Zeta at CBA LIVE 2024

I’ve been going to CBA LIVE for three years now and it’s easily my favorite show. As head of US Marketing for Zeta, I’ve seen a lot of shows. We’ve gone huge at the biggest tradeshow in the industry, bringing in bands like Foreigner and Journey. We’ve done small shows that are focused on meetings. But no show really gets it right the way CBA does, and it starts with the mission of representing the interests and needs of retail banks, which shows in the agenda and makeup. Community impact, compliance, responsible banking, and current trends. Unlike some tradeshows, CBA is by bankers for bankers.

That means trading quantity for quality, and this year was no different. Despite having a fraction of the attendees compared to bigger shows, we had many fantastic conversations with senior bankers from the most prominent financial institutions. One after another told us about their challenges with legacy technology. Common refrains included having to open tickets with their provider to accomplish simple changes or the inability to launch or even modify products without months or years of lead time. So much is made of the need for transformation and major change, but these leaders are just trying to run their portfolios in many cases.

Coming out of the show and filling up the calendar with demos and follow-up meetings, it’s clear that there’s a hunger for this solution. Even among banks that don’t have the ability or appetite to take on a new platform, you can sense them cheering for us, if only to have a viable modern alternative for when they are ready.

We led this year’s show with a bit of protest art. We bought an old 1990s mainframe computer and held a funeral of sorts for it, complete with Halloween-style funny gravestones and candles. We wanted to signal the need for modern banking to respond to the changes around us and ring an end to the era of the venerable mainframe. This struck a chord, and the bankers laughed as hard as anyone. They already know they want to modernize; they just need the tools to do it. The mainframe definitely turned heads, and the gravestones had people puzzling over the puns. More importantly, it was a great conversation starter on how Zeta could help them move forward.

A Tale of Two AIs

One of the biggest trends in modernization in any industry right now is Artificial Intelligence. Zeta was proud to be invited to talk on this topic not just once but three times!

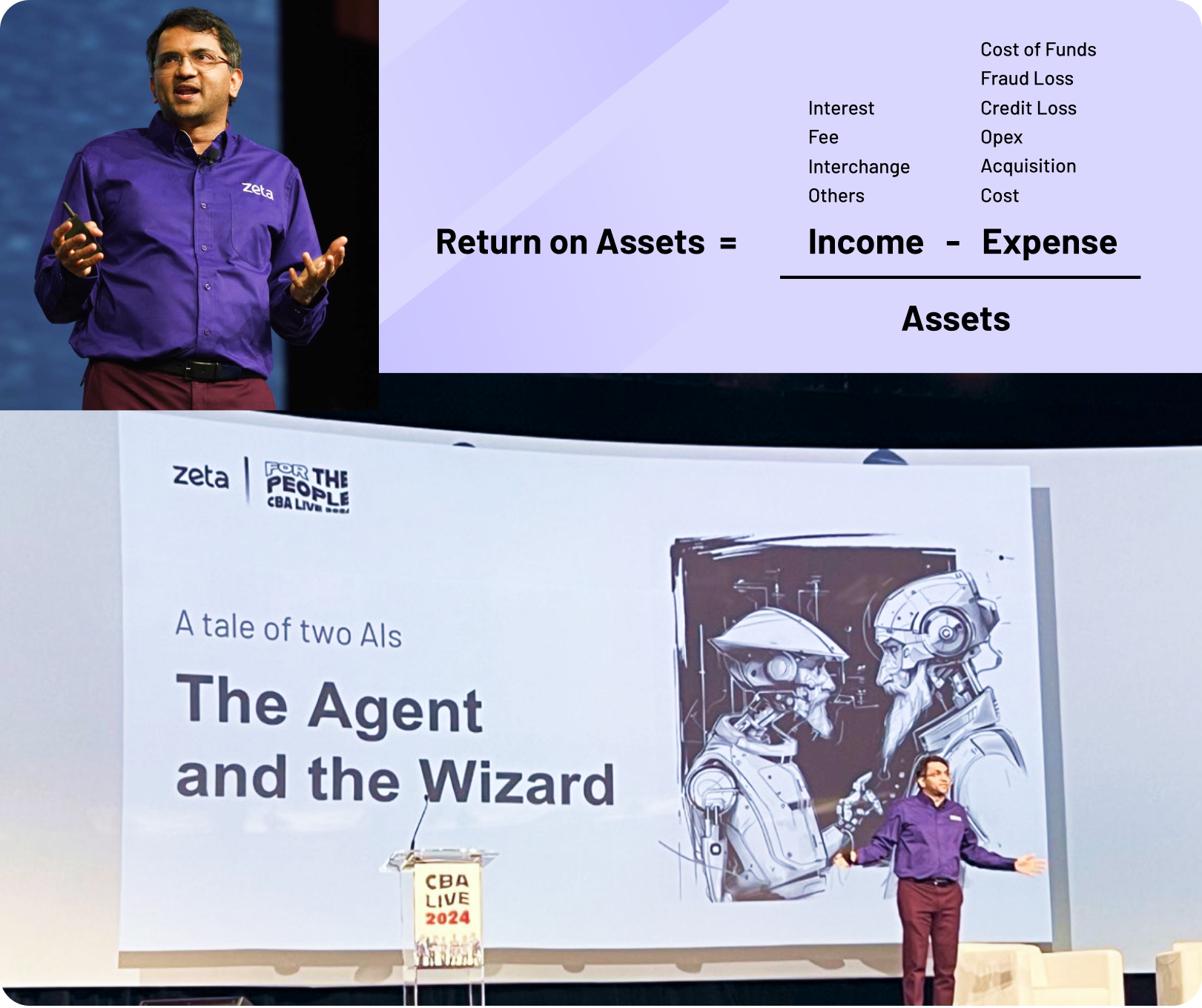

- Keynote address on AI’s impact on banking

- Deep dive on implementing AI

- Regulatory landscape for AI and its impact on complaints

Our CEO, Bhavin Turakhia, joined Nick Thompson, CEO of The Atlantic, in talking about the impact of AI on society and banking. Bhavin talked about the two main types of AI that would transform banking: Conversational AI and Decisioning AI. But eyes really opened when he talked about the success equation in banking and how AI could optimize decisions at every step of that equation. It was clear that banks that don’t adopt this will be left behind or acquired. My favorite quote: “Humans tend to overestimate what they can accomplish in a year and underestimate what they can accomplish in a decade.”

Following the keynote, Bhavin was joined by Patrick Viau from Rasa and David Excell, Founder of Featurespace, to discuss how Decisioning and Conversational AI are already used in banking and where it’s headed, as well as what the technology and platform implications of AI are. The discussion highlighted the benefits of Conversational AI for customer interactions, emphasizing its 24/7 availability, natural language interface, and ability to provide personalized experiences. Decisioning AI, on the other hand, was presented as a tool to optimize bank operations through complex data analysis.

The panel then delved into the most groundbreaking use cases for Conversational AI and Decisioning AI today, the technical capabilities banks require to leverage these AI technologies meaningfully, and the importance of guardrails and contextual LLMs in these implementations.

Our Chief Compliance Officer, Karla Booe, participated in a panel on AI’s impact on Complaints Management with her perspective on the regulatory landscape for AI. Alongside industry leaders Tony Antonopoulos from Rockland Trust Company, Heather Hajek from Synovus, and moderator Kelly Wogan from Huntington, Karla shared the latest information, including from just that morning(!) on the regulatory landscape for AI in banking. She called out that 2024 is going to be the year of regulation of AI, and explained how diverse regulatory and executive bodies, including those looking at national security, have AI on their radar as an emergent risk. She also added that while regulations are still trailing technology, regulators are getting better at communicating their concerns through guidances.

Finally, it wouldn’t be a Zeta show without a party, and we sure know how to throw one. We poured high-end bourbons, along with dinner and drinks, at our third annual Bankers and Bourbon party. This is where the best conversations happen too. When there’s no sales pitch, you’re just sitting down and networking with other bankers and having fun. Ironically, this is where we get so much interest in follow-up conversations as well. I suppose some 15 years old Pappy Van Winkle doesn’t hurt either!

Rooting for a vibrant, impactful banking industry

After our third year as Diamond Sponsors of CBA, we’re proud of the mission we share with them. A healthy and vibrant banking ecosystem is critical for our economy and nation. We’re excited to help banks modernize to compete for the next generation of consumers and look forward to returning next year.