What’s in Store for Banking Regulation under Trump 2.0?

Contents

The Republicans now control all three branches of the US Federal government. The next four years are likely to witness a regime that is friendlier to financial services, with both Congress and Federal agencies exercising lighter regulation.

As the new Trump administration takes office, it must reckon with pending legislation, the execution of election promises, and the treatment of outstanding rulemakings under incumbent Federal agencies. In this blog, we will explore some of the potential impact of the election on the activities in Congress and the regulatory agencies overseeing our industry.

Outlook for the 120th Session of Congress

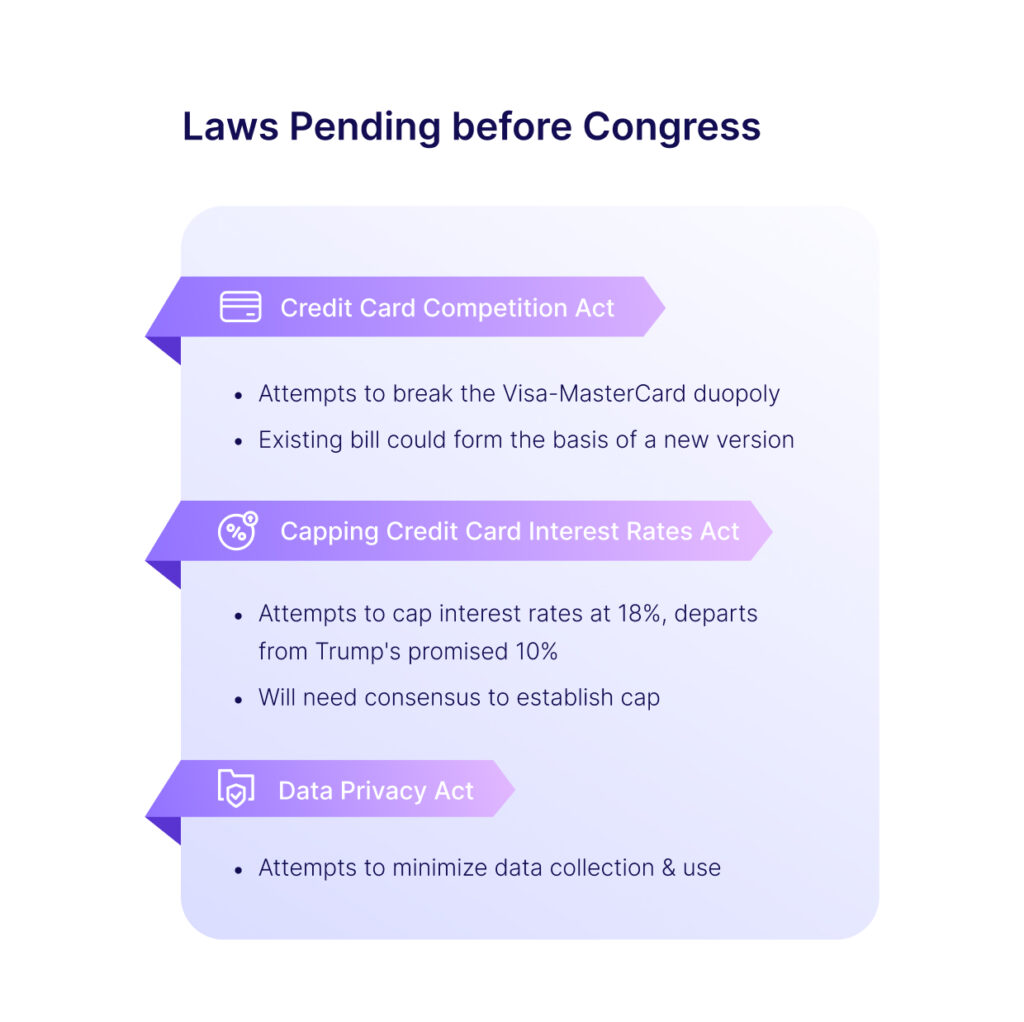

There are several proposed laws in the current session of Congress with potential impact on our industry that may be reintroduced in the new Congress. A few notable ones include:

The Credit Card Competition Act introduced by Sen. Dick Durbin

The Credit Card Competition Act would require credit cards issuing banks with more than $100 billion in assets to offer merchants the choice between two unaffiliated card networks – at least one of which cannot be Visa or Mastercard. The objective of the bill is to encourage competition among networks and reduce interchange fees charged to merchants.

While the legislation has spent several years in limbo, it has received bipartisan support, including from Vice President-elect JD Vance, Republican senators Josh Hawley, Roger Marshall, and Democrat senators Jack Reed and Peter Welch.

On November 19th, Durbin held a hearing on the legislation in the Senate Judiciary Committee, however no further action is anticipated in this session.

Even though the current form of the bill did not gain any traction, it could be a good template for crafting a new version, as well as being incorporated into legislation addressing the tax cuts set to expire in 2025.

Capping Credit Card Interest Rates Act introduced by Sen. Josh Hawley

During the campaign, President-elect Donald Trump called for a temporary 10% cap on credit card interest rates. Meanwhile, in 2023 Senator Hawley had introduced the Capping Credit Card Interest Rates Act proposing a permanent 18% cap.

Sen. Bernie Sanders and Rep. Alexandra Ocasio-Cortez had similarly proposed a 15% interest rate cap in 2019, which stalled out.

However, the framework of Hawley’s proposed legislation could be a starting point for a compromise to establish a cap, even temporarily, and be included in the legislation extending the expiring tax cuts.

The Data Privacy Act of 2023 introduced by Representative Patrick McHenry

As more states enact new privacy laws, the call continues to grow for a national privacy framework. The outline introduced in the Data Privacy Act of 2023, provided for data minimization, which required entities to collect only necessary data and use it solely for disclosed purposes. It also provides for pre-empting of state privacy laws to create uniform regulations across the country which carries bipartisan support.

Image 1

Federal Agencies in a Race against Time

The CFPB is expected to move full speed ahead on current proposed rulemakings until the new administration takes over in January 2025. It is highly anticipated that leaders of several Federal agencies like the current CFPB Director Rohit Chopra, Acting Comptroller of the Currency Michael J Hsu, and the Federal Housing Finance Agency (FHFA) Director Sandra L Thompson, will all be replaced on or shortly after January 20, 2025. Many expect Director Chopra to resign before the President-elect takes office.

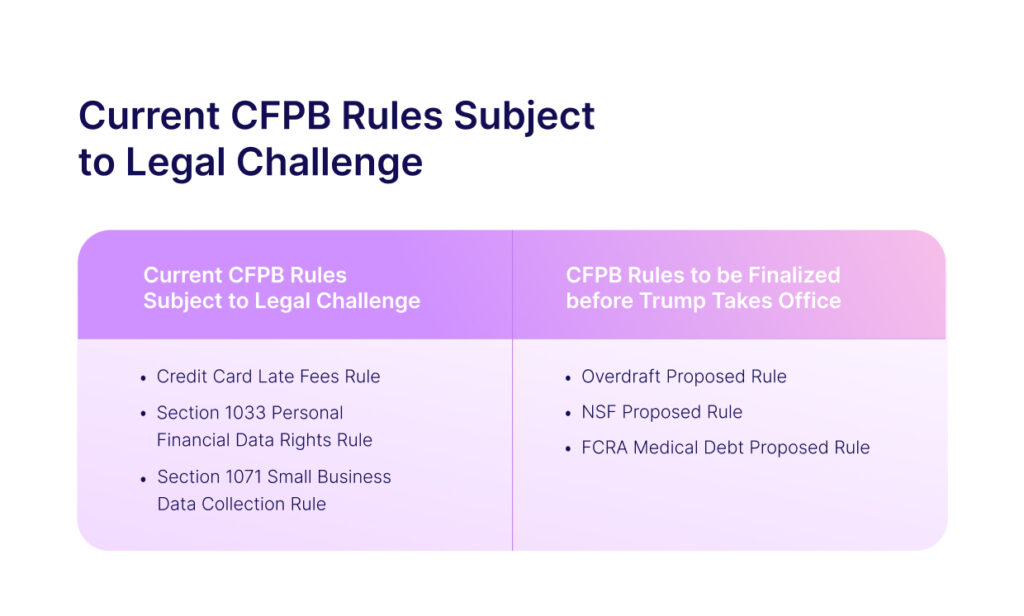

It is likely the incoming CFPB will immediately pause all rulemaking not currently implemented. The following is a list of some of the rules that have not been finalized. Those being challenged will most certainly be reviewed by the incoming CFPB team. These include, but are not limited to:

Final Rules Subject to Legal Challenge:

- Credit Card Late Fees Rule

The Credit Card Late Fees Rule aims to reduce the maximum credit card late fee from up to $41 to $8, aiming to eliminate excessive late fees that exceed what’s needed to cover collection costs. It is currently stayed from going into effect by the Texas District Court.

- Dodd-Frank Act Section 1033 Personal Financial Data Rights Rule

The CFPB’s Section 1033 Rule requires financial institutions to share consumer financial data with authorized third parties through secure APIs, giving consumers more control over their financial information and promoting competition. A lawsuit alleging that it exceeds the CFPB’s statutory authority is filed and awaiting a hearing in Kentucky.

- Dodd-Frank Act Section 1071 Small Business Data Collection Rule

The CFPB’s Section 1071 Rule requires financial institutions to collect and report data on small business loan applications, including demographic information about business owners, to identify potential discrimination in lending.

The final rule is in the implementation phase, but next year the Fifth Circuit will hear an appeal of the District Court decision in the CFPB’s favor.

Rules That Have Not Yet Been Finalized, But Will Likely Be Finalized Before President-Elect Trump Takes Office:

- Overdraft Proposed Rule

Aims to treat overdraft fees like credit card loans, requiring banks to follow credit card regulations and disclose APRs when charging these fees to consumers.

- Nonsufficient funds (NSF) Proposed Rule

Aims to prohibit banks from charging fees on transactions that are declined immediately at authorization due to insufficient funds.

- Fair Credit Reporting Act (FCRA) Medical Debt Proposed Rule

Aims to prohibit credit reporting companies from including most medical debt in consumer credit reports, including both paid and unpaid medical bills.

Image 2

Under the new administration, the CFPB may also revisit some of its other non-formal rulemaking releases, including its 1034(c) Advisory Opinion, its blog post on mortgage closing cost ‘junk fees’, and its circular on unlawful and unenforceable contract terms and conditions, among other items. Overall, we can expect the current CFPB’s approach to establishing new policies outside the formal rule-writing process via enforcement actions, information guidance, or other forms of communication to come to an end.

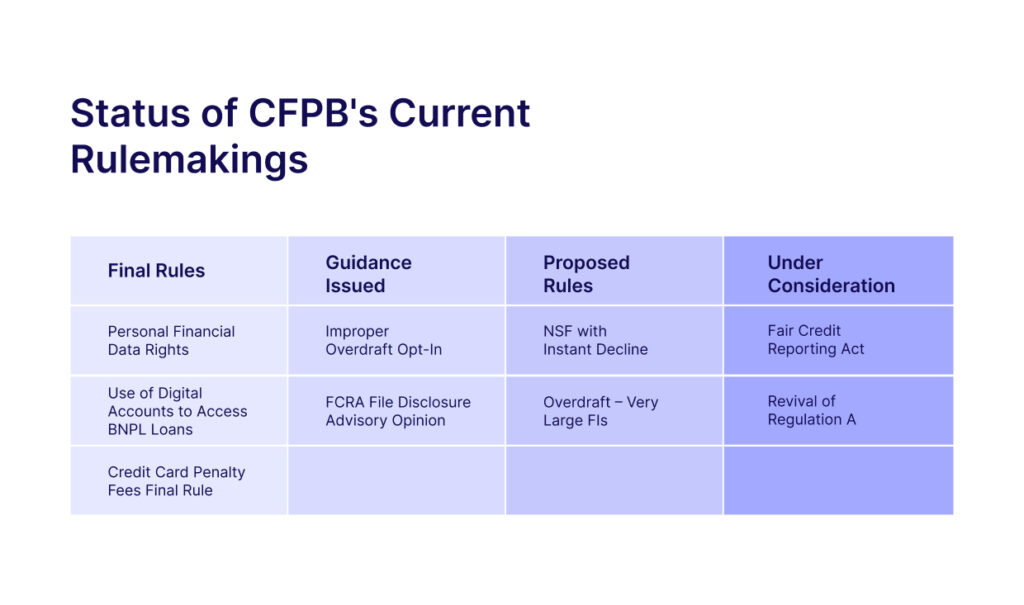

Also, given the President-elect’s focus on housing during the campaign, the current CFPB is expected to prioritize finalizing what has currently been proposed. The following image shows the various stages at which the current CFPB’s rulemaking stands.

Image 3

Conclusion

The anticipated changes in banking regulation under a second Trump administration could mark a significant shift in the financial services landscape. Key legislation like the Credit Card Competition Act, credit card interest rate caps, and the national data privacy framework will likely be reshaped and potentially incorporated into broader legislative packages, particularly as Congress addresses expiring tax cuts in 2025.

The CFPB, in particular, stands at a crossroads. The transition period will likely see a pause and review of numerous pending regulations. Rules currently facing legal challenges may face additional scrutiny or potential revision under new leadership.

As the financial services industry prepares for this transition, institutions should stay vigilant and prepared to adapt to these evolving regulatory changes while maintaining their focus on consumer protection and operational excellence.