Family Sharing Group9, all while traditional cards remain locked in single-user frameworks.

Deposits are at risk

As multiparty households grow more common, customer expectations shift with them. Millennials and Gen Z increasingly favor institutions that support collaborative financial management. Recent surveys show rising rates of primary checking account churn in these demographics, a trend projected to accelerate as joint decision-making becomes the norm in households, friend groups, and teams.

Costs are rising behind the scenes

When platforms aren’t built to handle shared behaviors natively, users turn to workarounds, like calling customer support for access issues, payment clarifications, or dispute resolutions. Each support call represents both a friction point and a financial hit. As collaborative usage rises, so does the cost of patching over product limitations with service bandwidth.

The competitive landscape makes it clear

Collaborative financial behavior has become a proven, scalable opportunity. The only question is whether banks will meet customers where they already are, or continue to cede ground to more adaptive, user-centric platforms.

The Shared Finance Framework

Forrester first labelled the unmet need for “Shared Finance” in 2016. At the time, researchers observed that banks offered little beyond joint accounts and secondary cards. In 2024, Forrester concluded that progress had been patchy, with most advances coming from fintech newcomers10. Eight years on, the core insight stands: money management is collaborative, but banking remains designed for the individual.

Working Definition

Shared Finance allows multiple, distinct identities to own, fund, view, and control a single financial relationship in real time – through product strategy and ledger architecture – with liability, permissions, and credit building aligned to each role.

This is more than UX. It demands an event‑driven core that stores roles alongside balances and exposes them through open APIs.

Scope at a Glance

Shared Finance isn’t a single product, it’s a cross-cutting capability that spans offerings, segments, and infrastructure. This table outlines where Shared Finance applies and why each dimension is critical to building a scalable, future-ready model.

| Dimension | What It Covers | Why It Matters |

|---|---|---|

| Products | Credit & charge cards, checking, savings pods, shared BNPL plans, revolving credit lines | All ledger‑based products gain engagement when more users participate |

| Customer Segments | Families, multigenerational households, unrelated roommates, SMB & startup teams, clubs & collectives | Shared needs cut across consumer and business banking |

| Infrastructure | Multi‑entity ledger, event stream, role‑policy engine, audit log | Capabilities must live at the core, not just the mobile layer |

Components of shared banking

How Shared Finance Differs from Joint Accounts

Joint accounts were built for simplicity, not flexibility. Shared Finance, by contrast, is designed for precision, transparency, and control. The table below highlights the key differences.

| Capability | Traditional Joint Account | Shared Finance |

|---|---|---|

| Permission Granularity | All / nothing | Per user, merchant, amount, time |

| Visibility | Mirror image for all | Configurable in real time |

| Liability | Joint & several | Role‑weighted or capped |

| Credit Building | Only primary owner | Each authorised spender |

| Audit Trail | Monthly statements | Event‑level log, API‑accessible |

Joint accounts vs. Shared Finance

By decoupling visibility and liability, Shared Finance solves the secondary‑access traps – secret PIN sharing, screenshot budgeting, unclear dispute paths – that plague joint accounts.

Lessons From Other Industries

Shared-access models aren’t new; they’ve transformed other industries by aligning product design with real-world usage patterns. These examples show how structuring access around groups, not individuals, can drive both retention and revenue growth. They didn’t just add users, they redefined relationships. By baking shared access into the product fabric, these industries turned coordination into loyalty, and roles into revenue.

- Industries like telecom and streaming prove shared-access models drive retention and revenue.

| Industry | Shared-Access Model | Measurable Impact11 |

|---|---|---|

| Telecom | Family data plans with per-line controls | Churn ↓25% ARPU ↑15% |

| Streaming | Profile-based subscriptions under one billing account | Retention ↑35% Watch time ↑25% |

| Enterprise SaaS | Role-based access permissions | Onboarding speed ↑50% Retention ↑30% |

| Ridesharing | Family accounts with shared ride credits | Usage frequency ↑20% |

| Retail Membership | Multi-user household memberships | Renewals ↑15% Spend ↑18% |

Cross-industry shared-access models and their business outcomes

Principles of the

Shared Finance Model

Designing for Shared Finance means rethinking how money is accessed, governed, and grown across multiple participants. The principles below offer a blueprint for building systems that reflect collaborative financial behavior securely, transparently, and at scale.

What Shared Finance Means for Your Business

Shared Finance changes the economics of banking relationships. It increases wallet depth, reduces servicing overhead, and opens up new paths to growth—all by aligning product design with how people actually manage money today.

- Shared Finance and collaborative controls could unlock $131 billion12 in incremental volume in SMB and family banking cards annually.

Top‑Line Expansion

Shared Finance unlocks new levers for revenue growth across acquisition, engagement, and monetization.

Higher Customer Lifetime Value (CLTV) via Network Effects

Every new active user on a shared account boosts spend without additional acquisition cost. In the US, the average yearly spend per credit card is $8,82313. When multiple participants transact on the same account—e.g., a parent and two teens—interchange revenue can effectively double or triple per account.

Cross-Sell Uplift Through Household Intelligence

Shared budgeting and account access give issuers deeper visibility into family or group spending behaviors. This allows for more accurate pre-qualification for loans, credit line increases, or insurance offers.

Fee Diversification Across Roles and Wallet

Role-based cards, configurable sub-wallets, and spend segmentation introduce new monetization points. These include incremental interchange from secondary users and FX revenue from travel-linked cards.

Cost Compression

By aligning access with intent, Shared Finance reduces support burdens, dispute volumes, and acquisition costs.

Intangible Dividends

Beyond financial returns, Shared Finance delivers strategic advantages in data, compliance, and inclusion.

Shared Finance, in short, produces a flywheel: every added participant raises spend and data richness, which lowers CAC and fuels smarter cross‑sell, which deepens relationships further. In a margin‑compressed environment, that compounding loop is hard to ignore.

From Feature to Foundation

Shared Finance is no longer a niche experiment — it’s fast becoming a foundational expectation. As customers increasingly manage money in groups, households, and teams, banks must evolve beyond the outdated assumption of a single-user account. Those who act early can define the new standard for collaborative finance. Those who delay may find themselves servicing low-margin, low-engagement relationships while digital-first challengers set the pace.

The Urgency is Real

Consumer behavior has changed

Today’s customers expect financial tools that mirror their real-world relationships. Products that treat money as a solo activity are losing relevance.

Operational inefficiencies are mounting

Workarounds like shared cards, spreadsheets, and customer service calls are symptoms of platforms not built for collaboration.

Regulatory scrutiny is increasing

Ambiguity in liability and access — particularly in joint accounts — is drawing attention from regulators. Clear, role-based frameworks are not just user-friendly; they’re compliance-friendly.

A Playbook for Getting Started

Banks don’t need to reinvent everything at once. A phased approach can de-risk execution while laying the groundwork for a scalable, Shared Finance platform:

Diagnose Hidden Demand

Diagnose Hidden Demand

Pilot Intelligently

Pilot Intelligently

Scale with a Shared Identity Framework

Scale with a Shared Identity Framework

References

- Pew Research Centre, The demographics of multigenerational households | March 2022

- Pew Research Centre, More adults now share their living space, driven in part by parents living with their adult children | January 2018

- Upwork, Freelance Forward 2023 | December 2023

- PayPal, Annual Report 2024 | February 2025

- CNBC, Zelle payments top $1 trillion in 2024 as network’s growth outpaces rivals including PayPal | February 2025

- Nilson Report, Merchant Processing Fees in the United States—2023 | 2024

- McKinsey, Where is customer care in 2024 | March 2024

- Businesswire, Greenlight Announces Custom Family Banking Solution for Financial Institutions to Better Serve the Next Generation | March 2023

- Apple, Apple Card is helping more than 12 million cardholders live healthier financial lives | January 2024

- Forrester, Why Digital Teams At Financial Providers Should Invest In Shared Finances | May 2016

- Zeta internal estimates

- Zeta internal estimates

- Nerdwallet, Credit Card Data, Statistics and Research | March 2025