Shattering the Co-Brand Glass Ceiling

An Innovation Guide to Scaling Co-Branded Credit Cards

Executive Summary

India’s credit card market has more than doubled over the past five years, crossing 111 million cards by mid-2025. Yet penetration remains low, at fewer than 8 cards per 100 people, and traditional bank-issued cards with generic rewards are losing their appeal. Growth will increasingly come from embedding credit inside ecosystems where customers already live, shop, and transact.

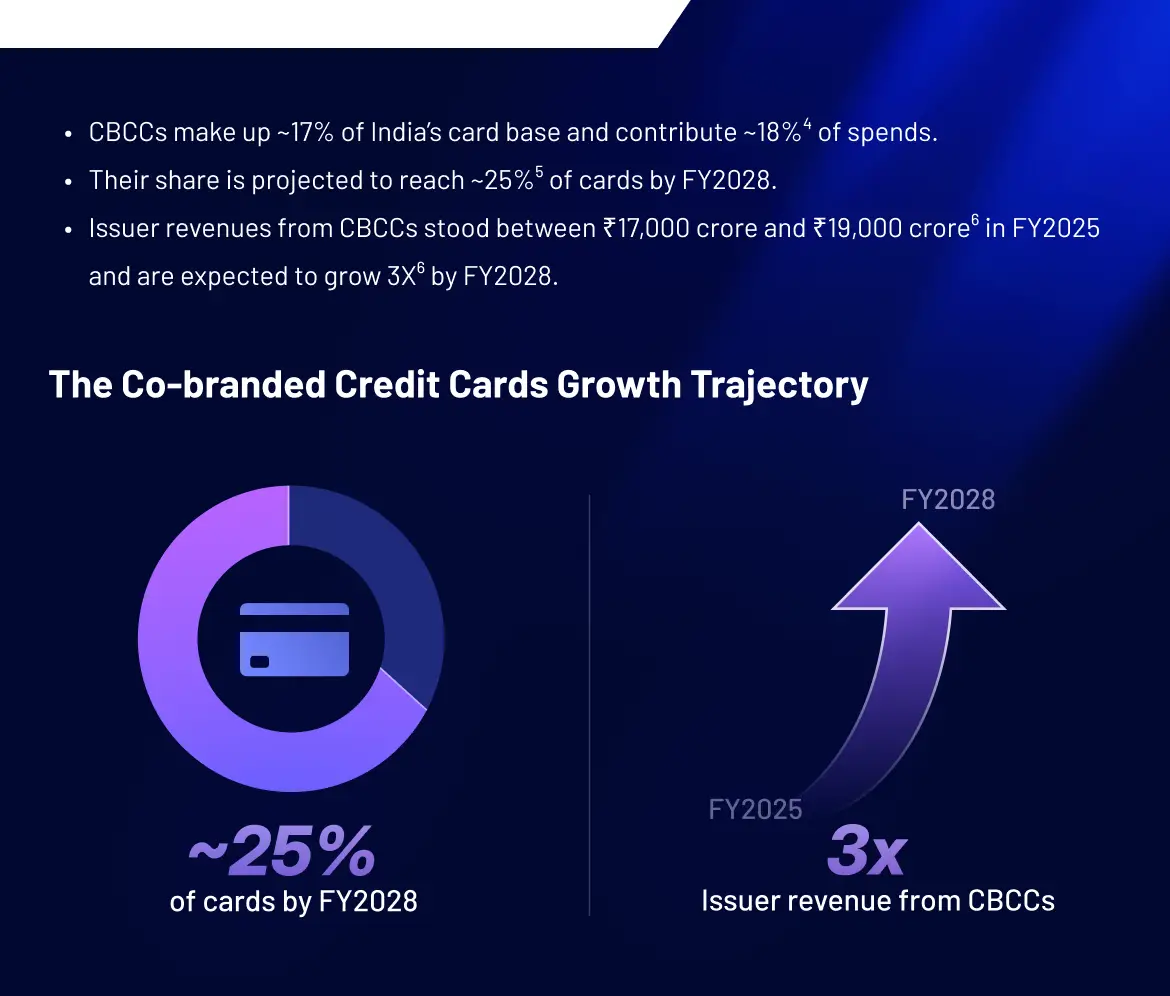

This is why co-branded credit cards (CBCCs) have become the fastest-growing segment of the market. They already make up ~17% of cards in circulation, contribute ~18%4 of spends, and are projected to reach ~25% of the base and nearly triple issuer revenues by FY2028.

CBCCs reduce acquisition costs, drive higher activation rates, and stimulate greater spending compared to generic cards. However, launching and maintaining a co-brand programme requires significant time and effort. Consequently, banks have limited their partnerships to a select few marquee co-brands capable of delivering scale, leaving most of the market untapped.

Even existing co-brand programmes face several challenges. Partners strive to offer a smooth, distinctive experience, resulting in each CBCC being a bespoke undertaking. Banks and partners must develop custom origination flows, each requiring separate compliance audits. Customer service responsibilities are split, rewards reconciliation is done per partner, and ongoing innovation is challenging.

Furthermore, most co-brand programmes run on legacy technology stacks, making them nearly indistinguishable across issuers. Typically, they offer accelerated rewards for partner spends with redemption confined to partner channels, while the bank’s role is reduced to backend support. As a result, customer choice is driven almost entirely by the partner brand’s appeal, not the issuer. Attempts by banks to cross-sell additional products rarely succeed, as traditional outreach channels like calls and SMS are ignored, with customers engaging primarily through the partner’s ecosystem.

It’s time banks changed the game.

Decades of legacy constraints have limited imagination and confined CBCCs to repetitive, undifferentiated models. To break out of this cycle, banks must fundamentally reimagine how co-brand programmes are designed, launched, and scaled.

In this paper, we present 15 strategic plays to reimagine CBCCs, empowering partners, banks, and customers alike. These ideas span four dimensions:

Achieving this breadth demands more than the usual strategy. Outdated platforms built for batch processing and uniform products hinder launches, inflate costs, and weaken portfolio economics.

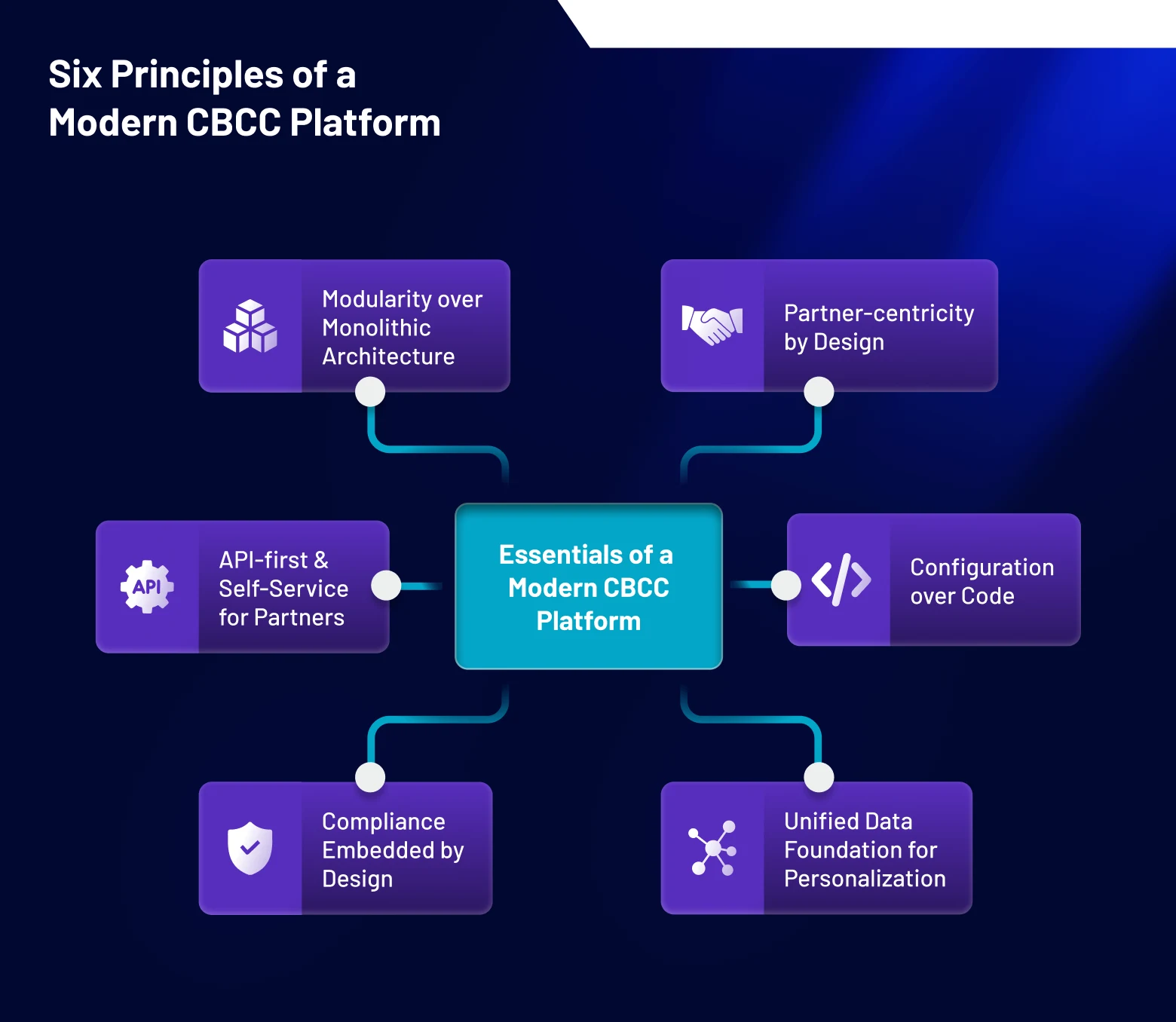

This paper outlines a next-gen technology blueprint built on six foundational principles, complemented by three additional enablers that together drive scalability and stronger economics.

In closing, co-branded credit cards are no longer a niche play. With modernisation, banks can expand beyond a handful of marquee programmes to orchestrate diverse, scalable portfolios across categories and geographies, unlocking the full potential of India’s evolving credit card landscape.

India’s Credit Card Market & Rise of Co-Brands

India’s credit card market has expanded rapidly over the past 5–6 years, with outstanding cards more than doubling since FY2018 to 111 million in mid-2025. Spends have grown at a 25–30% CAGR, yet penetration remains low - fewer than 8 cards per 100 people versus 30–50 in developed economies. Growth so far has been driven largely by urban, salaried customers, with the top five issuers commanding nearly 80% market share. Competition is intense, generic reward programs are losing appeal, and acquisition costs remain high.

From inception, credit cards have been more than credit. They are loyalty networks connecting banks, merchants, and consumers. Co-branded credit cards (CBCCs) represent the next phase of this model, embedding contextual rewards directly into the brands and platforms customers use daily.

Co-branded Credit Cards: Scale and Market Momentum

Co-brands that began with airline, fuel, and retail tie-ups are now mainstream growth engines. Digital-first ecosystems like Amazon–ICICI (>5M cards)1, Flipkart–Axis (>3.5M)2, and Tata Neu–HDFC (>2M)3 demonstrate how deeply they resonate with Indian consumers.

Why Co-Branded Cards Outperform Generic Programs

Co-branded credit cards (CBCCs) stand out as one of the most compelling growth models in the credit card landscape. Unlike generic card programs that typically take 4–5 years to break even, CBCCs deliver faster profitability thanks to superior economics - lower customer acquisition costs (CAC) and higher spend per cardholder. They succeed because they align issuer incentives and economics with those of the partner, creating shared wins at every stage. Each outcome delivers measurable gains for both sides, making the model both sustainable and scalable.

The table below illustrates how CBCCs translate these aligned economics into tangible outcomes for issuers and partners:

| Business Outcomes | ||

|---|---|---|

| Business Outcomes | Tech-led Mitigation | Impact |

| Lower acquisition cost | Upto before 60% lower CAC through partner | Acquisition subsidized via bank’s investment |

| Higher customer engagement |

~70% activation vs 50% for generic cards

20% higher spends |

Brand becomes the default spend destination |

| Revenue uplift | Interchange, interest & fee income | Revenue share & higher wallet share |

| Deeper customer insight | Access to quality sourcing | Behavioural data to personalize campaigns |

In essence, CBCCs thrive on a virtuous cycle of shared value. Lower acquisition costs for issuers translate into higher revenues for partners; stronger customer engagement fuels brand loyalty; and deeper insights empower both sides to refine offerings continually. This alignment of interests makes CBCCs not just faster to scale than generic card programs, but also structurally more resilient and profitable in the long run.

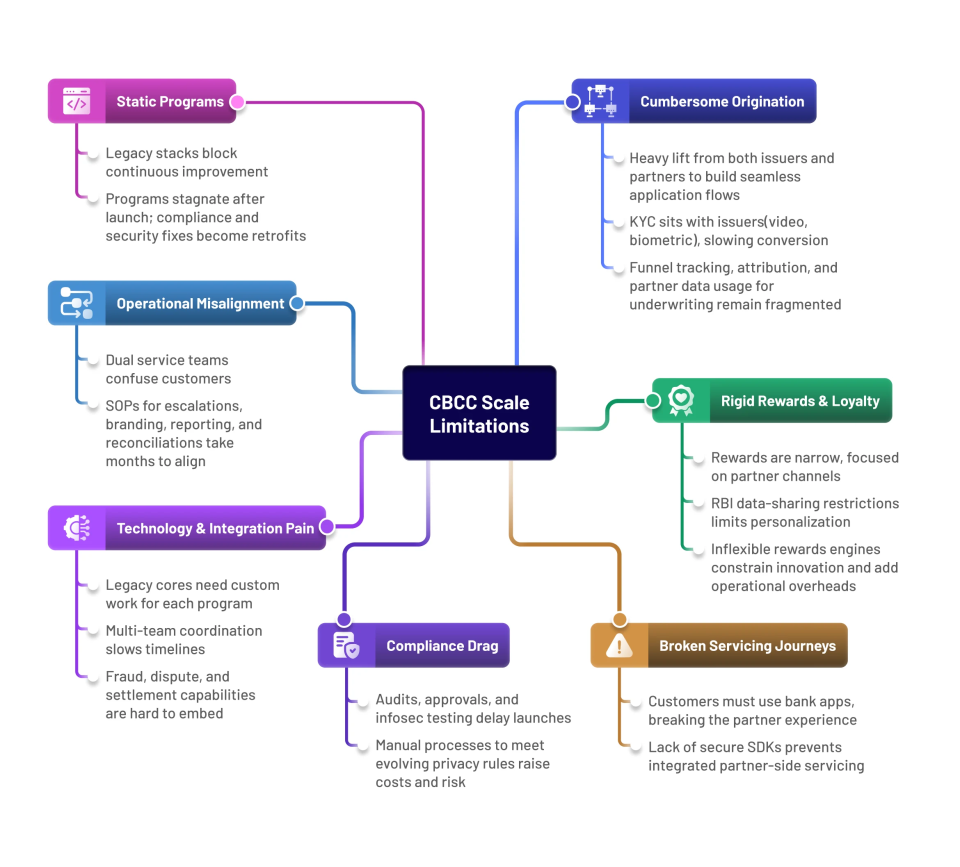

Operational Realities That Limit CBCC Growth

Despite strong economics, most CBCC programs struggle to scale. They are operationally heavy, slow to launch, and complex to maintain, limiting adoption to large banks and marquee partners. Even then, programs take months to go live, demand custom builds, and limited differentiation: higher rewards on partner spends with redemption tied back to the partner. Banks end up as back-end providers, while the true value of the card depends almost entirely on partner strength.

The following points highlight the key issues that currently limit CBCCs from scaling effectively.

These issues explain why CBCC portfolios remain limited despite their promise. Today’s programs are high-effort, high-friction undertakings viable only for a few large players. To unlock their true potential, banks must reimagine co-branding as an ecosystem-native model built on modern, flexible technology, one that reduces effort, embeds compliance, and enables continuous innovation.

Strategic Plays to Catalyse the Next Wave of CBCC Growth

Modernization provides the foundation for scale, but technology alone is not enough. The real differentiator lies in how issuers and partners apply this flexibility to design innovative programmes that shape new behaviours, embed into daily life, and unlock fresh revenue streams.

We frame this innovation agenda across four dimensions:

- Program expansion via partner enablement

- Enhanced consumer engagement through superior experiences

- Accelerated growth through product innovation

- Market expansion by penetrating new categories

Under these four dimensions, we identify 15 high-impact strategic plays that can redefine how CBCCs can be reimagined to be launched, adopted, and monetised. Each play highlights the current scenario, an innovative approach, and the tangible benefits for issuers.

These ideas are not speculative. They build on proven trends in adjacent markets, evolving customer expectations, and partner ecosystems. Together, they form a practical playbook for banks to move beyond generic reward structures and create differentiated, scalable co-branded portfolios.

Program expansion via partner enablement

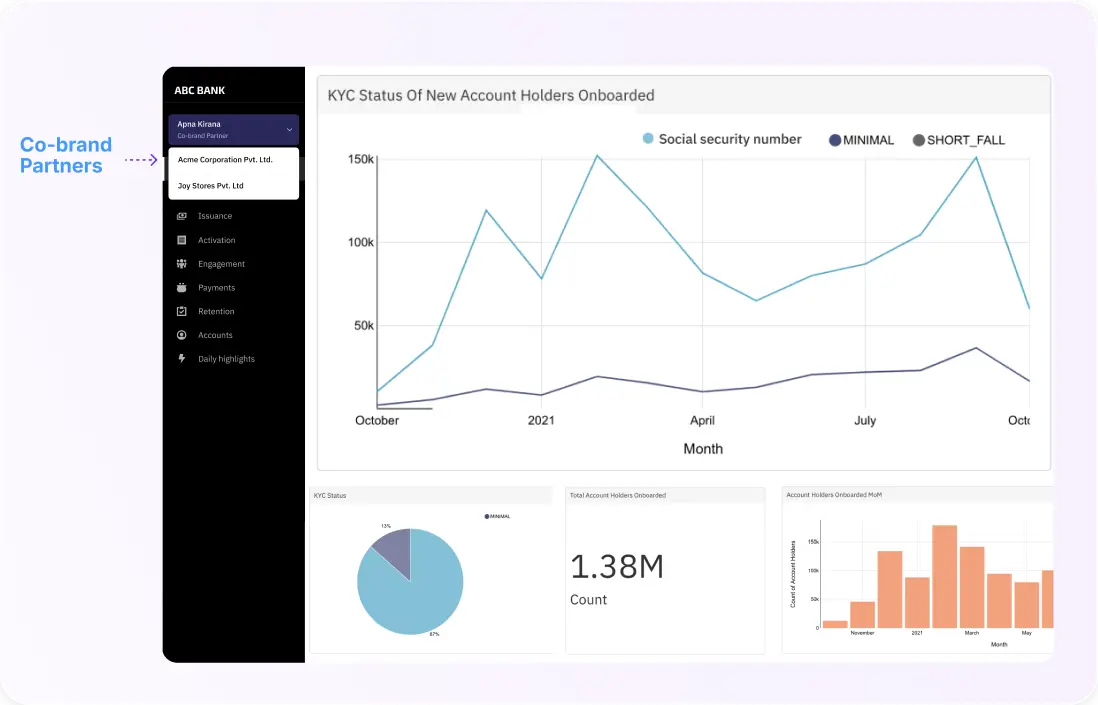

1. Enable robust partner management infrastructure

Most issuers still restrict co-branded programmes to a few large national partners, as each new integration is heavy, manual, and resource intensive. This leaves mid-sized brands and hyperlocal merchants - with deep loyalty and strong customer bases - largely untapped.

Approach:

A modern plug-and-play platform can streamline onboarding and management of multiple partners.

Standardised protocols such as secure APIs and SDKs make integration consistent, reducing effort and speeding time to market.

Issuers can quickly add partners, configure programmes, apply branding, set up subscriptions, and grant access to required APIs and events.

Centralised dashboards provide oversight of performance, transaction volumes, and customer engagement. Segregated controls allow granular management of each partner, ensuring compliance, data security, and tailored access rights - all from a single console.

Example:

Banks can expand cobrand programmes to regional brands such as V2/Vishal Mega Mart or Nalli Silks etc which collectively can drive significant new volumes.

Approach:

Co-brand partners should be able to embed their own reward logic, issue targeted coupons, and gamify behaviours such as responsible credit use (e.g., offering extra warranty when EMIs are paid on time). Access can be enabled via partner portals or secure APIs, with banks retaining oversight through maker-checker approvals.

A next-gen core system would then apply rewards based on these rules, automatically attach coupons, reflect them in statements, and equip customer service teams to manage related queries, ensuring a seamless experience.

Example:

An eCommerce partner could identify consumers dormant on its platform and provide coupons or offers for reactivation. These would be applied automatically for target users when they transact in relevant categories at non-partner sites or stores.

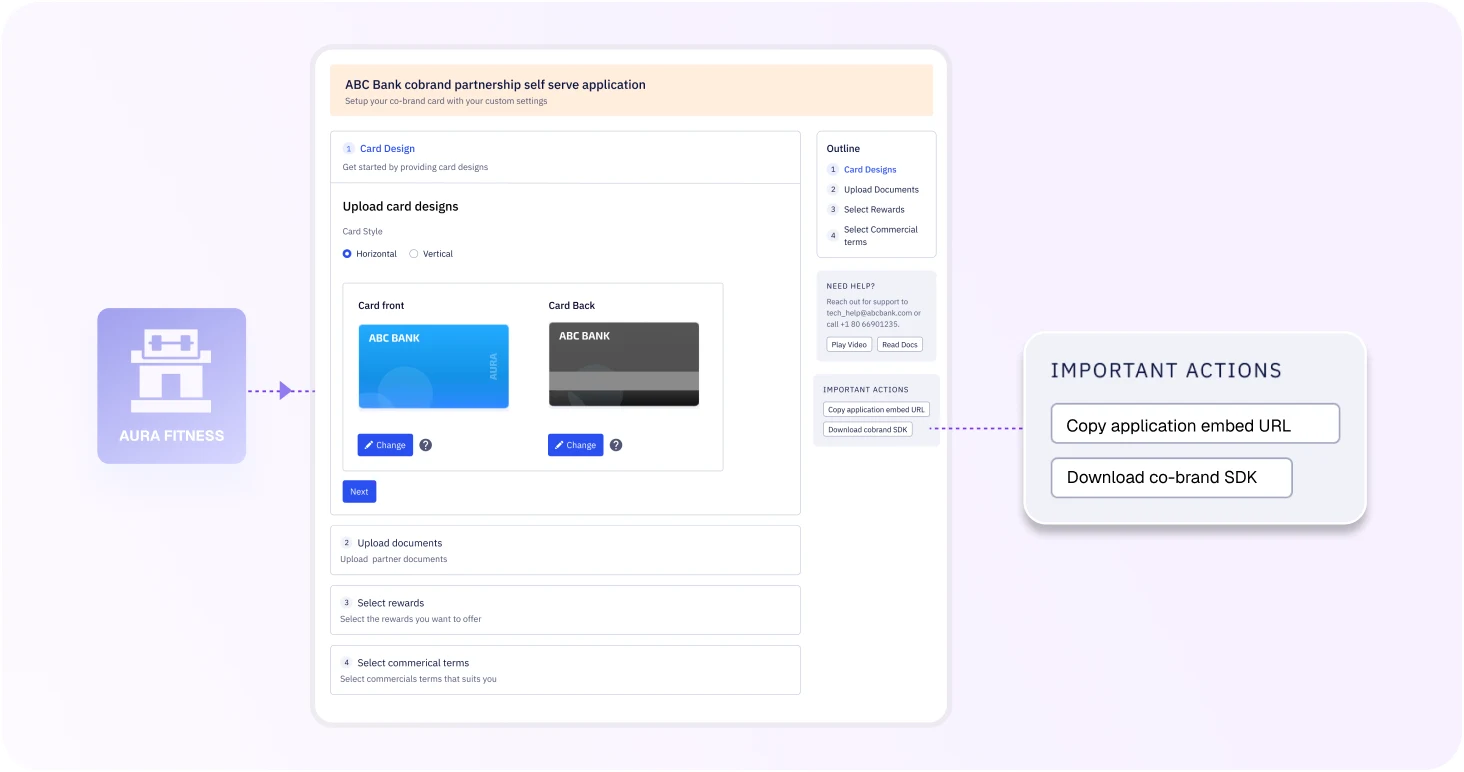

Approach:

A self-service portal enables partners to apply for inclusion in the bank’s co-brand program. Pre-defined templates let them choose terms suited to their scale, while documents, fees, and creative assets are submitted online. After verification, the program is auto created.

Onboarding gives partners customised links they can share with customers or embed in their platforms. Customers enjoy a seamless, partner-branded journey that boosts engagement and identity.

Underwriting remains the control point, ensuring only eligible customers are approved and portfolio risk stays managed.

Example:

A typical single-store supermarket serves 25,000–50,000 customers annually, often run by generational entrepreneurs with deep local loyalty. Introducing a co-branded credit card (CBCC) would allow these stores to issue targeted promotions and enhanced rewards for in-store purchases.

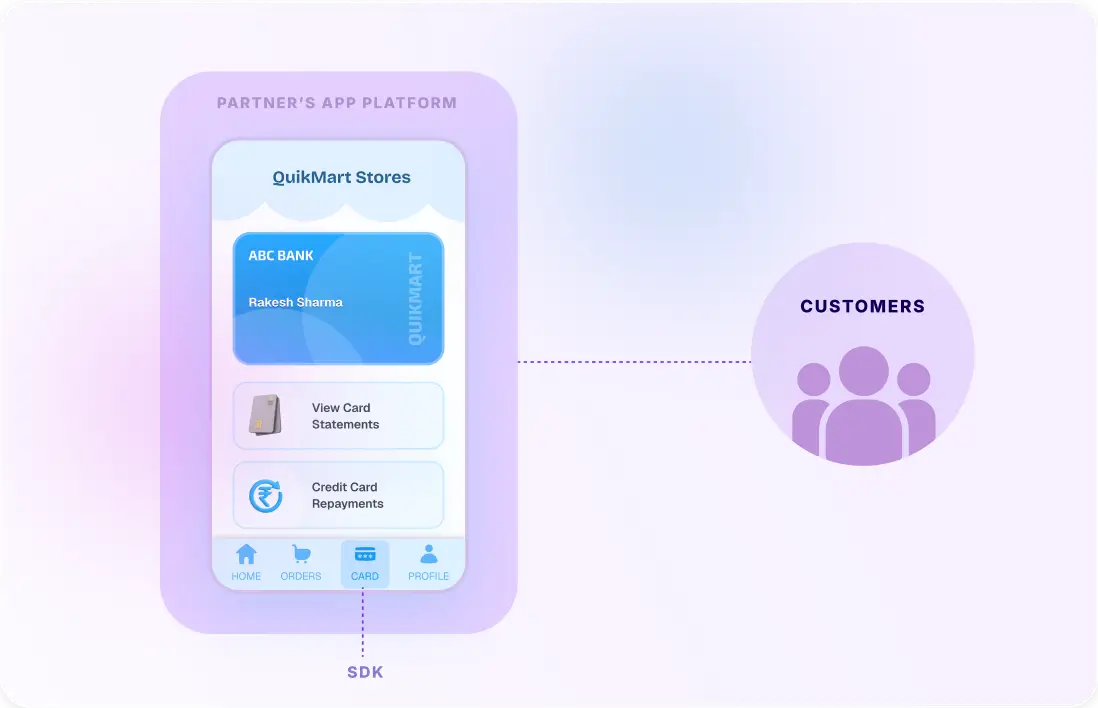

Approach:

A secure SDK embedded in the partner’s app allows customers to manage their entire card lifecycle - from activation to repayment - without leaving the partner platform. The issuer remains the regulated entity with full control of data and compliance, while the partner never sees sensitive banking information.

Example:

A fitness chain CBCC where customers can check balances, convert spends into EMIs, or pay bills entirely within the app, enabled by a secure SDK controlled by the bank.

Approach:

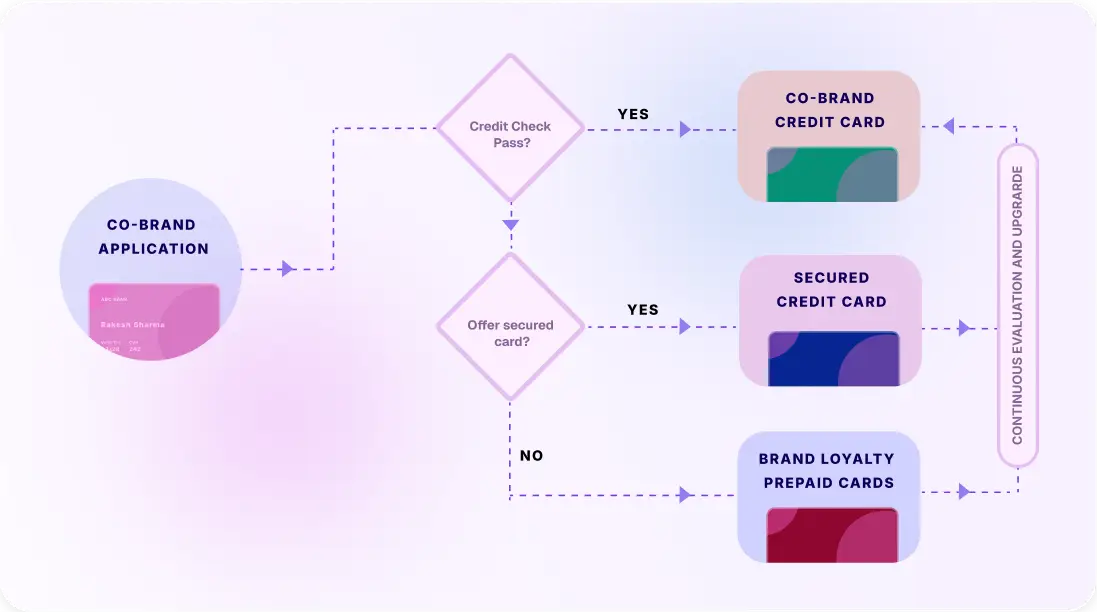

A CBCC can serve as a holistic loyalty platform for the partner. With the right technology, issuers can integrate multiple instruments - credit, secured, and prepaid cards - within the partner’s ecosystem. Eligible customers receive the CBCC, while others get secured or prepaid cards, ensuring all gain access to partner benefits. As these users transact, banks can track behaviour and upgrade them to CBCCs, deepening engagement and long-term loyalty.

Example:

A consumer electronics brand offering a co-brand card suite: a full credit card for established users, a secured card for thin-file customers, and a prepaid card for youth- all linked to the brand’s loyalty engine and benefits.

Accelerated growth through product innovation

Approach:

A hyper-personalized CBCC can tailor not just rewards but also fees, interest-free periods, and interest rates to specific users or segments. Real-time decisioning enables issuers to deliver instant, contextual offers and partner coupons - applied automatically at the individual or segment level.

Example:

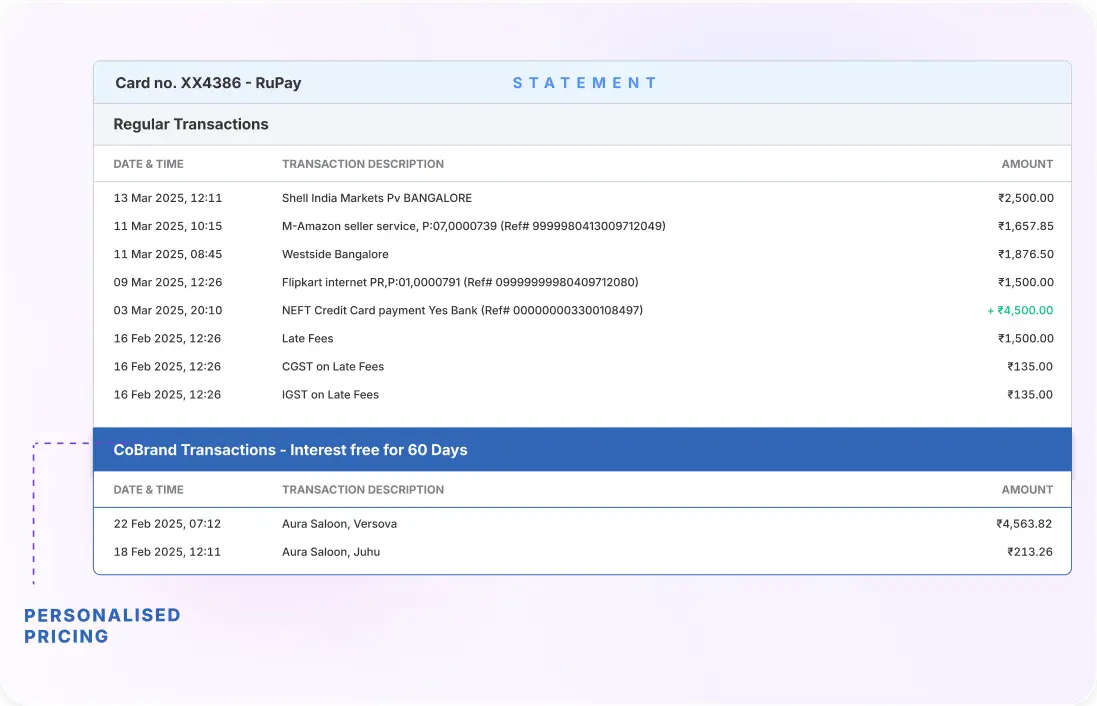

Consumer spends on the partner platform could be interest free for up to 60 days and other non-partner spends could be on the standard interest free up to 45 days terms. Late fee charges could be waived for specific period on large value purchases and so on.

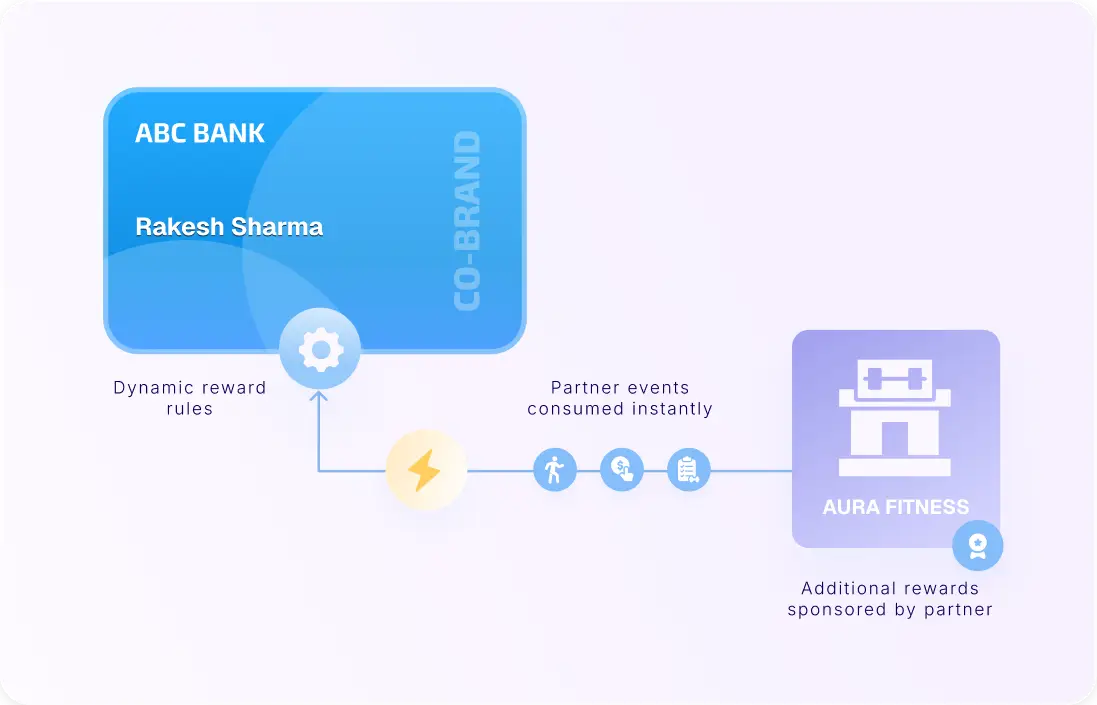

Approach:

A hyper-personalized CBCC allows issuers to configure dynamic reward rules by segment and consume partner events via APIs or event queues to trigger them in real time. While issuer-funded rewards follow agreed commercials, partners can sponsor additional rewards.

Example:

A fitness brand incentivizes its CBCC users by rewarding 1 reward point for every minute of exercise in addition to accelerated rewards for in-store purchases.

Approach:

Banks can unlock issuer-led subvention by partnering directly with OEMs for co-branded credit cards. Subvention terms are agreed between bank and manufacturer and embedded in the card platform. When a CBCC transaction occurs, users can instantly opt for benefits such as zero-cost EMIs, applied provisionally. Final approval comes after purchase authentication through partner-specific modules - for example, validating an IMEI for mobile devices or entering a unique code for appliances.

Example:

A Samsung partnered CBCC that customers use to purchase Samsung mobile phones from any retail outlet and selects zero cost EMI as the option on the bank’s CBCC app while using the card. The app prompts the user for the IMEI number and validates it against the manufacturer’s database to confirm the subvention.

Enhanced consumer engagement through superior experiences

Approach:

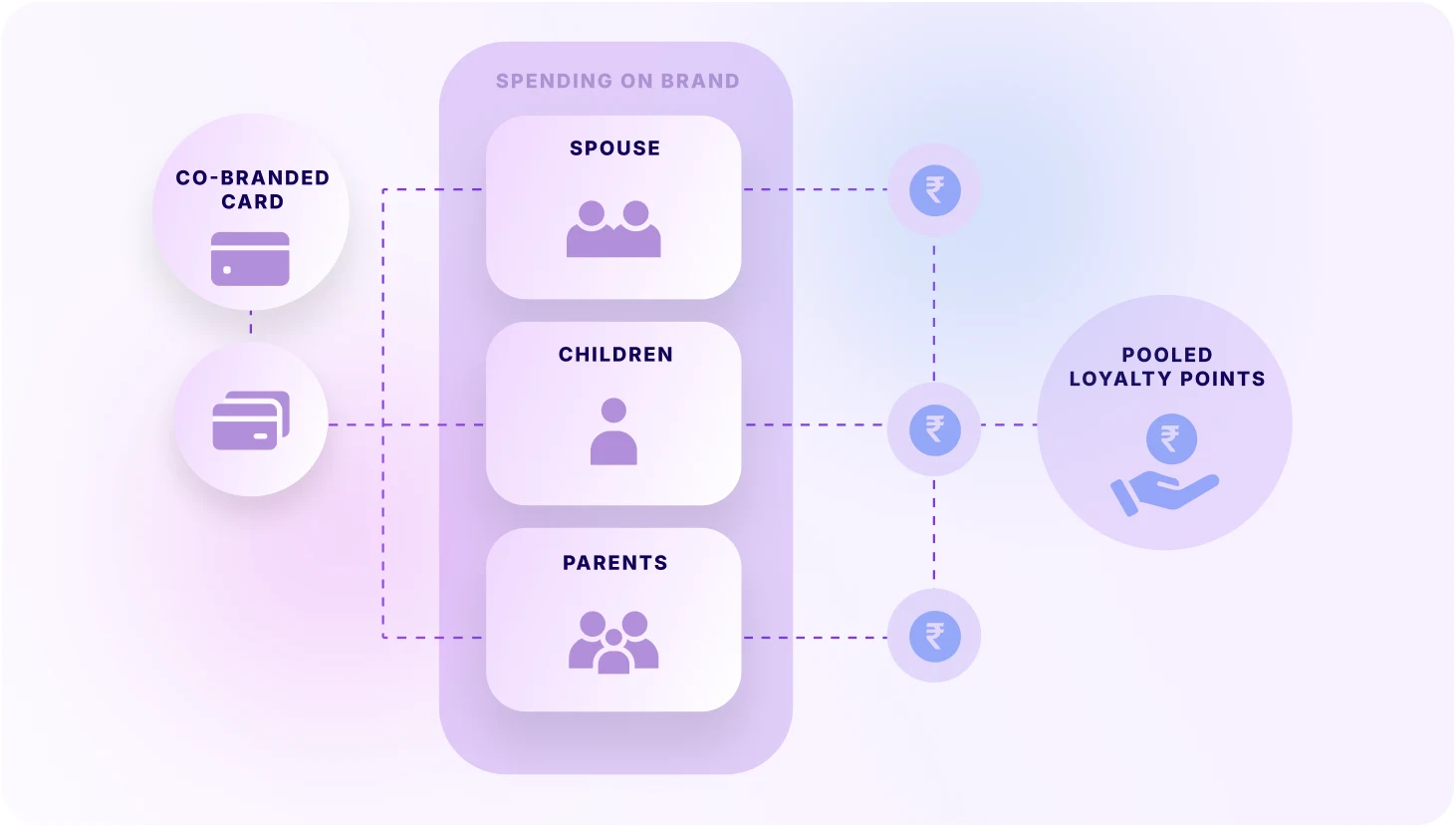

The add-on card experience can be significantly simplified for greater convenience and adoption. A primary cardholder should be able to instantly ‘push’ a virtual card token to a family member’s mobile wallet (e.g. Samsung Pay or Google Pay) with all necessary authorisations and compliance handled seamlessly in the background. Family members can then transact securely with the token, while the primary user retains granular control over spend limits and usage for each member. Co-brand partners can further strengthen engagement by issuing physical token instruments such as lockets, watches, or keychains that let add-on users transact effortlessly, extending the program’s reach and appeal.

Example:

A retail co-brand card offering add-on cards where a parent sets daily spend limits for a teen, or where the entire family earns pooled loyalty points within the partner’s ecosystem.

Approach:

CBCC customers can create spending groups by inviting members, with all spends earning rewards under group rules rather than individual schemes. Banks may offer general or partner-specific group reward programs, suspending individual rewards when required. Group rewards allow pooled spends to unlock higher-tier benefits, accelerate point accumulation, and enable bigger redemptions – all while preserving individual account controls.

Example:

A retail CBCC where families pool purchases across individual cards to quickly unlock higher cashback tiers, free deliveries, or bonus vouchers.

Approach:

CBCC programs should natively handle partner-issued vouchers, automatically apply them as relevant, so customers no longer track codes or expiry dates - redemption becomes seamless.

While cart level vouchers can be managed directly on the issuer platform, item specific vouchers require a bank-provided checkout solution integrated with the partner.

Example:

An eCommerce brand issues a 15% off on cosmetics purchases. The voucher is auto applied when user checks out, reducing cart abandonment and maximising usage.

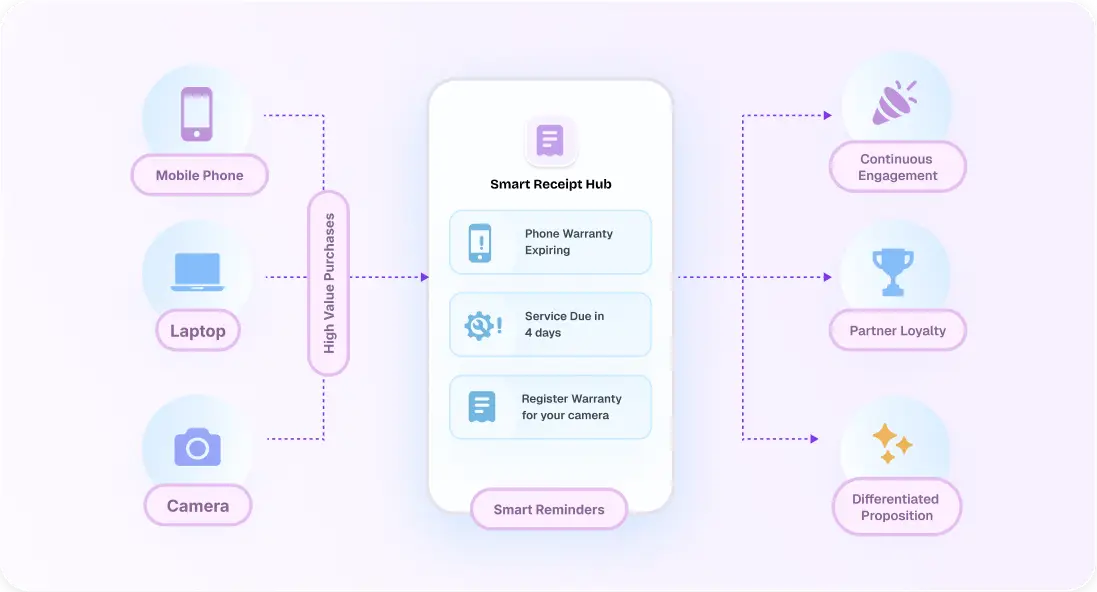

Approach:

Co-branded card programs can offer digital receipts and document management as a value-added service, particularly for high value purchases like electronics and white goods. Each purchase is automatically logged in the card app, with reminders for warranty expiry and service schedules.

Example:

An electronics retailer co-brand card stores receipts for smartphones and TVs bought on the card. The app issues reminders for warranty expiry or servicing, fostering continuous engagement between issuer, partner, and customer.

Approach:

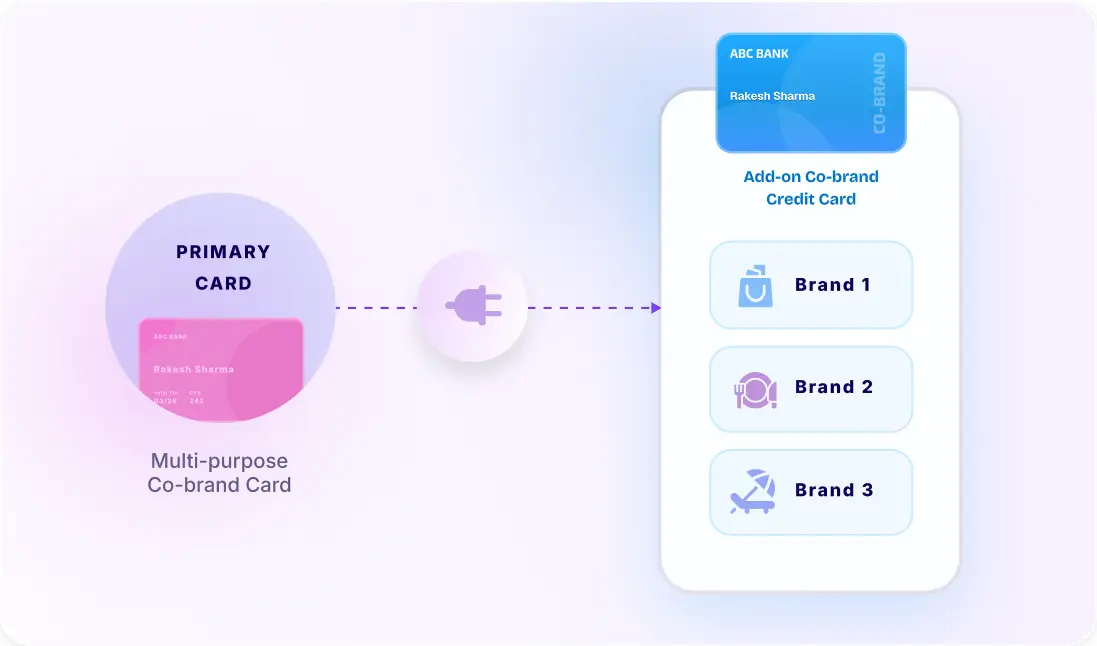

A unified co-branded card lets users to access multiple partner benefits seamlessly, with rewards managed dynamically per program. Each partner is represented by a ‘shadow card’, ensuring transactions routed correctly to each shadow card and rewards applied as per partner terms. Consumers enjoy simplified repayments with a single consolidated payment, with the option of a unified or detailed partner-wise statement.

An advanced technology platform can integrate existing CBCC programs into one unified card, significantly enhancing convenience. However, to protect portfolio economics; the platform must manage switching or per-CBCC fees, restrict switching types, and allow only defined combinations. This ensures operational efficiency while supporting strategic objectives.

Example:

HDFC Bank launches a unified co-branded card. A customer links their existing Swiggy and Indigo CBCCs and later adds a Tata Neu card which is auto linked as well. When the customer spends using the unified card, partner spends are auto-allocated to the respective CBCC shadow card while general spends are allocated as per customer preference or the best available rewards scheme

Market Expansion by Penetrating New Categories

Approach:

Issuers can drive growth by extending CBCCs into new categories. Modern platforms enable category-specific rewards, repayment models, and partner-driven propositions, such as:

-

Health & Wellness – Co-brand programs can offer easy EMIs for premium payments and enhanced rewards at network hospitals and pharmacies. Approve cashless hospitalization and medical expenses can be configured as spending rules on the CBCC, thereby expanding program reach. CBCCs and add-on cards can also act as authentication or identification for customers at network hospitals

-

Education & Coaching – CBCCs can offer EMI and recurring payment options for fees with partners rewarding students and families for course completion, performance etc. Add-on cards can cover student expenses and provide discounts at notified stores.

-

NBFCs – Banks can partner with NBFCs to leverage their underwritten, KYC-complete customer base. Through portfolio analysis, banks can assess additional credit limit available to the customer and extend incremental loans or credit lines via a CBCC.

-

Shopping malls – CBCCs today are mostly limited to partners that directly control the point of sale, restricted by legacy technology. Banks can partner with malls to offer flat discounts or enhanced rewards across all outlets. Integrating with the mall’s IT systems enables accurate identification of eligible MIDs/TIDs, while existing tenant database updates for revenue sharing make this model practical and easy to implement.

-

Sports Leagues – With highly loyal fan bases, a CBCC offering exclusive merchandise/ticket rewards, themed cards, app integration, and seasonal engagement would be very effective

-

Rural Brands – Banks have avoided rural brands due to smaller ticket sizes and higher risk but this has excluded a vast customer segment. Reimagining CBCC with flexible repayment cycles (seasonal, lump sum) aligned to local income patterns can drive penetration. CBCCs can also serve as instant loan disbursement channels. A Central Bank Digital Currency (CBDC) based credit card can enable tracking of purpose specific spends.

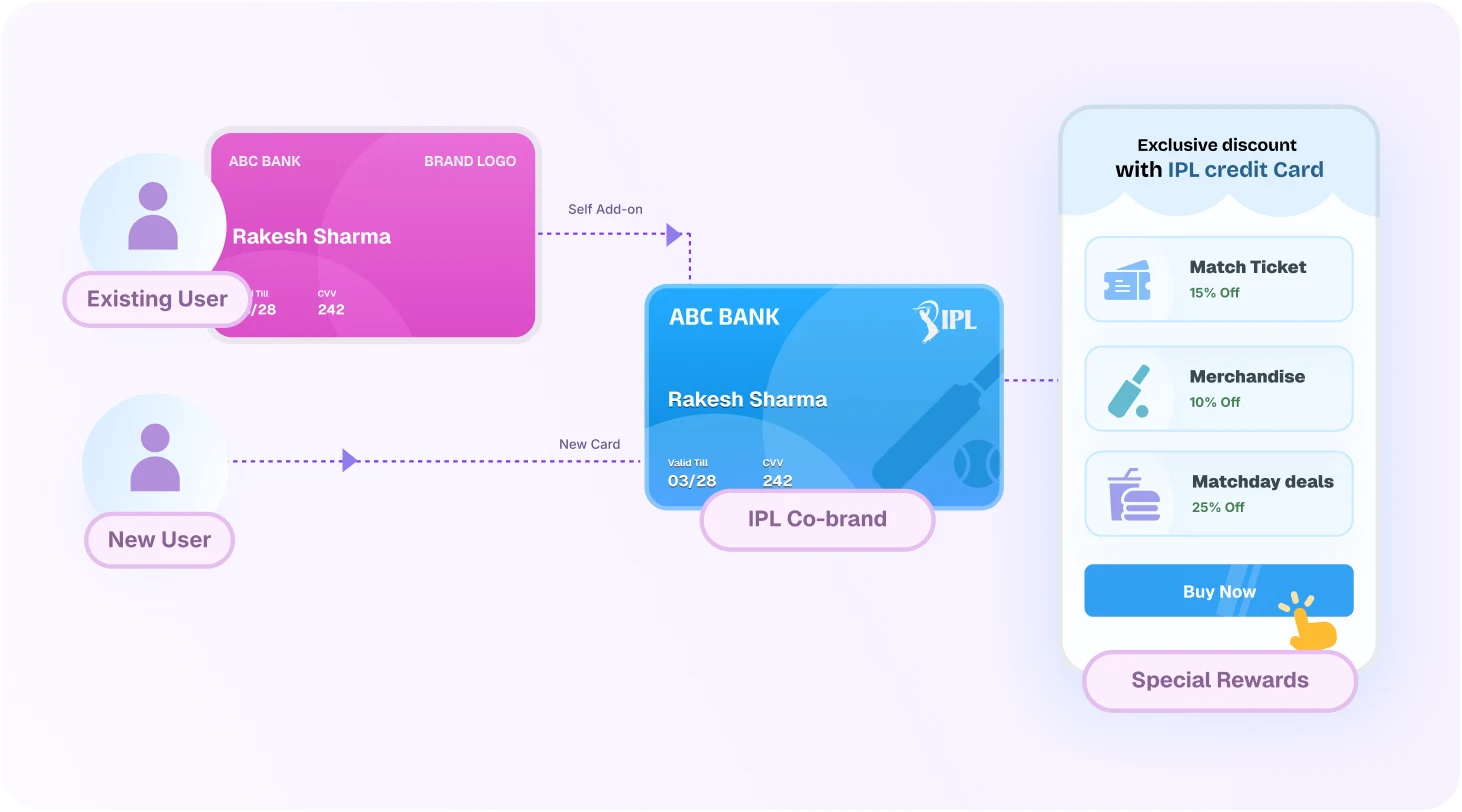

Approach:

Modern platforms enable quick launch of event-specific CBCCs with short lifecycles. They can be issued instantly as add-ons for existing customers or as standalone cards for new-to-bank users via digital onboarding. Rewards are time-bound and contextual such as ticket discounts, festive offers, or merchandise. After the event banks can cross-sell or upgrade customers into longer-term products.

Example:

An IPL-themed CBCC with instant issuance, exclusive rewards on match tickets, merchandise, and food delivery during games. The issuer app and virtual card are themed as per the cobrand partner and changed frequently based on the matches going on.

Full Upgrade vs. Dual Stack: Two Paths to Modernization

Barriers Posed by Legacy Systems

Legacy is no longer an option. They are the core reason most co-branded credit card (CBCC) programmes struggle to scale. Built decades ago for single-issuer models, they were never designed for the multi-party coordination, configurability, and agility that co-brands demand. Instead of enabling growth, they slow launches, raise costs, and erode portfolio economics.

The shortcomings show up across the CBCC lifecycle:

-

Acquisition bottlenecks: Partner integrations are slow and costly, limiting banks to large-scale programmes. Weak underwriting for new-to-credit customers further restricts expansion into new segments.

-

Shallow engagement: Traditional platforms cannot support bespoke EMI or subvention programmes or easily bundle other bank products. Spend stays concentrated on partner channels, preventing CBCCs from becoming the customer’s primary card.

-

Rigid rewards: One-size reward engines create expensive liabilities and little differentiation. Banks cannot configure rewards by customer, category, or partner, leading to weak economics and high burn.

-

Subvention inflexibility: Checkout-level EMIs make programmes unviable for many products. Without SKU- or OEM-level subvention, bank and partner incentives remain misaligned.

-

Compliance drag: Manual disclosures, bolt-on risk checks, and fragmented reporting delay launches and increase operational risk

Modernization, however, is about choosing the right path to transition.

Issuers may follow two broad strategies: a full upgrade or a dual-stack approach. Both paths ultimately converge on the same outcome - a unified modern core - but the journey differs in risk, complexity, and timing.

Full Upgrade

A full upgrade replaces the legacy platform entirely in a single migration. It delivers a clean shift to the modern platform but requires exhaustive preparation and carries higher execution risk.

Advantages

- Provides a clean break from legacy.

- Simplifies long-term operations with a single platform from day one.

- Eliminates costs of running parallel systems.

Considerations

- Higher execution risk from a single large cutover.

- Requires exhaustive readiness to replicate years of bespoke build in legacy.

- Potential disruption if cutover encounters delays or issues. can be fully sunset.

Dual-Stack

A dual-core approach runs legacy and modern platforms in parallel, with new programmes launched on the modern core and existing ones migrated over time. It lowers migration risk but adds operational complexity until the legacy system is fully retired.

Advantages

- Reduces risk through phased transition.

- Enables immediate launch of new programs on a modern stack.

- Maintains continuity for existing portfolios during migration.

Considerations

- Operational complexity of sustaining two cores in parallel.

- Integration overhead for reporting, compliance, and reconciliation.

- Longer transition period before legacy can be fully sunset.

Areas Requiring Modernization

However, running legacy and modern systems in parallel requires thoughtful design across six functional areas:

-

Onboarding & Underwriting

Modern stack: API-led KYC (video/biometric), real-time bureau checks, and alternate data for instant underwriting and credit limits.

Parallel Ops: Dual workflows allow origination on both stacks. Existing customers can be onboarded using prior KYC, with limits shared or reallocated. APIs should manage reversals (e.g., restoring limits on closure) and restoration of limits in the legacy system

-

Operations

Modern stack: Modular processing supports automated reconciliation, flexible settlements, and rapid product setup.

Parallel Ops: Banks may issue consolidated or separate statements. End-of-day extracts and APIs keep data synchronized, while simple tools support ad-hoc reporting.

-

Customer Service

Modern stack: Secure integrations embed the full lifecycle - from activation to servicing to repayments - within bank or partner apps.

Parallel Ops: SOPs must route service journeys across stacks. Tickets and data feeds should roll up into central systems for portfolio visibility.

-

Risk Management

Modern stack: AI-driven fraud detection, behavioural scoring, and adaptive limits.

Parallel Ops: Risk frameworks should monitor both stacks until migration, ensuring unified fraud and case management.

-

Compliance & Reporting

Modern stack: Compliance embedded by design with automated disclosures, consent tracking, and real-time dashboards.

Parallel Ops: Unified reporting is required across stacks. Consolidated dashboards should aggregate data to reduce manual effort.

-

Collections

Modern stack: Digital-first collections with contextual nudges, flexible repayment, and instant account status updates.

Parallel Ops: Integrated workflows avoid duplicate outreach. Configurable rules and APIs ensure accurate status updates across systems.

Modernizing for CBCC scale is less about replacing technology and more about re-architecting how issuers and partners collaborate. A dual-stack strategy allows banks to grow without disruption, mitigating risk while progressively shifting away from legacy constraints.

Next-Gen CBCC Technology Blueprint: Building for Scale and Relevance

All the strategic plays outlined earlier in this paper demonstrate what’s possible when co-branded credit cards are reimagined. But none of them can be executed on legacy platforms. Built for single-issuer control, batch processing, and one-size-fits-all products, these systems cannot support the agility, configurability, or multi-party collaboration that CBCCs demand without costly, time-consuming, and intrusive development.

To scale CBCCs sustainably across categories, partners, and customer segments issuers need a next-generation technology foundation. This blueprint is not just a system upgrade; it is the operating model that makes these innovative plays practical.

-

1. Modularity over Monolithic Architecture

Legacy stacks make every new programme a custom build. A modular platform breaks the credit card lifecycle into components viz. onboarding, underwriting, issuance, rewards, EMIs, settlement etc. that can be orchestrated flexibly.

Strategic Impact: Launch new categories, seasonal co-brands, or family add-ons in weeks, not months.

-

2. Partner-centricity by Design

Every co-brand has unique needs. A partner-centric platform allows each partner to configure product features, pricing, campaigns, rewards, and subvention within bank-defined guardrails.

Strategic Impact: Empowers mid-tier and regional brands to self-manage while banks retain control.

-

3. API-First & Self Service for Partners Principle

Heavy, manual integrations keep banks tied to marquee partners. Standardised APIs and self-service portals make onboarding new partners simple, scalable, and fast.

Strategic Impact: Unlocks mass partner enablement, from malls to hyperlocal brands, with minimal IT effort.

-

4. Configuration over Code

Rigid code changes make even small incremental refreshes costly and slow. A configurable engine lets banks adjust pricing, rewards, and subvention dynamically without having to resort to intrusive bespoke development.

Strategic Impact: Enables rapid experimentation - from event-based CBCCs to OEM-level subvention.

-

5. Unified Data Foundation for Personalization

Customer and partner data today sits in silos, limiting personalization. A unified data layer consolidates signals across transactions, rewards, and partner activity.

Strategic Impact: Supports hyper-personalized rewards, group loyalty, and contextual cross-sell.

-

6. Compliance Embedded by Design

Legacy systems bolt compliance on at the end, slowing launches. Modern platforms bake disclosures, consent management, and reporting directly into the process.

Strategic Impact: Speeds up programme approvals while meeting regulatory standards seamlessly.

These six principles transform CBCCs from high-effort, low-scale projects into portfolios that are diverse, agile, and resilient. They provide the foundation to execute the innovation agenda.

Additional Enablers for the Next Wave of CBCC Innovation

Beyond the six foundational pillars of the blueprint, issuers can unlock further advantage by adopting three emerging enablers. These are not optional add-ons but innovation extensions that can reshape the economics and engagement of CBCC programs.

1. Staged Underwriting & Secure Card Pathways

- Begin with low-risk products (secured or low-limit cards).

- Expand limits and features as behavioural and partner data builds over time.

Impact Safer entry into new-to-credit segments, higher approval rates, and future-ready customer pipelines.

2. Partner-Driven EMI & Subvention

- Allow partners to configure EMI/subvention at SKU or category level, aligned with their margin structures.

- Move beyond gross-level merchant EMI to contextual, catalog-wide offers.

Impact Higher EMI adoption, improved partner ROI, deeper engagement across product categories.

3. Embedded Cross-Sell

- Weave additional bank products (loans, deposits, insurance) directly into the CBCC journey inside the partner’s ecosystem.

- Move away from intrusive outreach (calls, WhatsApp) toward contextual in-app engagement.

Impact More effective cross-sell, higher share of wallet, stronger partner-bank integration.

Building with Zeta

Scaling co-branded credit cards requires more than point solutions. It needs a purpose-built platform that can deliver breadth, speed, and profitability, while removing the operational strain that legacy systems create. Zeta’s co-branded credit card stack is engineered ground-up to meet this need.

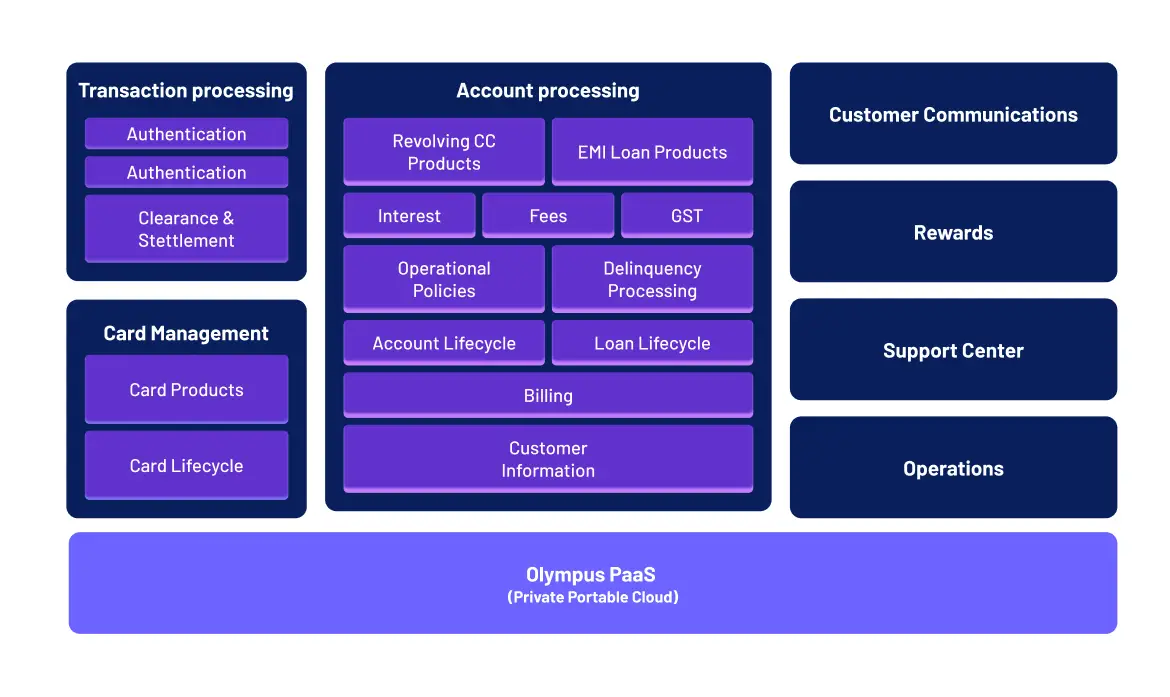

Zeta’s Credit Card Issuance and Processing Platform

Zeta’s cloud-native credit card platform brings together the full lifecycle of issuance and processing in one modern stack. From origination to authorization, billing, rewards, settlement, and customer servicing, every component is engineered to work in real time, with compliance and security built-in by design. This integrated backbone replaces fragmented legacy systems, giving issuers a scalable, API-first foundation to launch and manage credit card programs at speed.

Built for Co-brands

Beyond the core stack, Zeta's platform is architected to natively support co-branded credit cards. Each partner program can be set up as an independent entity with control over product features, pricing, rewards, and campaigns, while the bank centrally manages compliance, risk, and settlement. This design allows issuers to run multiple co-brand portfolios in parallel, profitably and without operational friction, while giving partners the flexibility to tailor customer engagement and loyalty strategies within their ecosystems.

The Zeta Differentiators

Zeta’s cloud-native credit card platform brings together the full lifecycle of issuance and processing in one modern stack. From origination to authorization, billing, rewards, settlement, and customer servicing, every component is engineered to work in real time, with compliance and security built-in by design. This integrated backbone replaces fragmented legacy systems, giving issuers a scalable, API-first foundation to launch and manage credit card programs at speed.

-

A Purpose-Built CBCC Platform

Dynamic Subvention & Pricing Engine: Configure bespoke subvention arrangements and differentiated pricing by leveraging granular merchant, OEM, and payment attributes.

Integrated Credit: Native, frictionless switch from purchase to credit (instant EMI, EMI conversion).

Credit-Card-as-a-Service: Issuers, brands, and networks stitched together into a ready-to-launch GTM model.

-

Ecosystem Access at Scale

Accelerate distribution through retail, travel, fintech, and lifestyle partners.

Faster go-to-market: Partner onboarding reduced to weeks vs. months.

-

Complete Program Ownership

Operational backbone: Reconciliation, settlement, dispute resolution fully managed.

Customer engagement: 24/7 support across channels, reducing issuer overhead.

Partner integration: Real-time APIs for loyalty, rewards, and advanced analytics dashboards.

-

Infinite Scalability, Security, and Compliance

Cloud-native architecture that auto-scales for festival spikes or campaign surges.

Built-in redundancy and failover ensuring near-zero downtime.

Zero-trust security with encryption, continuous verification, and network segmentation.

Fully aligned with RBI’s co-branding directives; PCI-DSS, SOC3, ISO 27001 compliant.

References

- ICICI Bank, Amazon Pay and ICICI Bank renew partnership, enhance India’s most-adopted co-branded credit card | September 2025

- Axis Bank, Annual Report 2024-2025 | March 2025

- HDFC Bank, Tata Neu HDFC Bank Credit Card Celebrates Milestone: Over 2 Million Cards Issued | March 2025

- Business Standard, Co-branded credit card share likely to double by FY28: Visa's Rishi Chhabra | December 2024

- YourStory, Co-branded credit cards are poised to outpace traditional credit cards | August 2024

- Zeta Internal Estimates

About Us

Zeta is a next-gen banking technology company. Zeta’s platform enables financial institutions to launch extensible and compliant banking asset and liability products rapidly. Its cloud-native and fully API-enabled stack supports processing, issuing, lending, core banking, fraud, loyalty, digital banking apps, and many other capabilities.

Zeta has 1700+ employees with over 70% in technology roles across locations in the US, Middle East, and Asia - representing one of the largest and most capable teams ever assembled in banking tech. Globally, customers have issued 25M+ cards on our platform.

Contact Us

Discover how your bank can benefit from Card Innovation. Share your details to schedule a Cards Innovation Workshop with our experts.