Owning the Relationship: Why Data, Not Deposits, Will Define Banking Primacy

Contents:

- The New Competitive Arena: Ecosystems, Not Banks

- Relationship Ownership Compounds Value

- The Next Competitor Is an Agent

- Owning the Moment Means Owning the Context

- From Product Portfolios to Relationship Platforms

- The New Economics of Data and Relationship Capital

- The Roadmap: Turning Data into Differentiation

- Why a Modern Card Platform Becomes Critical

- From Infrastructure to Intelligence: The Future of Relationship Banking

Retail deposit growth in the United States has fallen from nearly 21% in 2020 to 1% in 20241. And more than $3 trillion has left banks for fintech investment and savings accounts2.

Customers are finding better experiences elsewhere in ecosystems that see their behaviours, learn their needs, and act in the moment. These institutions own the relationship loop — the continuous cycle where every customer interaction generates data, that data drives smarter actions, and those actions deepen the relationship — which is powered by data, enabled by AI, and delivered in real time.

The New Competitive Arena: Ecosystems, Not Banks

Banks aren’t just competing with one another anymore. They’re up against ecosystems that capture more of the customer’s data and, as a result, understand their behavior better.

Apple Pay’s total sales volume has increased from $268 billion to $450 billion this year3. As many as 84% of freelancers would choose instant payments if given the option4. Moreover, digital banks and fintechs captured 44% of all new checking accounts opened in 2024, slightly surpassing megabanks and regional banks at 43%5.

In this environment, the usual advantages (large branch networks, competitive rates, strong marketing) can only take a bank so far. The real advantage will come from the ability to read customer signals quickly, personalize at scale, and respond in the moment.

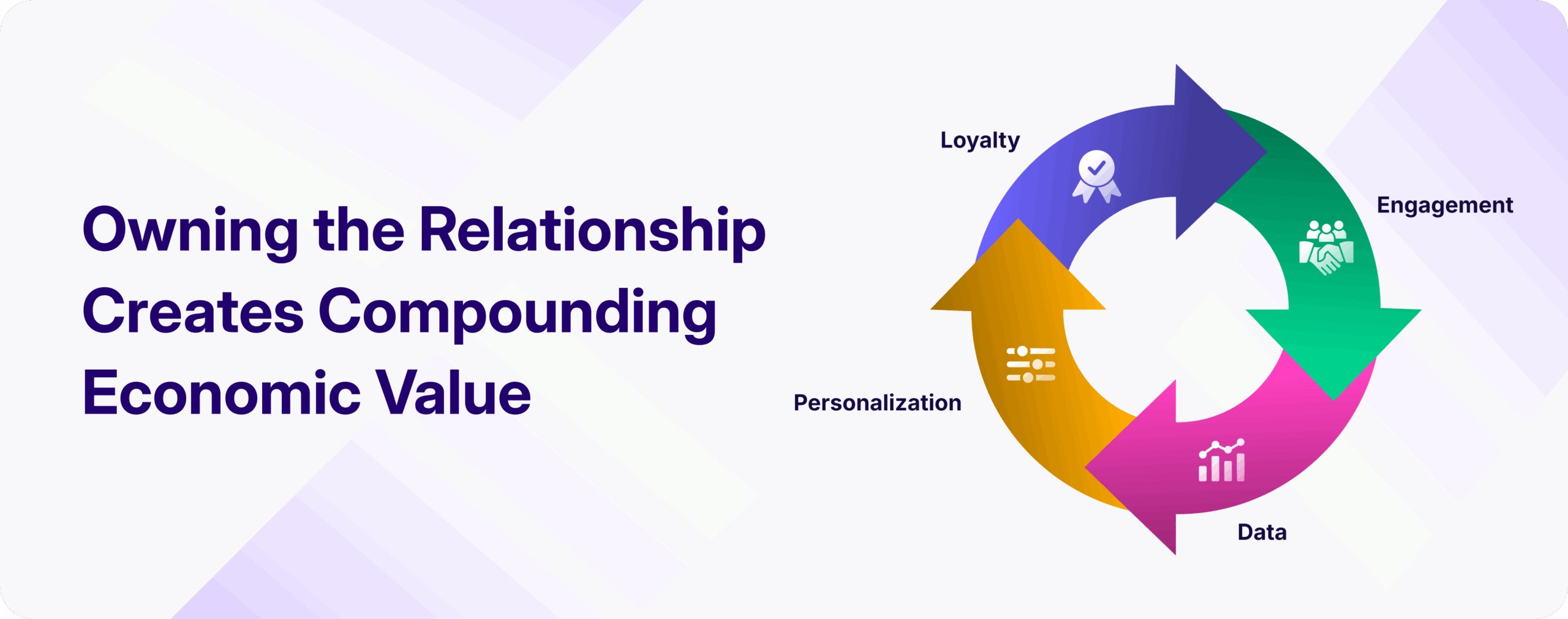

Relationship Ownership Compounds Value

When a customer designates a bank as their primary financial relationship, they anchor significantly more of their financial lives with the institution, which is why they deliver three times higher relationship balances6 and could result in a 20% uplift in banking revenue7.

This dynamic creates a feedback loop where every interaction produces insight like patterns in spend, income, and behavior that, when interpreted effectively, enable more relevant offers and more timely interventions. As these responses improve, so does the customer’s propensity to consolidate activity with the bank. The relationship becomes self-reinforcing: insight drives action, action strengthens trust, and trust expands value.

Sustaining this compounding effect requires a technology foundation that can observe signals in real time, derive meaning from them, and respond with precision. Without that capability, the economic potential of primary relationships remains largely unrealized.

The Relationship Flywheel

How: Seeing, Learning, and Acting in Real Time

Legacy cores were designed to capture the outcome of a transaction (the amount, the timestamp, the ledger entry) but they miss the intent and context that give those transactions meaning. In a world where customer behavior shifts rapidly, that blind spot leaves enormous value untapped.

Modern ecosystems are built to observe signals continuously and interpret what they imply about a customer’s financial life. For example, a sudden dip in deposits may indicate a change in employment, or a rise in day-to-day expenses might reflect a new household structure. Even small shifts in payment patterns can reveal emerging needs long before a customer articulates them.

Banks can intervene with precision when they detect shifts in real time. For example, they can trigger an overdraft alert before a payment is declined, surface a savings recommendation as soon as income rises, and adjust a credit line in step with predictable shifts in spending.

Cards Are Behavioral Sensors; Deposits Are Trust Anchors

Cards are used nearly once a day on average8, but only 24% of Americans report checking their account balances every day9. Each card authorization brings with it a rich set of attributes like where the customer was, what they purchased, how they paid, and when. This frequency and granularity make cards the most powerful signal of customer behavior.

Deposits, on the other hand, reflect trust and long-term commitment. Midcap banks with higher shares of retail deposits, for example, delivered net interest margins ~44 basis-points higher than peers reliant on wholesale funding and experienced asset growth that was more than twice as fast as those with weaker retail deposit bases10.

Viewed together, cards and deposits form the two essential pillars of relationship banking: one reveals how customers live day to day, and the other shows where they place their confidence. The real opportunity lies in unifying these signals within a single data foundation, so that every act of engagement becomes intelligence the bank can use to strengthen the relationship.

The Next Competitor Is an Agent

A growing share of financial activity is already being mediated by AI. Around 67% of Gen Z use AI for financial tasks11. And by 2030, agentic commerce could account for $3-5 trillion globally12.

The emerging competitor to the banking relationship is an intelligent agent that can make recommendations, execute transactions, and manage financial routines on the customer’s behalf.

In that world, the question for banks is no longer only how to serve customers directly, but has also expanded to how they can be the primary institution those agents choose to work with.

Owning the Moment Means Owning the Context

Personalization only works when it is anchored in timely, accurate data. Banks that adopt event-driven architectures are seeing tangible performance gains, including faster innovation and shorter personalization cycles.

The strategic advantage is shifting towards institutions that can secure speed, completeness, and contextual richness of the data they harness. The banks that win will be those capable of interpreting a customer’s context in the moment it matters, transforming ordinary transactions into precise, relevant experiences that strengthen the relationship.

From Product Portfolios to Relationship Platforms

Instead of structuring teams and technology around individual products, leading banks are aligning around customer journeys and the data flows that shape them.

Batch processes are being replaced with real-time event streams, and broad, one-size-fits-all campaigns are giving way to AI-driven contextual actions. In this model, traditional product management evolves into — a continuous cycle in which every transaction, signal, and response informs the next best action.

The New Economics of Data and Relationship Capital

Data is now an economic asset that directly shapes growth, efficiency, and competitive advantage. In this context, relationship capital emerges as a new form of equity: the combined value of trust, data, and real-time utility delivered to customers.

Institutions that effectively activate their relationship data will see increases in customer profitability and reductions in cost-to-serve. Each card swipe, payment, or balance update contributes to this compounding value, building a new measure of primacy in banking: the depth and quality of a bank’s relationship equity.

The Roadmap: Turning Data into Differentiation

A clear four-phase roadmap can help institutions turn real-time data into true differentiation:

1. Visibility: Begin capturing event-level signals across cards and payments.

2. Connectivity: Create a unified view of the customer by integrating deposit, card, and payment data.

3. Context: Use real-time signals to drive personalized, context-aware actions.

4. Intelligence: Feed AI and agent ecosystems with trusted, live data to extend relationship relevance.

Progressing through these phases moves a bank from reacting to transactions to anticipating them and creating relationships that compound value over time.

Why a Modern Card Platform Becomes Critical

New-age issuers can launch card variants or loyalty features in days, while most banks remain bound to mainframe release cycles.

- Modern architecture transforms transactions into real-time data that fuels AI models, analytics, and personalization engines.

- Microservices isolate failures and prevent system-wide disruption. Cloud-native scale brings elasticity and auditability, enabling banks to meet regulatory expectations with greater consistency while reducing operational risk.

- Owning the modern card platform gives banks direct command over the customer experience, the innovation agenda, and the data flows that power both, enabling them to own the relationship.

From Infrastructure to Intelligence: The Future of Relationship Banking

The next era of banking is how intelligently banks can engage each customer. Success will depend on the ability to understand intent, interpret behavior in real time, and deliver experiences that feel relevant in the moment.

In that environment, data becomes a key indicator of primacy. Deposit share will likely mirror data share, because the institutions that see more customer moments will naturally earn more of the customer’s financial life.

AI will elevate the relationship, allowing banks to move beyond transactional service and into the role of contextual advisors.

Reaching this future requires building the data foundation, modernizing the stack, and creating intelligence at the edge. When these elements come together, customer relationships stop functioning as static accounts and become living systems of value that compound insight, engagement, and trust over time.

References:

- OCC | Bank Deposit Growth to Remain Sluggish Through 2025 | 2024

- Cornerstone Advisors | Stemming the Deposit Outflow: The $2 Trillion Investing Opportunity for Banks and Credit Unions | 2025

- PYMNTS Intelligence | Apple Pay @11: Usage is Up, but Competitors are Gaining Ground | 2025

- PYMNTS Intelligence | Generation Instant: Freelancers Use Instant Payments to Reduce Financial Hardship | 2024

- Forbes | Why Fintechs Are Beating The Banks In New Checking Accounts | 2025

- BCG | Building Next-Gen Primary Banking Relationships | 2024

- Accenture | Banking Consumer Study: Reignite human connections | 2023

- Federal Reserve Bank of Atlanta | 2024 Survey and Diary of Consumer Payment Choice | 2025

- Empower | Money on the Mind | 2025

- McKinsey | Banking on the next generation: A playbook for US midcap banks | 2025

- Experian | Americans are embracing Gen AI to make smart money moves | 2024

- McKinsey | The agentic commerce opportunity: How AI agents are ushering in a new era for consumers and merchants | 2025