Path to Value with Elena: A Roadmap for Card Issuers

Contents

- Conversational AI for Card Support: An Adoption-ready Use Case

- Elena’s Framework for Improved Operational Outcomes

- Realizing Value with a Conversational AI Assistant

- Implementation Roadmap

- From Concept to Value: Implementation Guidance

Conversational AI for Card Support: An Adoption-ready Use Case

Card support presents a compelling business case for AI adoption due to these key advantages:

- Card support exhibits high structural compatibility with AI capabilities: bounded knowledge parameters, predictable inquiry patterns, and quantifiable resolution paths.

- Card support interactions primarily consist of data retrieval, status verification, and standardized transactional processes—all functions that align with current AI capabilities.

- The operational metrics governing card support—average handling time, first-contact resolution rate, cost per interaction—provide clearly defined success parameters and facilitate precise ROI calculation.

- As McKinsey’s research indicates, AI-enabled card support can automate 50-80% of contacts and reduce calls escalated to human agents by up to 80%1.

Elena’s Framework for Improved Operational Outcomes

Elena, Zeta’s AI-powered card assistant, adopts the following framework for improved operational outcomes for issuers.

Improved Self-Service Effectiveness: Next-gen card controls and security features can reduce live agent dependency by up to 75%2

Automation of Routine Queries: Elena’s natural language interfaces can automate an additional 20% of remaining calls, ensuring only complex issues reach human agents

Enhanced Operational Efficiencies: Cloud-native infrastructure enables flexible capacity management, 24/7 availability with 99.9% uptime, and faster response times

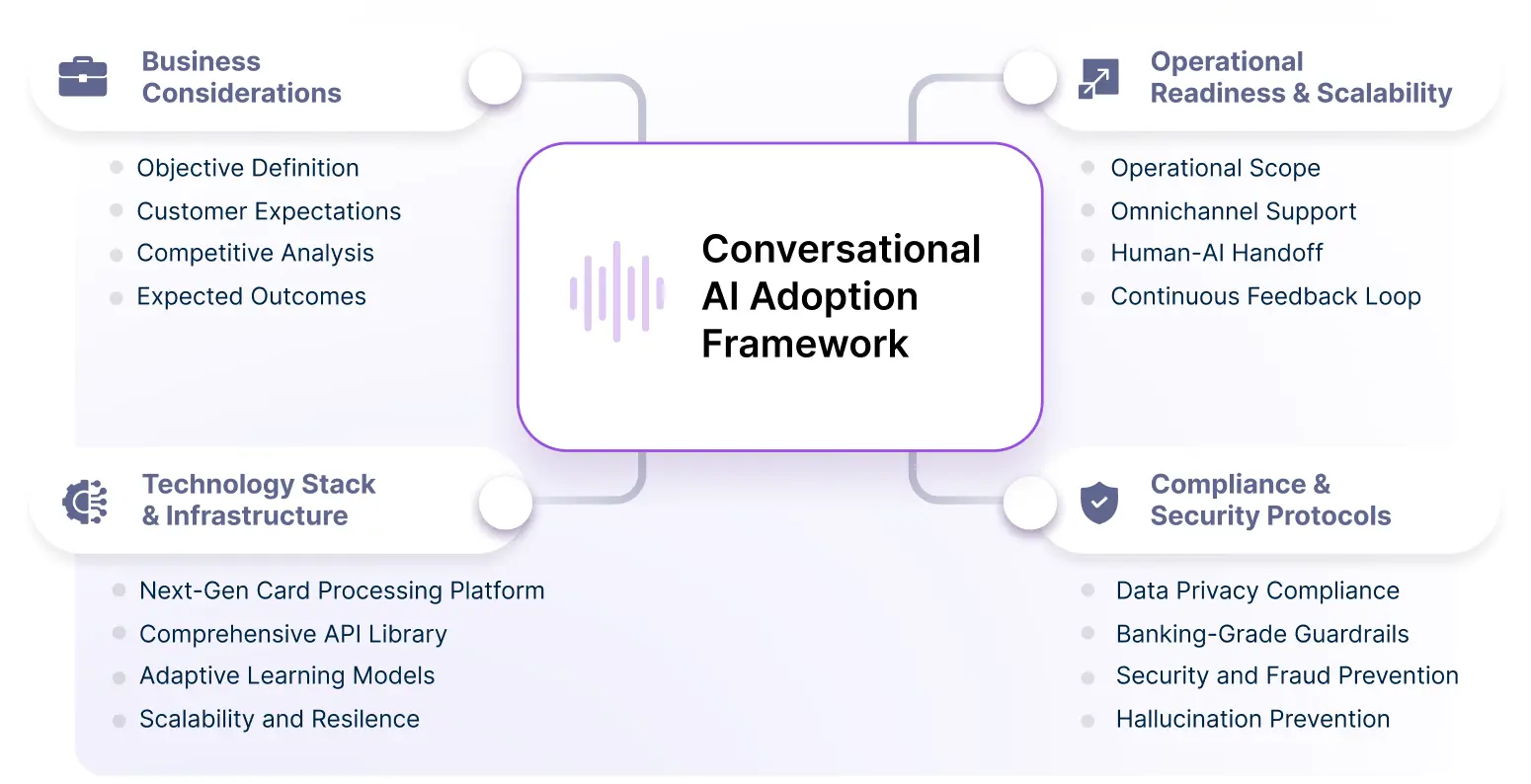

Realizing Value with a Conversational AI Assistant

Realizing value with Conversational AI requires evaluating key considerations across four critical dimensions:

Business Considerations

Objective Definition: Prioritize business goals – reducing service costs, enhancing satisfaction, or improving resolution times.

Customer Expectations: Identify preferences regarding personalization, resolution speed, and channel accessibility.

Competitive Analysis: Benchmark capabilities of leading issuers’ AI solutions to ensure your offering remains competitive and identify differentiation opportunities.

Expected Outcomes: Quantify targets such as reduced agent-handled queries, faster response times, and improved satisfaction ratings to establish clear ROI metrics.

Operational Readiness

Scope Definition: Ring-fence services your AI will provide – information sharing (balances, statements), financial transactions (payments), and insights (spend categorization).

Omnichannel Service Delivery: Ensure seamless accessibility across mobile apps, websites, and IVR, catering to different customer preferences.

AI-Human Handoff Process: Implement smooth transitions to human agents when queries exceed AI capabilities, preserving conversation context to prevent customers repeating information.

Continuous Feedback Loop: Integrate analytics and customer feedback to iteratively improve AI responses and expand capabilities over time.

Compliance and Security

Data Privacy Compliance: Adhere to relevant regulations (CARD Act, CCPA) through robust consent mechanisms and data encryption protocols.

Banking-Grade Guardrails: Prevent unauthorized actions by limiting AI access to predefined, approved workflows and knowledge sources. Implement verification protocols for high-risk actions.

Security and Fraud Prevention: Deploy anti-fraud measures including transaction verification and suspicious activity detection, integrated with existing security systems.

Hallucination Prevention: Implement multi-layered controls including intent validation, enterprise-grade language models, robust prompt engineering, and systematic input validation.

Technology & Infrastructure

Next-Gen Processing Platform: Leverage cloud-native, real-time platforms to handle API requests, transactions, and data access with high availability and scalability.

Comprehensive API Catalog: Ensure availability of extensive APIs supporting all customer interactions from simple queries to complex requests like payment processing.

Scalability and Resilience: Design architecture to scale on demand, handling high volumes without performance degradation, with redundancy for uninterrupted service.

Implementation Roadmap

A successful implementation follows these phases:

Assessment and Planning: Evaluate support operations, define objectives, align stakeholders, and develop implementation plans

Infrastructure Preparation: Assess systems, implement API connections, configure security controls, and establish monitoring capabilities

Initial Deployment: Launch limited functionality, conduct testing, analyze performance data, and train support staff

Scaling and Optimization: Expand capabilities, refine conversation flows, enhance channel integration, and improve handoff procedures

Continuous Improvement: Conduct regular reviews, update training data, introduce new features, and monitor the competitive landscape

From Concept to Value: Implementation Guidance

The successful implementation of Conversational AI for card support requires a systematic approach across the four dimensions outlined in this framework. By addressing business considerations, operational readiness, compliance requirements, and technological infrastructure, issuers can transform their support capabilities while ensuring regulatory compliance and operational excellence.

For issuers considering this path, a strategic implementation approach is recommended:

- Begin with a thorough assessment of current capabilities against the framework

- Develop a phased implementation plan with clearly defined success metrics

- Establish cross-functional governance to address all framework dimensions

- Implement continuous monitoring and optimization processes

The most effective implementations will balance automation efficiency with service quality, ensuring that technological capabilities serve business objectives rather than driving them. While the framework provides structure, each issuer must adapt it to their unique operational context and customer needs.

References

- McKinsey | The next frontier of customer engagement: AI-enabled customer service | March 2023

- Zeta internal estimates