Reimagining UPI For Banks

10 Winning Ideas to Lead the Next UPI Wave

Digital Payments Today: An Opportunity for Banks to Redefine Their Role

UPI’s Explosive Growth Has Bypassed Bank Innovation

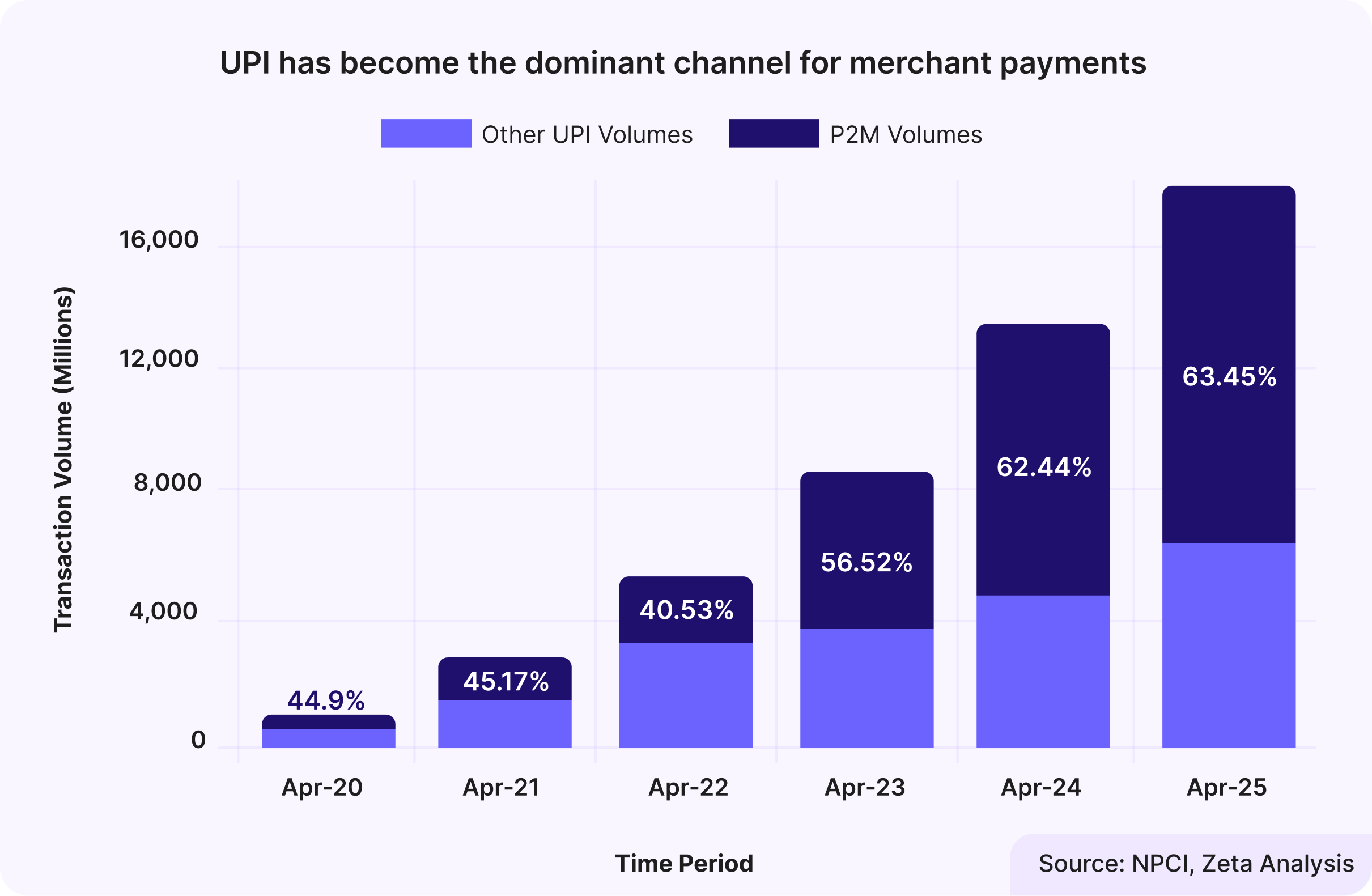

India’s Unified Payments Interface (UPI) has grown over 14x in transaction volume in just five years, rapidly evolving from a peer-to-peer (P2P) money transfer mechanism into being the country’s dominant channel for merchant payments. Today, peer-to-merchant (P2M) transactions make up more than 60% of all UPI activity, highlighting its critical role in everyday consumer payments.

This expansion is likely to gain further momentum with the recent steady rollout of features like:

- UPI Lite: Enables low-value, offline transactions with minimal friction

- UPI Plugins: Simplifies in-app UPI checkouts for better conversion

- RuPay Credit Card on UPI: Enables UPI payments directly from RuPay credit cards

- UPI Circle: Facilitates shared use of an account through secure delegation of access

- Credit Line on UPI: Embeds pre-approved credit within the payment flow

These innovations are not only boosting transaction volumes but also lifting average ticket sizes and expanding use cases across customer segments.

Yet, ironically, banks who are the original architects and essential infrastructure providers of UPI have largely remained on the sidelines. For most banks, payments continue to be viewed as a low-margin, last-mile utility rather than a core strategic lever. This perspective has meant fewer investment in payment experience innovation, and modest monetization strategies. As a result, most banks have made minimal investments in enhancing UPI infrastructure or customer experience.

While fintechs are building intelligent, personalized interfaces and monetizing user data, banks remain focused on compliance and processing. This has meant that banks’ PSP apps often emphasize utility over experience with untapped potential in differentiation and personalization.

In effect, UPI has become a runaway success story without visible bank innovation. To stay competitive, banks must shift from being mere infrastructure providers to active owners of user experience, engagement, and value creation.

Fintechs Are Leveraging Payments to Capture Banks’ Core Business

Entities beyond traditional banks - such as fintechs and other non-banks - have reimagined UPI as more than just a payment utility, turning it into a strategic lever for acquiring and monetizing customers. By leveraging UPI as a customer acquisition funnel, third-party payment service providers are successfully cross-selling high-margin products like credit, BNPL, insurance, and investments, effectively turning UPI into a revenue engine.

Fintechs now dominate small-ticket lending. According to DLAI data:2

- 77% of personal loans (by volume) under ₹ 1 lakh were originated by fintechs

- 50% of value in the same segment also came from fintech players

These are not isolated wins but repeatable data-driven models that use UPI transaction patterns for underwriting and cross sell.

The merchant side tells a similar story.

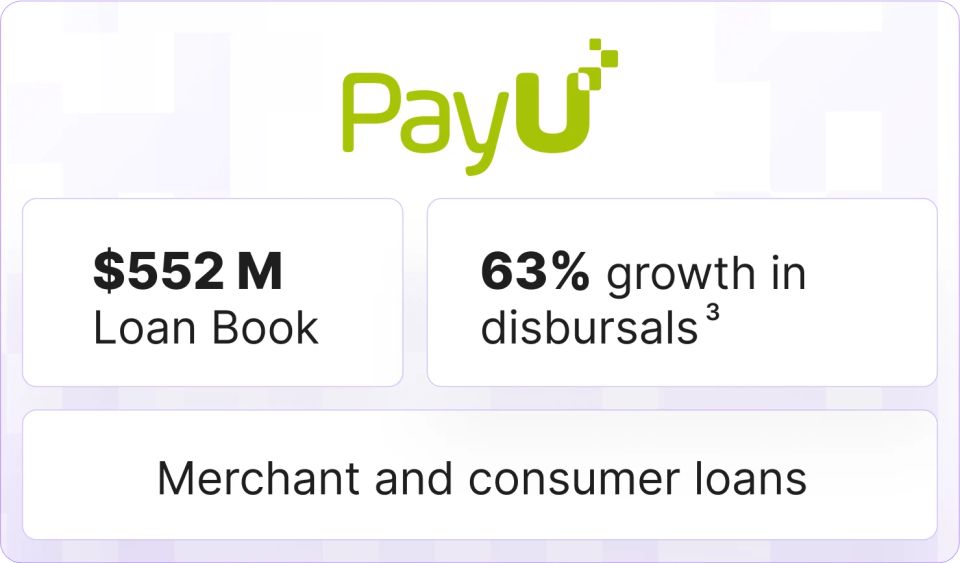

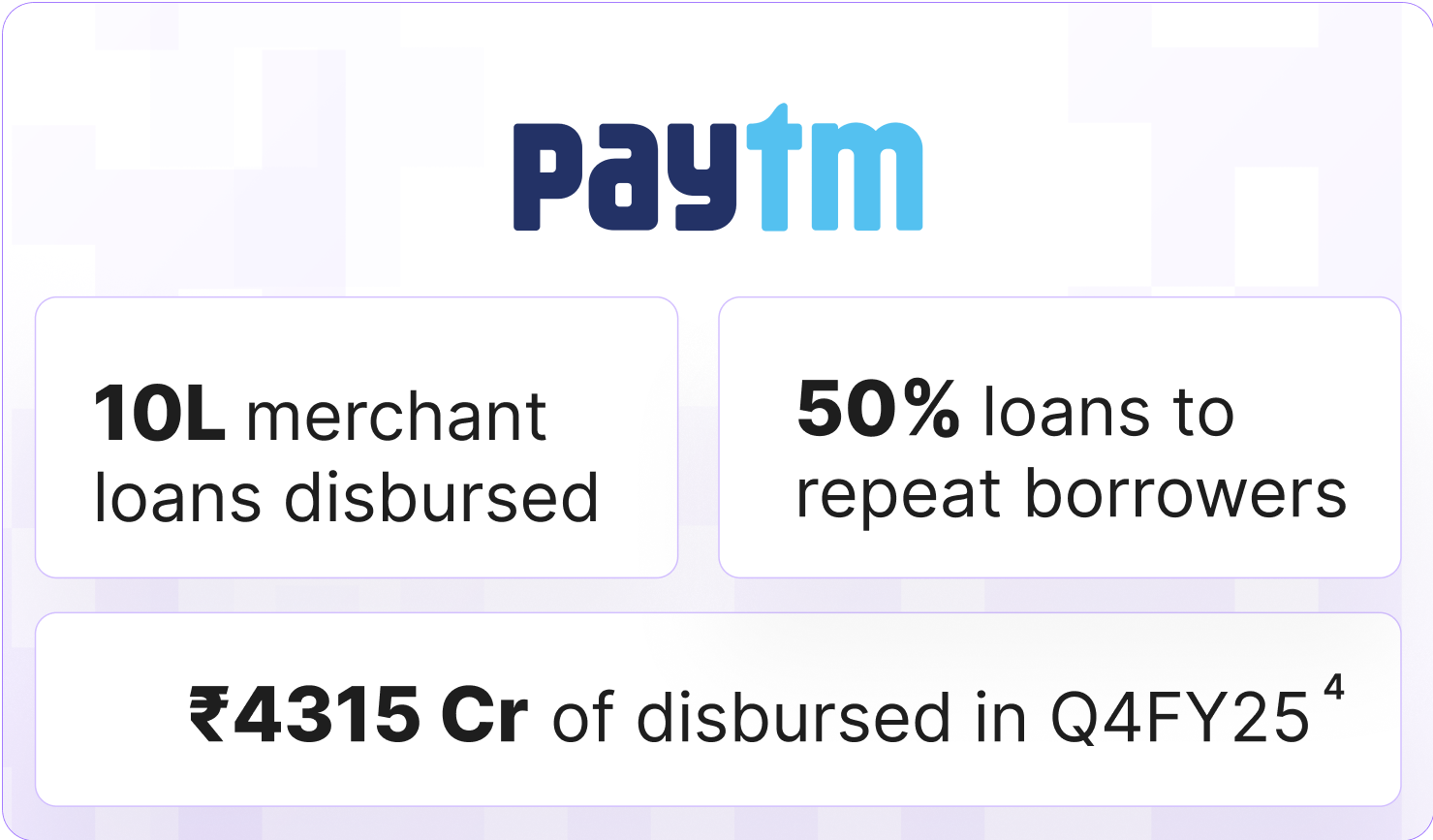

Payment Aggregators like PayU, Paytm, BharatPe, PhonePe, and Google Pay offer merchant loans and advances - underwritten using UPI transaction data and repaid via daily QR-linked deductions. They onboard merchants, manage interfaces, and control credit delivery, even though banks are the legal acquirers.

Examples of Fintechs using UPI as a Credit Acquisition Funnel

In contrast, while banks shoulder the infrastructure costs and manage processing, third-party apps control the customer relationship - owning the data, engagement, and monetization opportunities. Banks are left carrying the risk, but missing out on the rewards.

The Paradox: Banks Subsidize Ecosystem Growth But Miss Its Upside

A central irony in the UPI model is that banks shoulder much of the cost while the rest of the ecosystem captures its value and visibility with users. With zero MDR (Merchant Discount Rate) in place, nearly all operating costs - transaction processing, infrastructure maintenance, fraud mitigation, and compliance - fall on issuing and acquiring banks. Industry estimates peg

- Annual UPI operating costs at ≈ ₹ 10,000 crore

- Government subsidy covers only ₹ 1,500 crore5

That leaves banks to absorb a ₹8,500 crore shortfall annually.

This cost asymmetry has created a challenging dynamic: the more successful UPI becomes; the greater the strain on banks - in both real costs and strategic positioning. As third-party providers monetize user engagement and expand their financial offerings, banks are left paying for a system that increasingly sidelines them.

This dual blow - rising financial costs and declining customer primacy - makes a compelling case for banks to urgently rethink their role in UPI, moving from silent rail providers to active participants in shaping user experience, monetization, and long-term ecosystem value.

Payments Is Now a Core Business Driver, Not Just a Cost Center

UPI has transformed payments into a strategic lever for customer acquisition, monetization, and ecosystem relevance. For banks, far from being a cost center, UPI now represents one of the largest untapped revenue pools in Indian financial services.

Recent data reveals the scale of this shift:

- Blume Ventures, in its Indus Valley Report, projected that India may have foregone $4.1 billion (approx. ₹35,000 crore)6 in annual revenue due to the absence of MDR on non-P2P UPI transactions.

- PwC estimates that UPI could process 1 billion transactions per day, by FY 2027-28 unlocking a revenue potential of ₹47,400 crore annually7. This estimate includes monetization from multiple sources across MDR, interchange fees on credit cards, and credit lines on UPI.

Yet, despite being the foundational enablers of UPI powering both issuer and PSP infrastructure, banks see minimal returns. The lion’s share of revenue today accrues to third-party apps, anchored in their control of customer engagement. Meanwhile, most bank-led PSP offerings remain undifferentiated.

This lack of differentiation is more than a missed revenue opportunity. It creates a strategic gap. As fintechs and other alternate providers use UPI to anchor customer journeys, banks’ risk weakening primacy across savings, lending, and merchant services.

For banks, the path forward is clear: reframe payments not as transaction enablers, but as the platform for customer acquisition, credit delivery, merchant monetization and long-term ecosystem control.

A competitive bank-led PSP offering can:

- Drive revenue by monetizing usage and cross-selling high-margin products

- Deepen engagement by embedding UPI into contextual banking journeys, and

- Reinforce trust through transparent, secure, and personalized payment experiences

Banks Are Starting To Reshape UPI Economics In Their Favour

As payments become a core business lever, banks are beginning to assert control over the infrastructure they operate.

Recent developments8 show that full stack issuer-PSP banks have begun charging Payment Aggregators (PAs) a transaction-based fee for access to their UPI rails thus breaking away from the default model of free, subsidized access. In many cases, these fees are waived or discounted if funds settle into the bank’s own merchant accounts thereby nudging PAs and merchants toward tighter bank integration.

Beyond just cost recovery, this move signals a strategic step to rebalance incentives and

re-anchor the bank’s role in

digital commerce. UPI is no longer a zero-revenue channel. For banks, reclaiming ownership over payment economics

is a foundational step toward establishing primacy in the ecosystem.

The Strategic Imperative: Build UPI-Centric Products

For too long, banks have looked at UPI as an efficient payments rail over accounts but not as the basis for building differentiated products and offerings. That view is no longer sufficient.

With recent innovations, the opportunity landscape has changed. The scope of UPI is no longer confined to P2P and P2M transfers. It now touches lending, collections, subscriptions, and more.

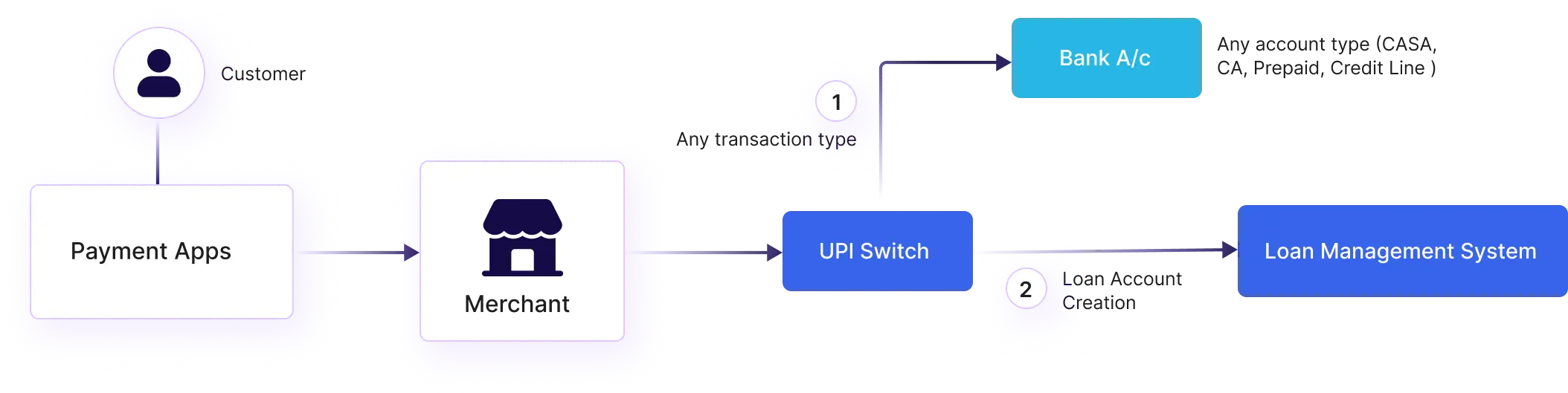

To truly compete, banks must stop treating UPI as a channel and start building products with UPI at the core. This requires more than app enhancements. It demands architectural rethinking. Fragmented systems architected as silos across CASA, lending, and cards inhibit innovation. For instance, while converting any UPI transaction into an EMI is logically possible and attractive, it’s difficult to execute across fragmented systems.

The imperative is clear: if banks want to win the next phase of digital payments, they must adopt a UPI-centric approach to build forward-looking, UPI-native product constructs that are modular, interoperable, and deeply integrated with customer journeys. This means designing for orchestration, not just compliance. And anchoring innovation in user needs, not legacy constraints.

The next sections of this paper build this blueprint, moving from diagnosis to design, to help banks turn payments from a cost burden into a strategic growth engine.

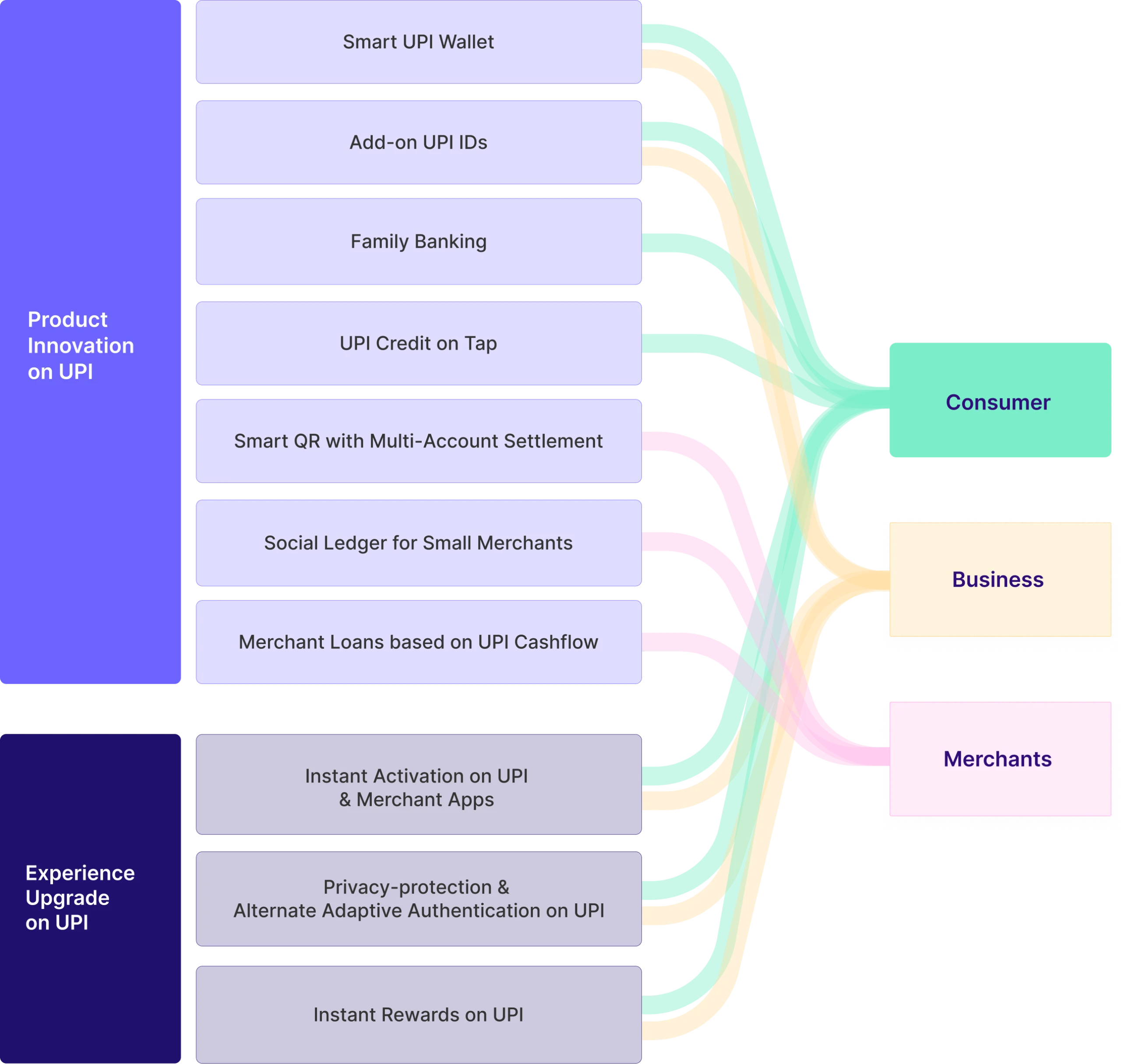

NPCI Protocol Readiness and Bank Participation

The following section outlines ten transformative UPI products and user journeys designed to help banks differentiate in India’s rapidly evolving digital payments landscape.

However, it's important to note that some of the proposed use cases may require protocol-level changes, extensions, or new feature enablement by NPCI.

At Zeta, we are actively collaborating with NPCI and several leading banks to make such innovations real. As a member of the NPCI Partner Program, Zeta contributes to early-stage discussions and pilots of UPI innovations, ensuring that the vision articulated in this paper is not just conceptual, but executable.

We view this paper as a directional blueprint, rooted in what is technically possible today, what is regulatorily feasible with change, and what is necessary for banks to retain primacy in UPI. We invite banking leaders and innovators to join us in co-creating the next wave of UPI-led transformation.

10 High-Impact Ideas for Banks to Win the Next Phase of UPI

Full-stack banks - banks with both issuer switch and PSP capabilities - can build innovative UPI products and experiences that help them differentiate from and compete with third-party payment apps. Of the many such payment experiences an issuer-PSP bank can build, we’ve curated 10 that deliver outsized impact.

1. Smart UPI Wallet

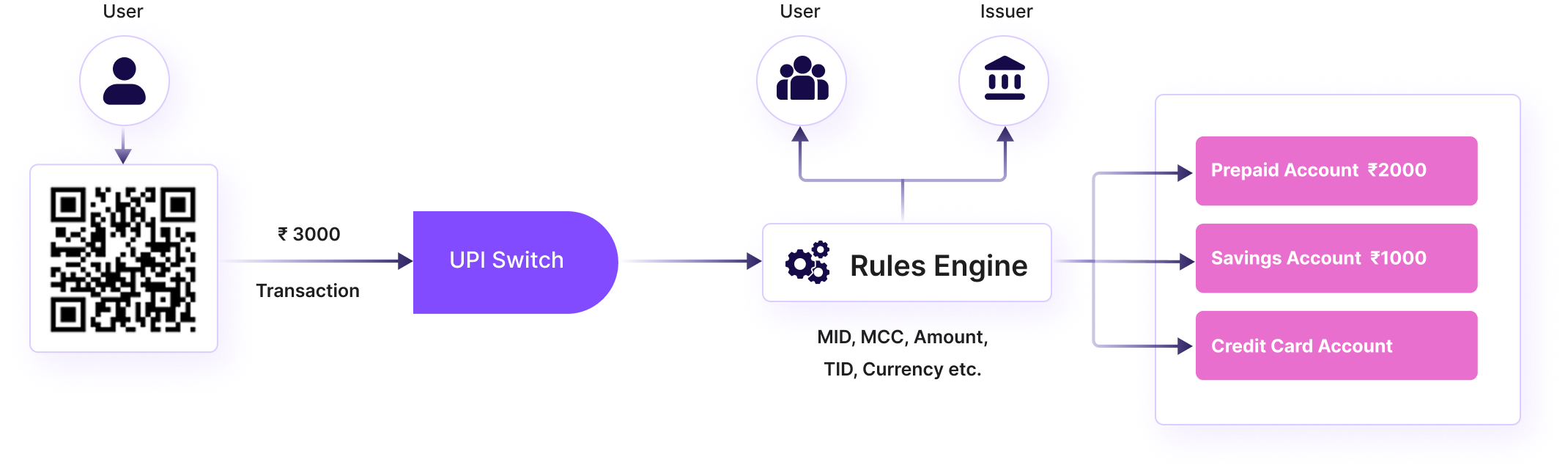

Allow users to link multiple accounts - savings account, credit card, prepaid wallet - to a single UPI ID and set preferences for their use. A configurable UPI switch dynamically selects the account to be debited for each transaction based on preferences set by the user.

What's Broken Today

What's Broken Today

Users often link multiple accounts (savings, prepaid, credit line) to a single UPI app. But UPI defaults to the last-used account or manual selection. This creates confusion, failed transactions, or suboptimal payment behavior.

There’s no intelligent system for choosing the best account based on payment context.

What Banks Can Offer Instead

What Banks Can Offer Instead

Enable users to configure rules (by merchant type, value, day/time) for automatic selection of the best account, e.g., use credit line for large spends, prepaid wallet for fuel, savings account for bills.

The UPI switch dynamically routes payments from the right source.

Why This Matters to Banks

-

Increases usage across products by embedding smart logic into every transaction

-

Improves payment success rates and enhances user experience with minimal effort

-

Drives higher fee and interest income by optimizing which account gets used

How it Works

2. Add-on UPI IDs

Allow account holders to link multiple add-on UPI IDs to an account with granular controls for each ID. Customers can thus allow family, friends or employees to pay from their bank account and set transaction permissions for each add-on user based on value, merchant category, location, day, etc.

What's Broken Today

What's Broken Today

A major limitation with UPI is that it remains a single-user experience despite a multi-user need. There is no structured way for multiple individuals to transact from the same bank account using distinct UPI IDs. Today, the primary account holder must use delegate access features that offer limited transactional and security controls. This for example, severely constrains:

- Households looking to manage family spends from one savings account

- Employers wishing to empower staff for operational spending

What Banks Can Offer Instead

What Banks Can Offer Instead

Add-on UPI IDs allow banks to offer multiple, customized UPI handles linked to the same account, each with user-defined spend and usage controls.

Key Capabilities:

- Primary account holder can issue secondary UPI handles to family or staff

- Each handle comes with custom rules for spend limits and usage restrictions

- Transactions are still processed and settled from the same account, ensuring consolidated financial management

Why This Matters to Banks

-

Higher transaction throughput from a single account

-

Increased engagement via family or team-based use

-

Trust-building through controls that prevent misuse

How it Works

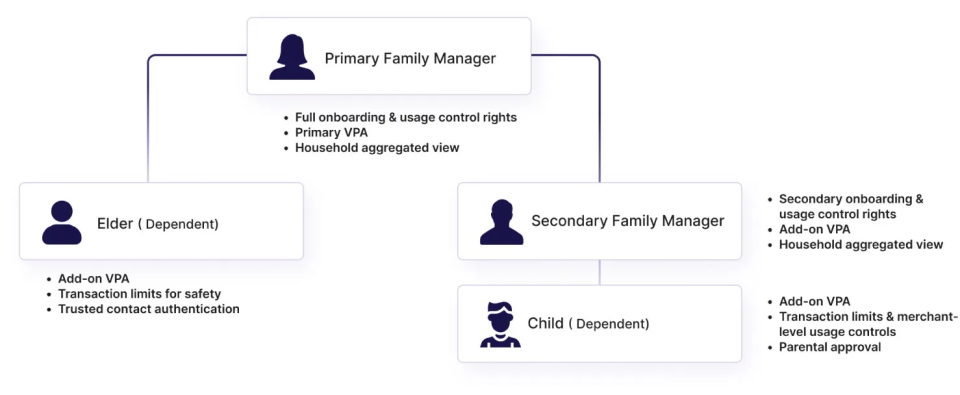

3. Family Banking

Give families a compelling reason to bank together with a shared family hub experience. Drive acquisition by allowing account holders to onboard family members and track payments and savings together.

What's Broken Today

What's Broken Today

Most UPI implementations today are designed around individual users. Families, especially those with non-earning members, dependents, or elders, struggle to transact jointly. Workarounds involve sharing credentials or cards, which compromise security, visibility, and control.

- Minors can’t transact; Elders rely on others

- No shared view of family spending or controls

- Missed opportunity for banks to anchor the full household

What Banks Can Offer Instead

What Banks Can Offer Instead

Let customers create a Family Hub within the bank app, invite family members as add-on users, and set role-based access to the primary account. Each member gets their own login and VPA, with visibility and permission levels defined by the primary user.

Key Capabilities:

- Shared payment access with custom controls

- Unlock usage for minors, students, dependents

- Unified dashboard for joint tracking and rewards

Why This Matters to Banks

-

Anchors the full household to the bank’s ecosystem, boosting retention

-

Drives higher transaction volume with multiple daily users per account

-

Opens new segments like minors, senior citizens, and shared wallets

How it Works

4. UPI Credit-on-Tap

Allow customers to convert any UPI transaction to a loan or EMI during a transaction, in real time. Customers can discover and activate credit options like BNPL, EMI loans and credit lines contextually while making UPI payments.

What's Broken Today

What's Broken Today

UPI is cash-equivalent today. It lacks contextual, real-time credit options at the point of payment. Customers who face liquidity gaps during checkout are left with no option but to abandon the transaction or switch to credit cards (if available).

- Lost conversion at high-ticket spends

- No visibility into pre-approved credit lines during UPI use

- Banks miss a massive monetization opportunity

What Banks Can Offer Instead

What Banks Can Offer Instead

Enable users to convert any UPI payment into credit at the time of checkout. Offers can be personalized based on amount, merchant, or past spend behavior. Approval and repayment terms are shown instantly, with zero disruption in flow.

Key Capabilities:

- Contextual offer shown at UPI intent/payment page

- EMI term selection with interest, tenure, charges

- Auto-repayment via UPI AutoPay or linked account

- Credit rules defined by bank (limit, pricing, segment)

Why This Matters to Banks

-

Monetizes UPI traffic via interest, subvention, and credit usage

-

Increases average ticket size and transaction stickiness

-

Anchors users to bank’s UPI for high-value purchases

How it Works

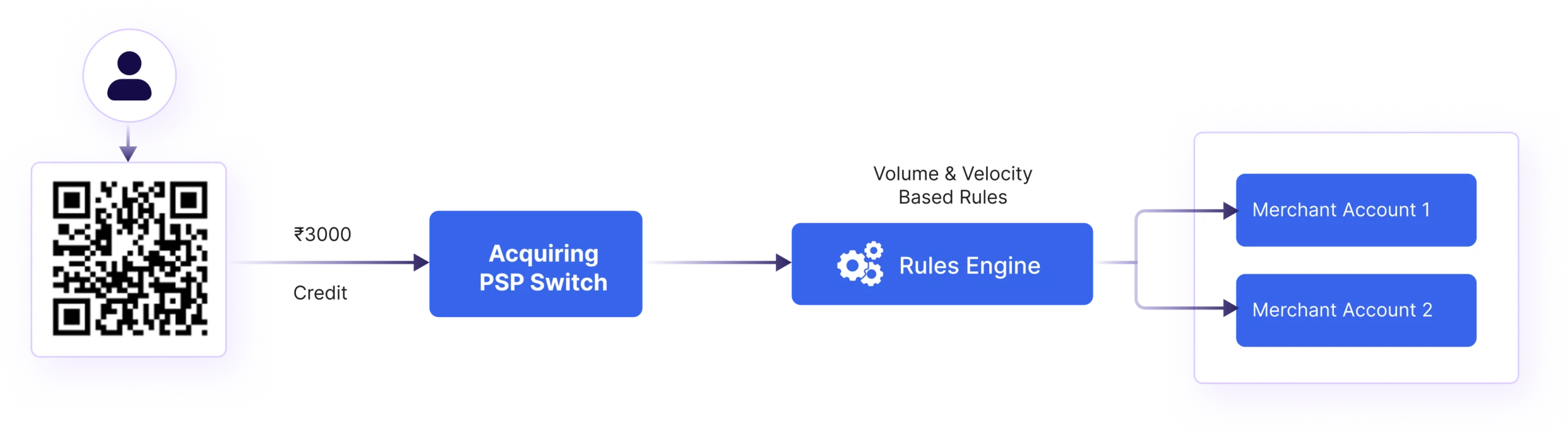

5. Smart QR with Multi-Account Settlement

Allow small merchants to link multiple accounts to a QR code and set preferences for each. Collections are settled to specific linked accounts based on merchant preferences, enabling them to manage cashflow efficiently.

What's Broken Today

What's Broken Today

Today’s static QR codes are linked to a single account, which becomes a bottleneck for merchants, especially those handling large daily volumes. Once limits are breached or cashflow constraints arise, payments fail or get delayed, and reconciliation becomes difficult.

- Rigid settlement flows

- Manual fund sweeps across merchant accounts

What Banks Can Offer Instead

What Banks Can Offer Instead

Enable merchants to link a single QR code to multiple accounts (e.g., current, savings, loan repayment), with a rule engine that dynamically determines where to settle funds based on logic like time of day, transaction size, or balance thresholds.

Key Capabilities:

- One QR → Smart routing to the right merchant account

- Rules based on volume, time windows, or value limits

- View all settlements in one merchant dashboard

Why This Matters to Banks

-

Increases merchant stickiness by solving real operational pain

-

Drives higher QR usage across all merchant accounts

-

Unlocks cross-sell (e.g., working capital loans, sweep accounts)

How it Works

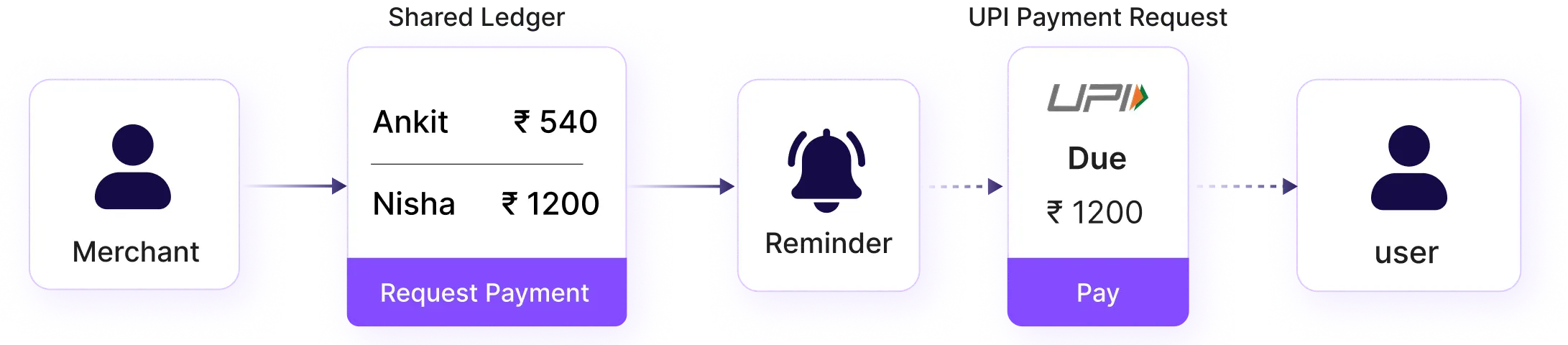

6. Social Ledger for Small Merchants

Allow small merchants to track, collect, and settle dues seamlessly within your UPI app. The social ledger allows merchants to maintain a shared record of payments with their customers and suppliers. They can settle outstanding by initiating payments and payment requests directly from the ledger.

What's Broken Today

What's Broken Today

Small merchants track credit and dues manually using paper, notebooks, or scattered WhatsApp messages. There’s no structured digital record of who owes what, leading to missed collections, delayed payments, and friction in business relationships.

- Manual khata systems are prone to errors

- Settlement cycles are unpredictable

- No integration with real payments or reminders

What Banks Can Offer Instead

What Banks Can Offer Instead

Enable merchants to maintain a shared ledger with customers and suppliers inside the bank’s UPI app. Allow them to record dues, send reminders, and settle via UPI with a single tap. Each entry is structured with narration, status, and timestamp.

Key Capabilities:

- Shared ledgers by contact (customers, vendors)

- Record: amount, due date, settled/ unsettled

- One-tap reminders and payment requests

- Settle directly via UPI or mark as manually settled

Why This Matters to Banks

-

Drives daily engagement from merchants beyond just collections

-

Deepens relationship and opens path for credit and cashflow-based products

-

Strengthens retention by embedding banking into core merchant workflow

How it Works

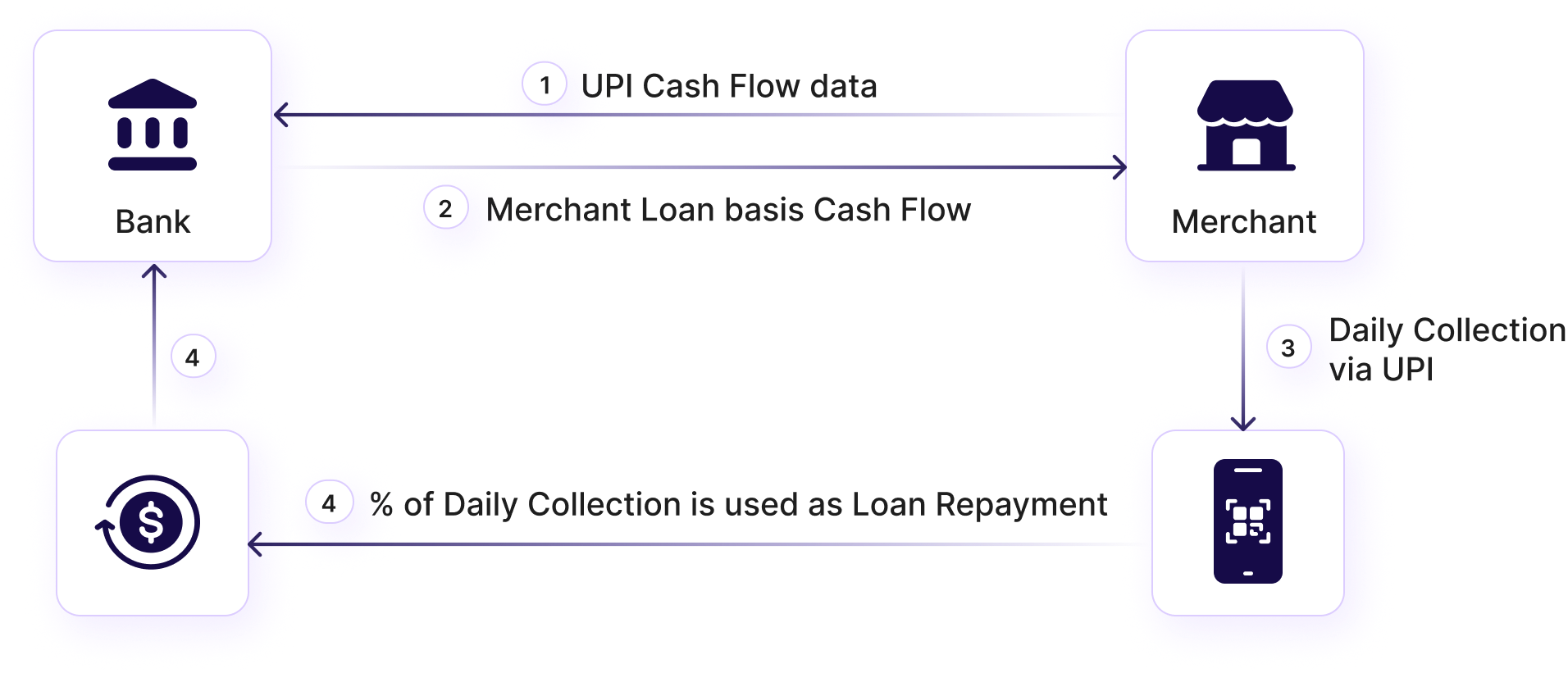

7. Merchant Loans Based on UPI Cashflow

Offer contextual credit offerings to merchants based on their UPI cashflow. Embed credit options like merchant cash advances, daily installment loans and loans against receivables within the merchant’s payment management experience to deepen engagement.

What's Broken Today

What's Broken Today

Banks have visibility into merchant collections via UPI, but this data is rarely used to offer timely, contextual credit.

- No embedded lending at the point of settlement

- Banks miss out despite owning accounts and transaction visibility

- Merchants turn to alternate lenders with higher rates

What Banks Can Offer Instead

What Banks Can Offer Instead

Use UPI collection patterns to offer pre-approved working capital to merchants in the form of daily settlement loans, instant advances, or loans against receivables.

Key Capabilities:

- Real-time eligibility based on daily/weekly inflow

- Instant settlement advance

- Repayment via auto-deduct from future UPI collections

Why This Matters to Banks

-

Monetizes UPI data to generate interest and fee income

-

Strengthens merchant retention through credit linkage

-

Establishes a competitive edge over fintech lenders

How it Works

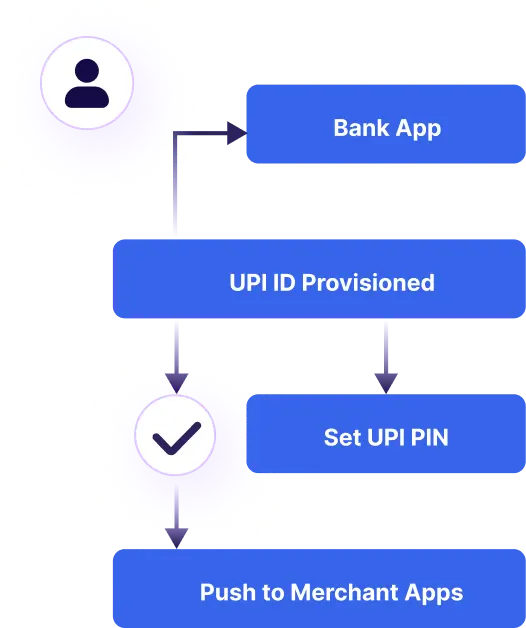

8. Instant Activation on UPI & Merchant Apps

Allow customers to activate their account on UPI seamlessly from within your bank app in two simple steps – taking away the friction of discovering and linking accounts on third-party apps.

What's Broken Today

What's Broken Today

UPI account linking and provisioning is fragmented today.

- Users must manually discover bank accounts on third-party PSP apps

- UPI PIN setup often requires card or Aadhaar-based authentication in unfamiliar contexts

- This not only breaks the onboarding experience but also disconnects users from the bank’s monetization pathways

What Banks Can Offer Instead

What Banks Can Offer Instead

Instant Activation enables seamless account linking and UPI PIN setup directly from the bank’s mobile app, with the added ability to provision the VPA across third-party apps instantly.

Key Capabilities:

- Push provisioning of VPA to NPCI and partner apps

- PIN setup in-app, without dependency on debit card or Aadhaar

Why This Matters to Banks

-

Higher UPI volumes via frictionless onboarding

-

Higher handle activation rate via own app

-

Removes friction in discovery and activation on third-party apps

How it Works

9. Privacy-Protected UPI and PIN-Less Authentication

Empowers users to mask their real UPI identity with anonymous VPAs, preventing exposure of personal handles in public transactions. Additionally, PIN-less and OTP-less authentication leverages modern device-level and context-aware authentication methods to replace traditional authentication flows.

Alternate PIN-less and OTP-less Authentication Methods

Swipe to Pay

Single swipe to authenticate the payment instead of PIN or OTP

Biometric Authentication

Face ID or Fingerprint to authenticate the payment

Passkey Login

Use of device-generated passkeys for secure login

TOTP

Time-based OTP for large transactions

Trusted Contact Verification

Stepped up verification delegated to another trusted contact

What's Broken Today

What's Broken Today

UPI transactions today expose personal VPA details and rely heavily on PIN-based flows. This leads to user discomfort, especially among privacy-sensitive segments, and frequent drop-offs or failures in authentication due to PIN entry issues or delays.

- VPA exposed to unknown merchants

- PIN entry friction in public or high-stress environments

- Missed opportunity to serve new segments (e.g., minors, women, seniors)

What Banks Can Offer Instead

What Banks Can Offer Instead

Banks can make UPI safer and more user-friendly by offering anonymous VPAs to protect user identity and enabling alternate, adaptive authentication methods designed to boost trust and ease of use.

Key Capabilities:

- Anonymous VPAs (e.g., txn1234@bank) valid for a limited time

- PIN-less auth options - Swipe to Pay, FaceID/ Fingerprint, Passkey, Trusted Contact

- Controls to toggle privacy + select default auth method

Why This Matters to Banks

-

Increases adoption among privacy and safety-conscious users

-

Improves transaction success rates through frictionless auth

-

Differentiates bank apps with safety-first, modern experience

How it Works

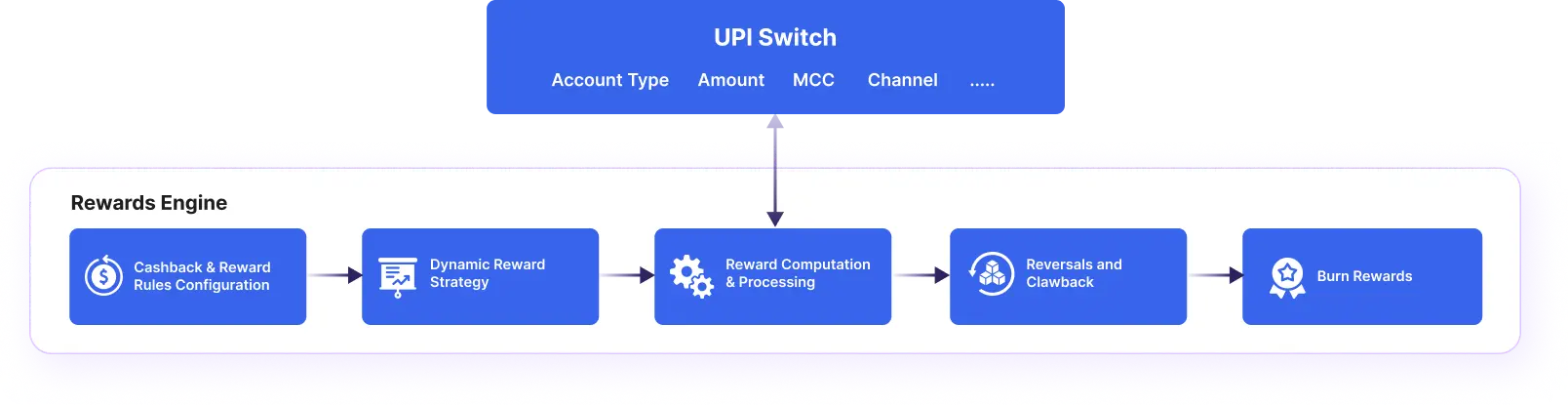

10. Instant Rewards on UPI

Offer instant cashback and rewards on UPI transactions. Partner with merchants to offer merchant-funded reward programs with real-time earn and burn capabilities.

What's Broken Today

What's Broken Today

Most UPI transactions offer no incentive to users. Even where rewards exist, they are delayed, vague, or buried inside third-party apps. Banks miss the chance to create daily usage hooks, reinforce loyalty, and differentiate their PSP experience.

- Rewards are generic, slow, or hard to redeem

- No engagement feedback loop after a transaction

- Merchant-funded rewards not integrated into bank rails

What Banks Can Offer Instead

What Banks Can Offer Instead

Deliver real-time rewards on UPI transactions viz. cashback, points, or vouchers at the moment of payment. Personalize based on spend category, payment mode, or merchant. Let users instantly redeem, track, or burn rewards in the same app.

Key Capabilities:

- Earn shown instantly after payment e.g., ₹10 cashback / 20 reward points

- Burn points or cashback in next purchase or bill pay

Why This Matters to Banks

-

Drives repeat usage and makes the bank’s UPI handle the default

-

Builds habit loops around transactions and rewards

-

Enables merchant partnerships and cross-sell via reward rails

How it Works

A Practical Framework for Prioritizing Quick Wins and Long-Term Plays

To reclaim leadership in UPI, banks must innovate with both speed and strategic clarity. While third-party apps continue to gain ground by offering slick and sticky payment experiences, banks still control the critical ingredients, viz. accounts, credit rails, trust, and capital. The opportunity lies in deploying these advantages across targeted, high-impact UPI innovations.

But not all innovation ideas are created equal.

To prioritize effectively, banks need a structured approach that helps distinguish quick wins from long-term strategic bets. This requires objectively evaluating each innovation not just on appeal or feasibility, but on its ability to deliver measurable business value across revenue, engagement, and trust dimensions. The following sections provide such a framework -

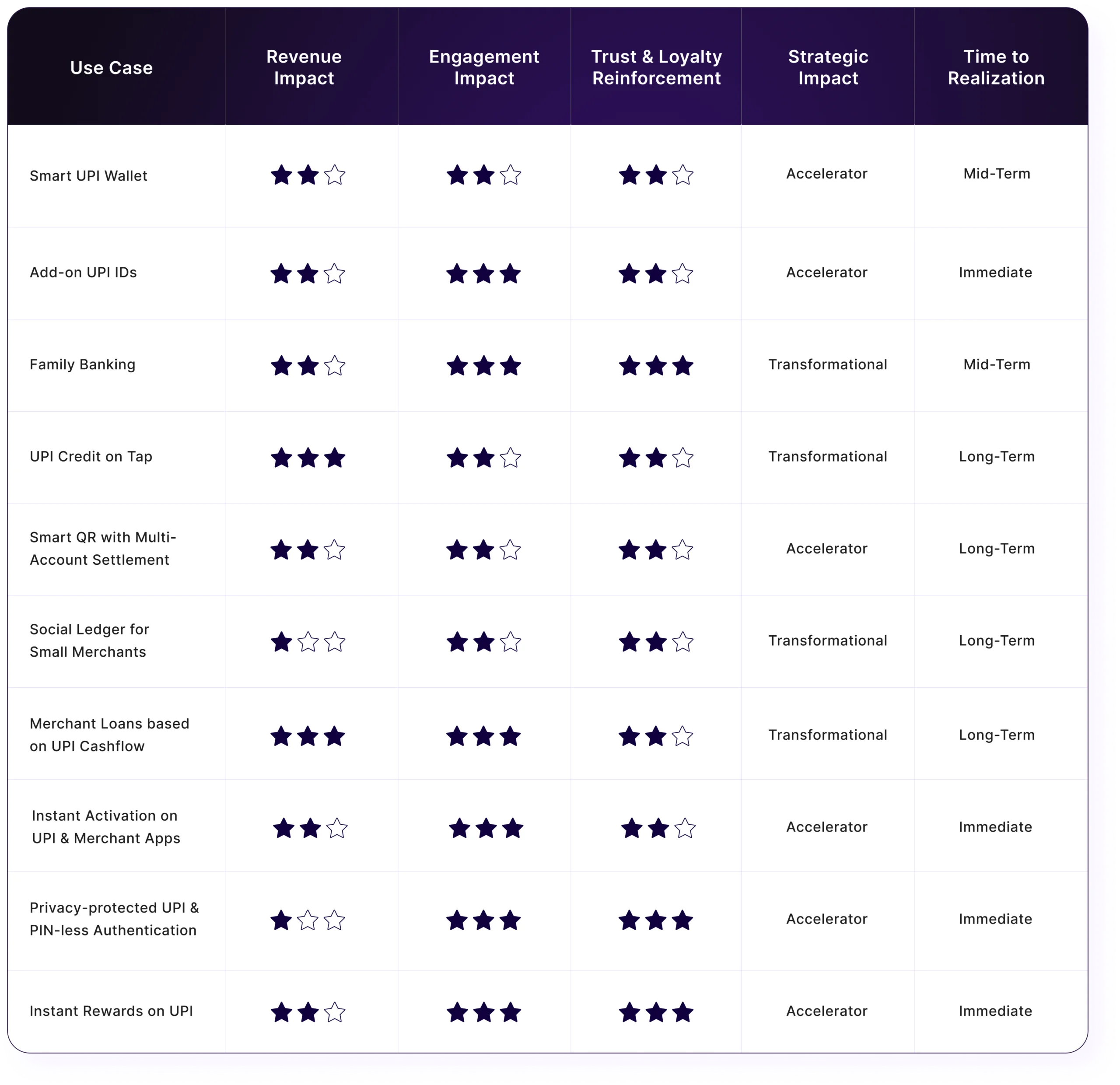

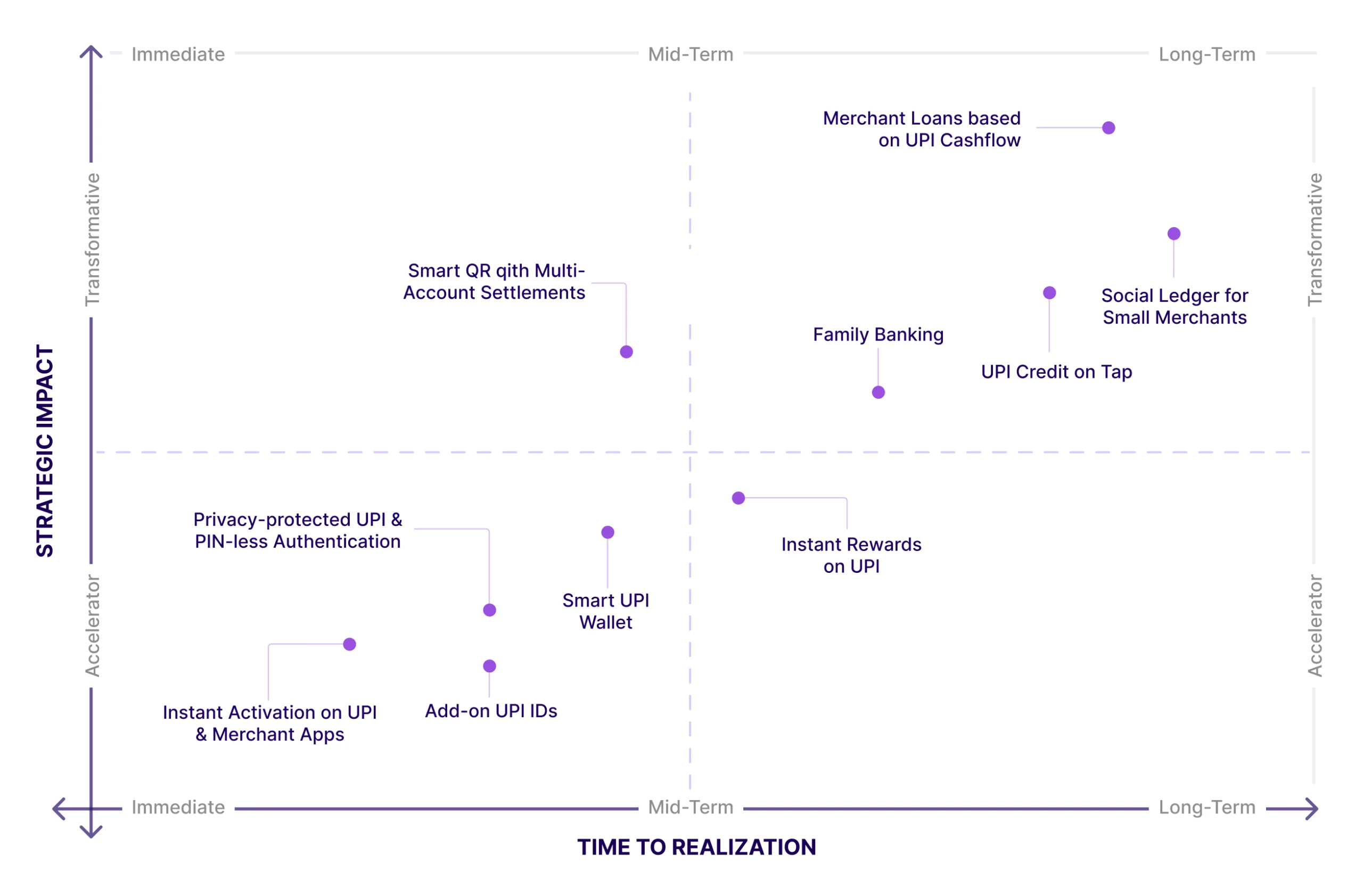

A. Use Case Impact Mapping

The table below evaluates each of the ten UPI innovation use cases across three critical business outcomes:

-

Revenue Potential

(monetizable via credit or cross-sell)

-

Customer Engagement

(frequency, stickiness)

-

Trust & Loyalty

(security, privacy, loyalty)

These individual scores are then synthesized into composite scores across two key dimensions, namely

- Strategic Impact: A composite weighted view of the use case’s ability to deliver across revenue generation, user engagement, and trust & loyalty reinforcement. Strategic impact is categorized as:

- Transformational: Long-term strategic plays that enable banks to unlock structural differentiation or expand into new monetization frontiers. These ideas involve new product constructs, business models, or platform capabilities that reposition the bank competitively.

- Accelerator: High-impact initiatives that drive measurable growth in the near to medium term through higher adoption, activation, usage frequency, or monetization uplift. These ideas enhance existing capabilities, unlock untapped user segments, or improve product stickiness and usage intensity.

-

Time to Realization: Reflects the feasibility of bringing each use case to market. This incorporates system

readiness, integration complexity, and process maturity, and is categorized as:

- Immediate: Can be deployed quickly within current infrastructure and workflows

- Mid-Term: Requires moderate changes in system integration or business operations

- Long-Term: Needs foundational architectural upgrades, regulatory engagement, or deep cross-system orchestration

B. Sequencing UPI Innovation: From Quick Wins to Long Term Plays

Some use cases can be launched quickly with outsized returns, while others require deeper investment to build long-term strategic plays. The following grid offers a practical, multi-layered framework to help banks prioritize, sequence, and execute UPI innovations.

The result: a clear, actionable framework to sequence “quick wins” and “strategic plays” while ensuring alignment with overall business priorities.

UPI Use Cases: What to Build, When & Why

C. Four Guiding Principles for Execution

While the sequencing framework helps visualize what to build and when, successful execution depends equally on how these innovations are brought to life.

The following four principles serve as design constraints and success enablers, collectively guiding banks on what to build, who to build for, how to deliver effectively, and how to continuously refine for sustained impact. These principles are parallel levers that must be applied in unison to drive meaningful UPI innovation.

Four Guiding Principles for Execution

-

Business Momentum

Prioritize tasks and initiatives that drive business momentum

-

Innovation Across Personas

Balance roadmap to cater to different user personas.

-

Technology Readiness

Evaluate the readiness of technology for implementation and scaling.

-

Learning and Feedback

Industrialize learning and feedback loops for continuous improvement.

-

Prioritize for business momentum

- Start with quick wins that align with short-term KPIs, be it UPI adoption growth, merchant acquisition, or app engagement. These deliver immediate impact and serve as internal proof points.

-

Balance innovation across personas

- Ensure the implementation roadmap spans innovation for all segments, viz. retail users, businesses, and small merchants. This avoids concentrating benefit in only one segment and builds well-balanced market relevance.

-

Evaluate technology readiness

- Assess the flexibility of your switch and core systems, API readiness, and integration maturity. For instance, implementing a smart UPI account selector demands a highly configurable switch with robust rule-based routing. In contrast, enabling UPI Credit on Tap requires deeper integration between the switch and the lending system to avoid fragmented experience and operational complexity.

-

Industrialize learning and feedback loops

- Use early rollouts as learning grounds. Capture metrics, monitor behavioral shifts, and use insights to refine go-to-market, pricing, and design of longer-term plays. For instance, insights drawn from instant UPI provisioning can reveal friction points that inform broader onboarding strategy.

- To ensure speed and precision in execution, banks should institutionalize a cross-functional team comprising representatives from

- Product – to define use-case constructs

- Engineering – to assess time-to-implementation

- Compliance & Risk – to ensure regulatory alignment

- Business – to craft adoption strategies and measure ROI

These principles are enablers that ensure the prioritized roadmap translates into measurable outcomes. They help align business goals with operational readiness, maintain ecosystem balance across consumer and merchant segments, and build institutional agility through feedback loops.

Conclusion

Together, the impact mapping, sequencing framework, and execution principles offer a complete framework to guide banks from strategic prioritization to effective rollout, ensuring business-aligned sequencing of innovations that are both achievable and transformative. By applying this structured framework, banks can break the inertia, demonstrate innovation leadership, and reclaim customer primacy in India’s UPI-led digital economy.

References

- EY, The Role of Fintech in Building Viksit Bharat | January 2025

- Business Standard, Fintechs lead small-ticket loans’ volume with 77% market share | March 2024

- The Arc, PayU India reports 28% growth in topline, losses jump by 48% | December 2024

- Paytm, Paytm Q4 FY2025 | May 2025

- CNBC-TV 18, Explained | Merchant Discount Rate charges: How this may affect you | April 2025

- Blume Ventures, Indus Valley Annual Report 2025 | February 2025

- PWC, Indian Payments Handbook 2024 – 2029 | August 2024

- Mint, ICICI Bank to charge Google Pay, PhonePe & other payment aggregators | August 2025

Building With Zeta:

An Introduction to Zeta’s UPI Stack

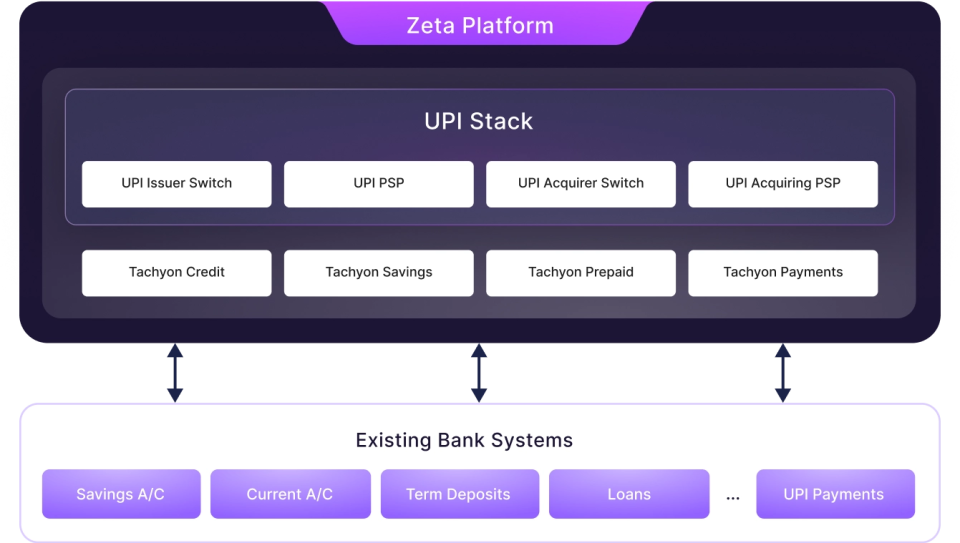

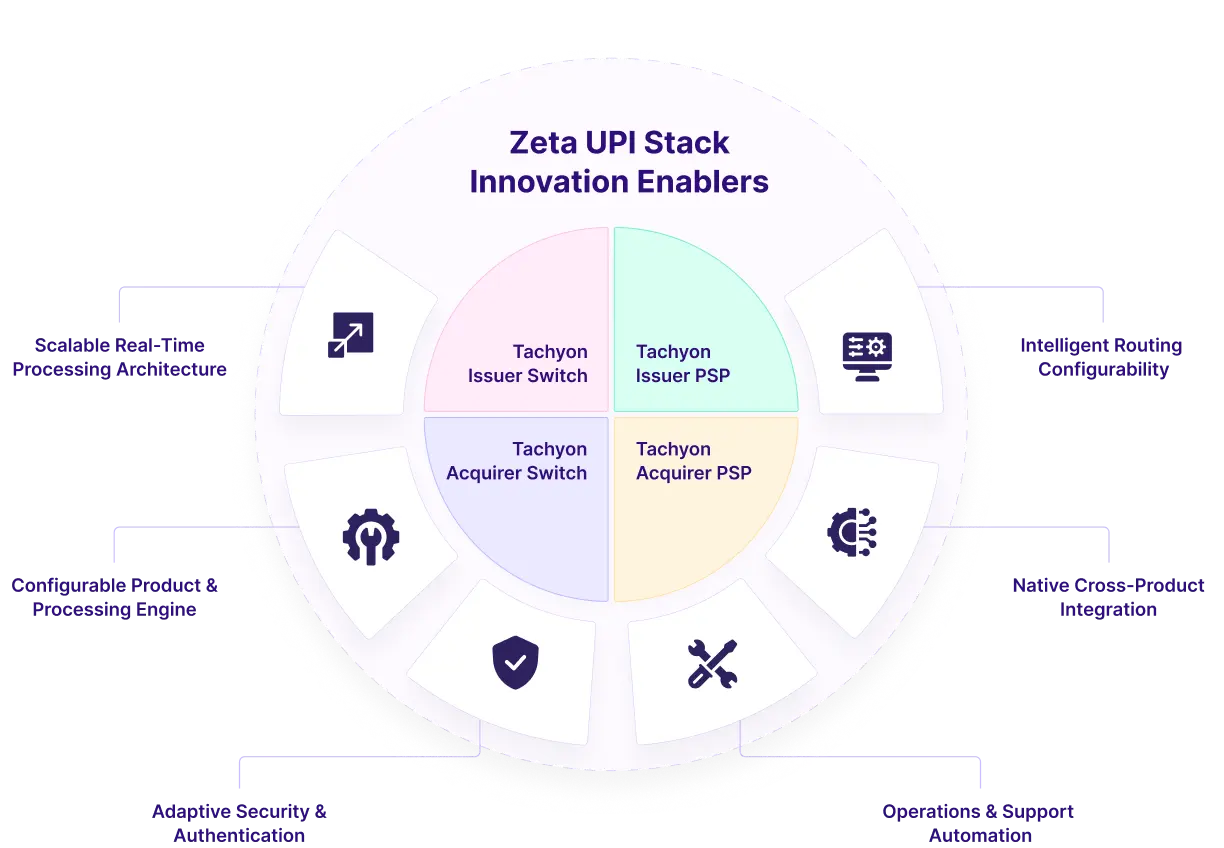

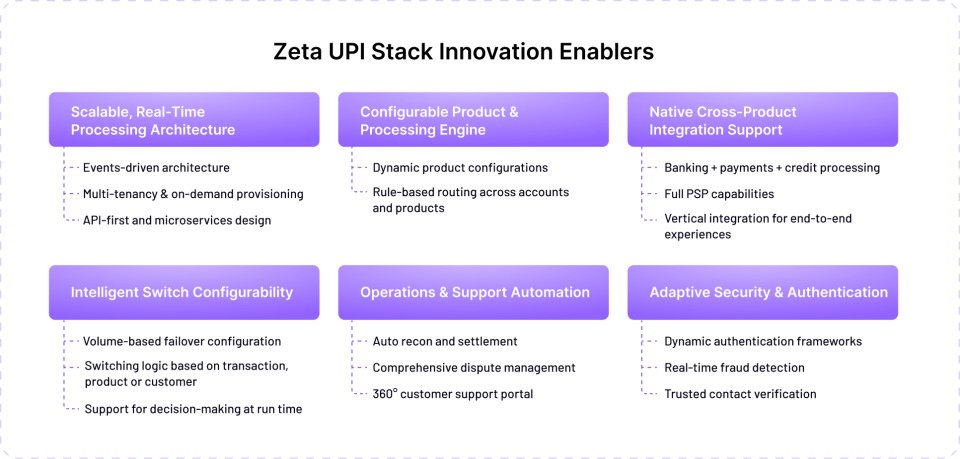

While most banks have a UPI stack today, this infrastructure is leveraged for basic routing and execution. Zeta is reimagining the UPI stack as an innovation platform that allows banks to differentiate with product design, real-time experiences and adaptive security.

Today, banks’ existing core banking systems and UPI stacks are unable to offer the functional or technical scalability required to realize UPI’s innovation potential.

- Legacy architectures, designed for batch processing, are unable to support real-time, high-volume transaction processing

- UPI processing volumes are driven by single-switch architecture, limiting on-demand scalability during peak periods, as well as banks’ ability to create intelligent routing solutions

- Rigid configurations in products and execution engines limit innovation

- No native support for cross-product flows, like integration of credit and payments, leading to complex, expensive integration projects

- Limited support for operational automation, leading to increased costs, reduced accuracy and compliance gaps as scale and complexity increase

Addressing these limitations requires a UPI stack designed specifically for innovation - one that can layer seamlessly on top of existing core banking infrastructure while unlocking real-time capabilities. Zeta offers banks a complementary UPI platform that provisions data and configurations from core systems to enable flexibility and scalability that legacy architectures cannot deliver on their own.

UPI Stack

The Zeta UPI Stack Offers Innovative Features to Help Banks Differentiate and Compete

About Us

Zeta is a next-gen banking technology company. Zeta’s platform enables financial institutions to launch extensible and compliant banking asset and liability products rapidly. Its cloud-native and fully API-enabled stack supports processing, issuing, lending, core banking, fraud, loyalty, digital banking apps, and many other capabilities.

Zeta has 1700+ employees with over 70% in technology roles across locations in the US, Middle East, and Asia - representing one of the largest and most capable teams ever assembled in banking tech. Globally, customers have issued 25M+ cards on our platform.

Contact Us

Discover how your bank can benefit from UPI innovation. Share your details to schedule a UPI Innovation Workshop with our experts.