- Cards & Payments

- 3 min

Shared Finance Is Re-Architecting Banking for the Next Era of Growth

Shared Finance is reshaping banking by enabling families, partners, and teams to manage money together. Discover how banks can use this shift to deepen relationships, drive engagement, and unlock new growth.

-

-

Rahul Bagati

Vice President, Marketing and Strategic Partnerships

-

- Cards & Payments

- 6 min

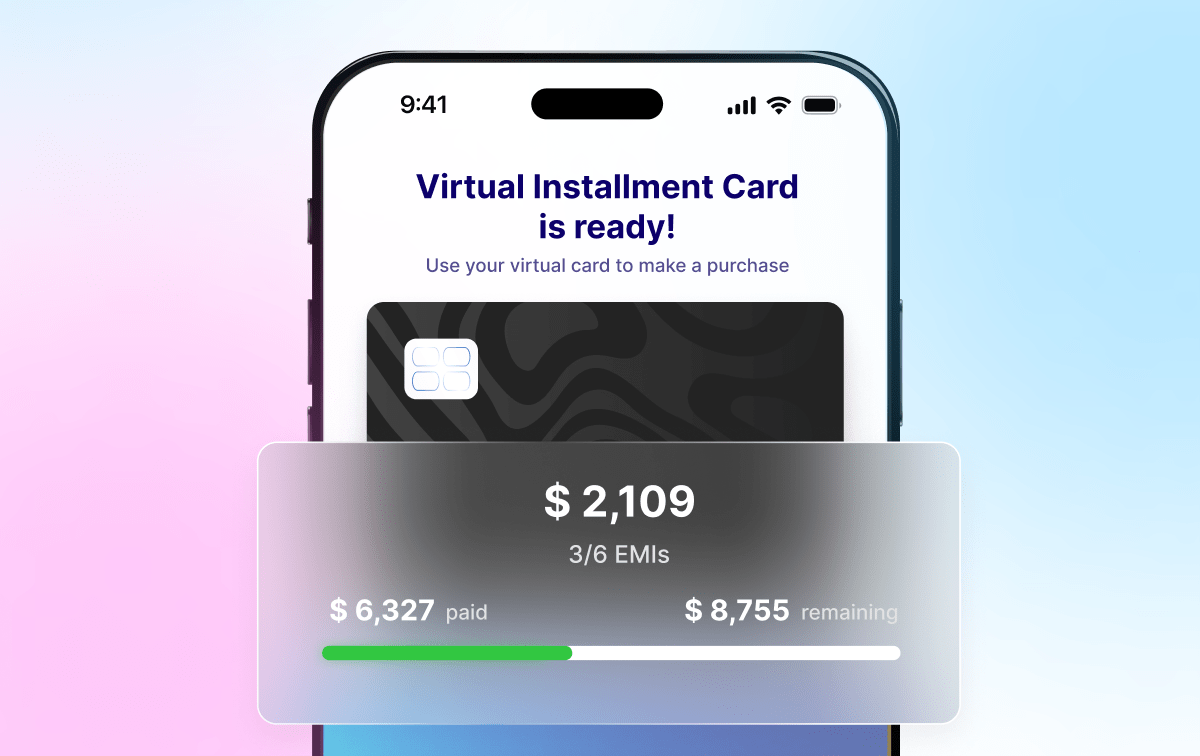

Virtual Installment Cards: Improving BNPL Outcomes for Banks and Customers

Virtual Installment Cards are game-changers. They empower banks to compete with BNPL by offering flexible, structured payments that drive purchase decisions and enhance customer loyalty.

-

-

Chris Harris

Head of US Marketing for Zeta

-

- Cards & Payments

- 4 min

Breaking the Status Quo with Transformative Card Experiences

Next-gen card platforms are empowering issuers to offer innovative experiences like family hubs & virtual installment cards that drive customer loyalty, enhance security, and boost card utilization.

-

-

Gary Singh

President, North America

-

- News & Updates

- 2 min

Sparrow x Zeta Wins Tearsheet’s Best Banking Card Product Award

Sparrow card, powered by Zeta, has won Tearsheet’s Best Banking Card Product award for empowering underserved Americans with modern, customer-first experiences.

-

- Technology

- 5 min

Understanding the Role of Dynamic CVV in Digital Fraud Prevention

Enabling dynamic CVV in cards can help issuers build stronger customer trust and reduce the financial impact of fraud on businesses and consumers.

-

-

Bharathi Shekar

Director, Product

-

- Perspectives

- 5 min

Why Financial Institutions Fail to Modernize and How to Fix It

In a recent conversation with innovation expert Geoffrey Moore, we explored the challenges banks face in modernization. Moore’s 4 Zones of Transformation framework—Performance, Productivity, Incubation, and Transformation—offers a clear roadmap for financial institutions. By understanding these zones, banks can better manage tech debt, foster innovation, and drive long-term success.

-

-

Gary Singh

President, North America

-

- Credit Line on UPI

- 6 min

Credit Line on UPI: Why Proactive Planning is Key to Success

Credit Line on UPI (CLOU) is revolutionizing digital lending in India, presenting banks with a $1 trillion opportunity by 2030. To succeed, banks must plan ahead—evaluating market trends, regulatory shifts, and technology readiness to unlock new revenue and reshape traditional lending products.

-

-

Salil Ravindran

Product Marketing at Zeta

-

- AI in Banking

- 5 min

Decoding the US Regulatory Landscape for AI Adoption in Banking

As AI continues to reshape banking, regulatory themes like data privacy, transparency, and ethical frameworks are evolving to create guardrails for its adoption.

-

-

Karla Booe

Chief Compliance Officer, Zeta

-

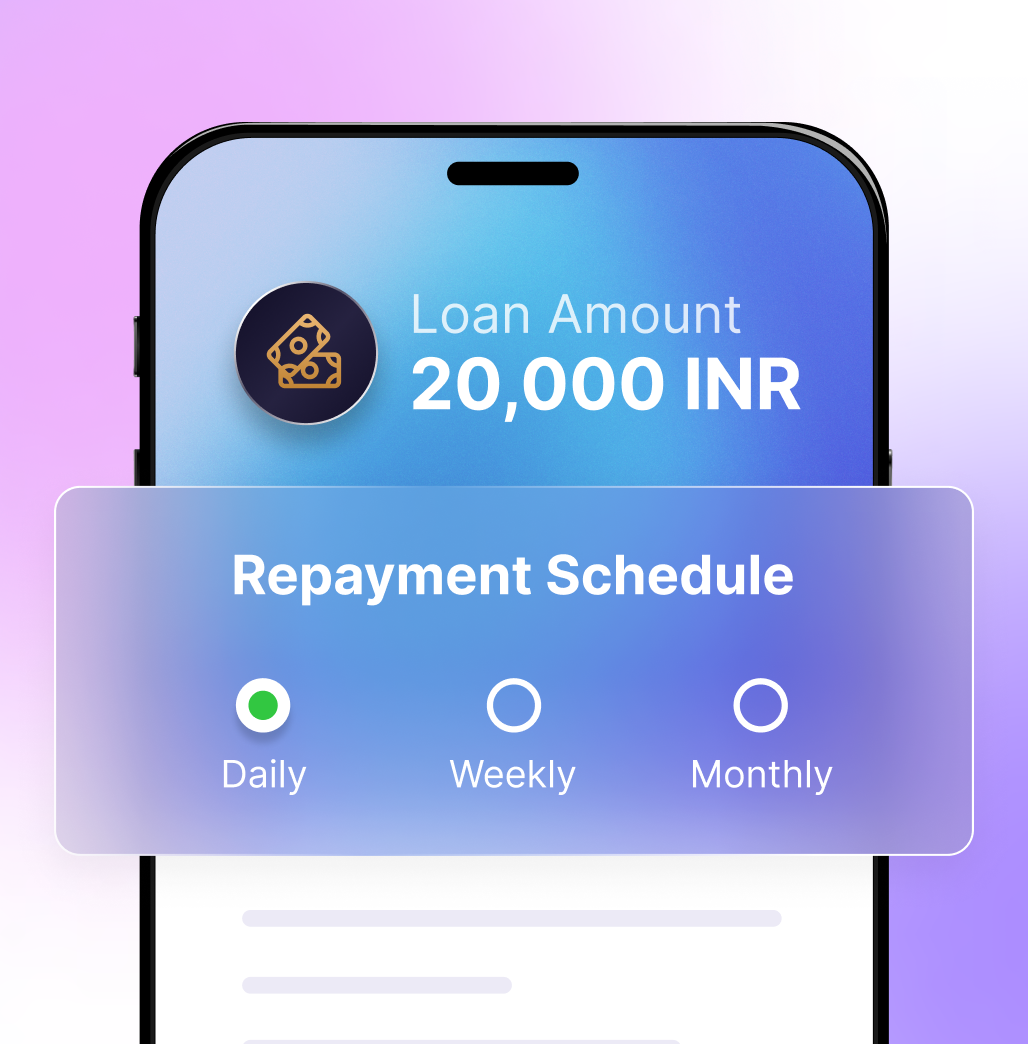

- Credit Line on UPI

- 6 min

Rewriting India’s EMI Rulebook With Credit Line on UPI (CLOU)

Discover how Credit Line on UPI can revolutionizing India’s loan repayment system, shifting from traditional EMIs to more adaptable EPIs, and enabling cashflow-based financing for cashflow-dependent borrowers.

-

-

Deepak Kumar

Head of Product Management at Zeta India

-

- Cards & Payments

- 5 min

Family Hub Card Programs: The Next Growth Engine for Credit Unions

Credit Unions face a sustainability challenge with their aging members, but engaging Gen Z through family programs could drive long-term growth.

-

-

Jeff Van Wie

Senior Vice President of Sales and Business Development at Zeta