5 Ways Modern Card Technology Drives Business Value for Issuers

The landscape of card technology is shifting rapidly, fueled by advancements in digital payments, evolving consumer expectations, and a growing competitive landscape. Banks face a critical decision: modernize their card processing systems or risk falling behind.

With outdated systems threatening revenue and agility, banks may see a significant impact on revenue if they do not adapt and invest. The Datos Insights (formerly Aite-Novarica) Group1 estimates that revenue at risk for retail banks that do not focus on modernization could be 10% to 15% of retail bank payments revenue annually, or $100 billion to $150 billion globally.

However, conversations about moving to modern card processing systems must go beyond leveraging the cloud or using new technology. The next generation of card processing is about enabling new business models for issuers and launching products that meet innovative use cases.

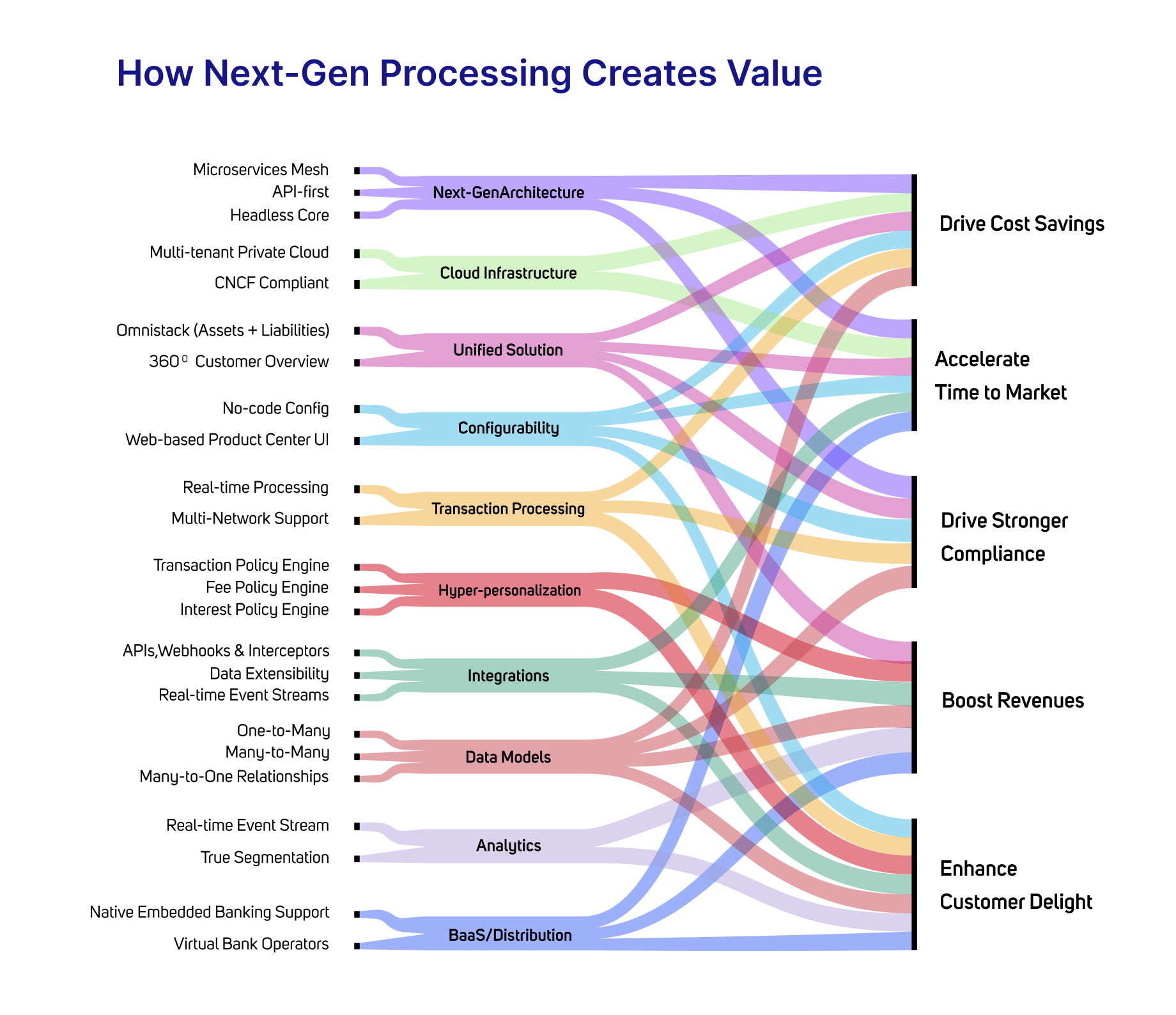

Most boards wrestle with prioritizing such a significant shift over other operational considerations. Apart from the challenge of proving the urgency of such a move, the risk of disrupting traditional processing workflows must be evaluated against possible benefits. This blog presents a value creation framework to demonstrate how the 10 dimensions of next-gen issuer processing overcome the shortcomings of legacy systems to help banks achieve 5 value outcomes.

5 ways next-gen processing adds value

The premise of next-generation issuer processing is straightforward. It allows banks to transform into genuinely digital-native organizations that build stronger customer relationships and enhance revenue while significantly reducing IT and operational costs.

Compared to legacy processing systems, which were deployed when cloud, mobiles, or even the internet did not exist, next-generation technology is inherently connected, scalable, and composable. For example, while legacy processing platforms have a monolithic architecture with hard-coded objects and poor API coverage, next-gen issuer processing systems are powered by a Microservices, API-First, Cloud-Native, Headless (MACH2) core that allows near-infinite scalability and extreme integrability – in turn enabling rapid innovation of products with seamless connectivity with the larger financial services ecosystem.

You can read our white paper on modernizing card technology platforms for a fuller drill-down into the 10 capabilities that differentiate next-gen issuer processing from legacy processing.

Image 1

Let’s evaluate how specific differentiators of next-gen issuer processing can help banks drive cost savings, accelerate time to market, drive stronger compliance, enhance customer delight, and boost revenues (image 1).

1. Drive cost savings

A McKinsey report found that operating costs of fintech banks powered by next-gen core platforms are around 10 percent of the operating costs of traditional banks3. Specifically, next-gen processing platforms enable cost savings through:

- Higher productivity: Modern software increases capacity creation by 25% – 30%4 by enabling agile practices, while also reducing banks’ IT spend on acquiring, training, and retaining talent that can work with legacy systems.

- Reduced legacy debt: Keeping legacy systems operational consumes a significant share of the IT budget. With modern technology, banks can invest significantly more in revenue-generating projects, yielding a virtuous cycle.

- Increased automation: Modern processing systems enable a higher order of automation leveraging Artificial Intelligence (AI) and Machine Learning-led applications like chatbots and generative AI.

2. Accelerate time to market

In the 2023 Global Payments Report, McKinsey observes that modernization of banks’ technology stacks halves the time to market for new products5. The elements that drive this acceleration are:

- Faster product conceptualization: Research finds that a lightweight processor platform can enable an organization to advance new products from concept to launch in two to three months6. At scale, the results are truly transformational.

- Owned product roadmap: Modern engineering practices enable the use of low-code, configuration-based interfaces, and intuitive UX to create and configure products. This empowers banks to build unique products without depending on vendors.

- Faster integrations with third-party surround systems: Next-gen processing platforms enable third-party integrations like CRMs, Rewards Catalogs, Lifecycle Marketing, Credit Decisioning, Fraud Management, or AML/BSA in weeks v/s years, allowing banks to build winning product experiences.

3. Enhance customer delight

McKinsey research7 shows that banks designated as ‘Customer Experience (CX) leaders’ generate 72% more total shareholder return than ‘Customer Experience (CX) laggards’. Next-gen processing platforms drive customer delight in two significant ways:

- Hyper-personalization or catering to segments of one: A compelling payment experience requires personalization that goes beyond fee or interest-rate offers, and drives engagement beyond the payment transaction. This is not possible with existing card technology. Next-gen processing drives hyper-personalization by allowing product configuration across payment limits, rewards, fees, interest programs, and repayment policies for each customer and transaction.

- Integrated and seamless journeys: Next-gen processing platforms deliver a data platform capable of ingesting, analyzing, and deploying vast amounts of data in near real-time across touchpoints like Mobile App, Web, Call Center, IVR, Chatbots, Email, and SMS.

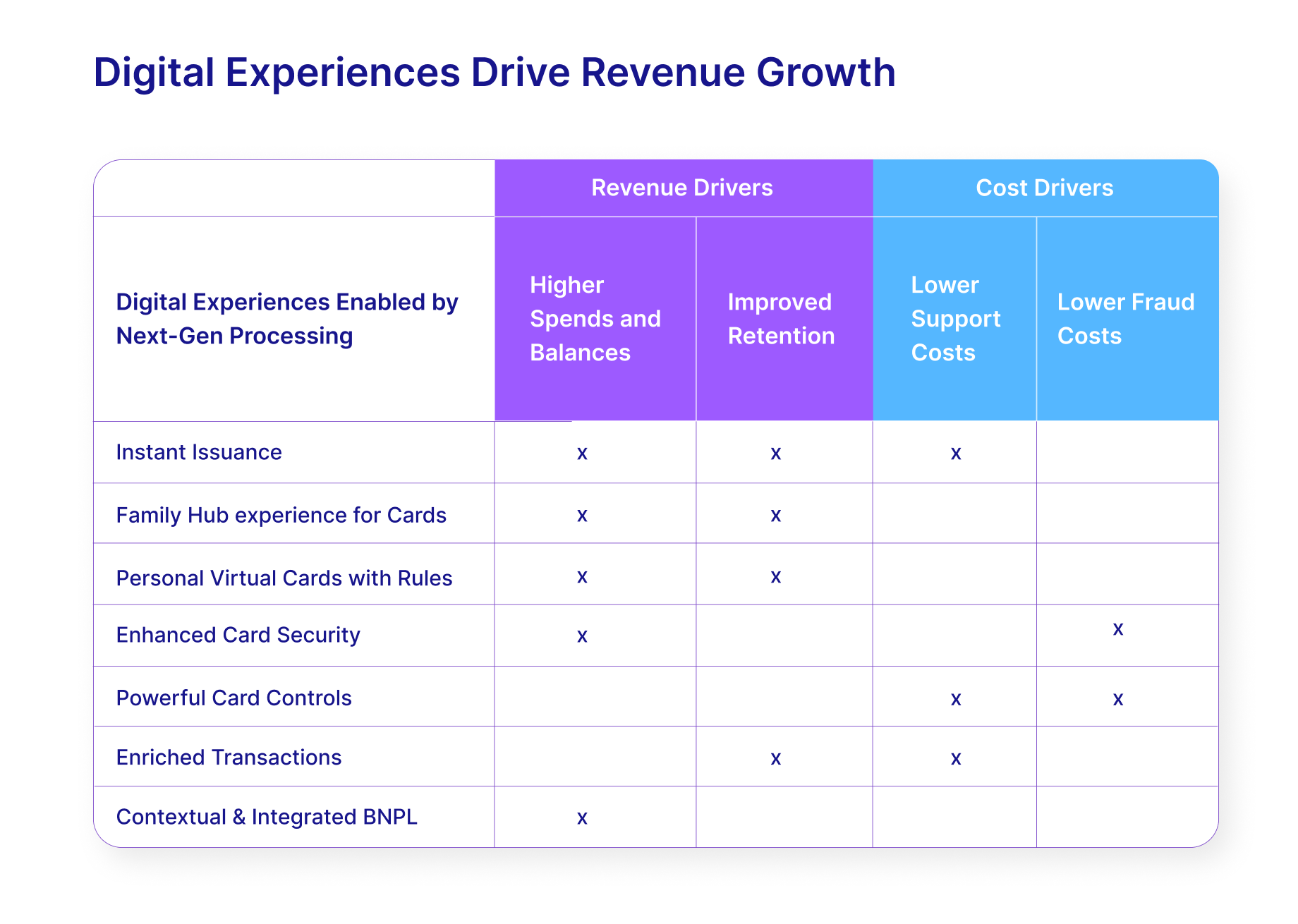

4. Boost revenues

Next-gen processing systems drive growth in revenue for banks by helping them deliver winning digital experiences (image 2), build a vibrant ecosystem of distribution and partnerships, build products for new customer segments, and improve upsell, cross-sell, retention, and top-of-wallet use.

Image 2

5. Drive stronger compliance

In recent years, financial institutions have been particularly impacted by rising compliance costs. Most compliance management frameworks today rely on post-facto audits, manual interventions, and little to no automation in response to changing compliance or risk norms. The architecture of next-gen systems enables banks to have an ‘always-on’ posture on compliance through stronger programs that not only guarantee compliance but do so efficiently and at lower cost.

Securing card revenues over the next decade of innovation

Geoffrey Moore, Innovation Expert and Author of best-selling books such as Crossing the Chasm and Zone to Win, recently delivered the keynote at Zeta’s exclusive banking workshop. In his address, Moore issued a critical call to action, emphasizing that digital transformation is not a choice but an imperative for the financial industry.

While the challenges of building a case for transformation remain, the next generation of technology solutions is establishing itself as a viable alternative. As Accenture argues in their 2023 Top 10 Banking Trends report8: “The likely disruption caused by a multi-year transformation was always a good excuse for sticking with your mainframe. However, today’s cloud-native platforms not only dramatically reduce the timeline; they also allow migration and the launch of new products to be done progressively, which reduces the risk. The ROI has improved dramatically”.

The time to act is now.

Footnotes

- Aite Novarica Group, Payments Modernization in Retail Banking | December 2020

- MACH Alliance, MACH Alliance

- McKinsey, Should US banks be moving to next-generation core banking platforms? | July 2022

- McKinsey, Beyond digital transformations: Modernizing core technology for the AI bank of the future | McKinsey | April 2021

- McKinsey, On the cusp of the next payments era: Future opportunities for banks | September 2023

- McKinsey, Beyond digital transformations: Modernizing core technology for the AI bank of the future | McKinsey | April 2021

- McKinsey, Five ways to drive experience-led growth in banking | May 2023

- Accenture, Top 10 Banking Trends for 2023 | February 2023